What is the difference between level funded and fully insured? In simple terms, level funded plans offer the flexibility to manage health care costs by allowing businesses to pay a predictable monthly amount that includes estimated claims, administrative fees, and stop-loss insurance. On the other hand, fully insured plans involve paying a fixed premium to an insurance company, where the insurer assumes the risk and handles all administration. Here’s a quick breakdown:

-

Level Funded Plans:

- Pay a consistent monthly amount

- Retain any unused claim funds

- Lower costs but assume some risk

-

Fully Insured Plans:

- Pay a set premium to the insurer

- Insurer pools risks and administrative tasks

- Less customization but more predictable costs

With health insurance costs consistently on the rise, small to medium-sized businesses are seeking cost-effective and flexible solutions for their employees. Choosing the right plan can seem overwhelming, but understanding the fundamental differences between these two options can guide business owners toward making an informed decision for both financial stability and employee well-being.

I’m Les Perlson, a seasoned professional in the insurance industry with expertise in employee benefits design. With over 40 years of experience, I’ve helped businesses steer the complexities of what is the difference between level funded and fully insured health insurance plans, ensuring they choose the best fit to manage costs and provide optimal employee benefits.

Relevant articles related to what is the difference between level funded and fully insured:

- alternative health insurance solutions

- an insured has a stop loss limit of 5000

- level funded health insurance explained

PROMPT:

The above is a intro section for an article titled “Level Funded vs Fully Insured: Which Plan Fits Your Needs?”, about the keyword “what is the difference between level funded and fully insured”, was written for the company NPA Benefits, to be published on https://www.npabenefits.com.

Understanding Fully Insured Plans

Fully insured plans are a popular choice for many businesses due to their simplicity and predictability. Let’s explore the benefits and limitations of these plans to see if they might be the right fit for your organization.

Advantages of Fully Insured Plans

Fixed Premiums and Cost Predictability

One of the main attractions of fully insured plans is the cost predictability. You pay a fixed premium to an insurance carrier, which covers all the healthcare costs for your employees. This means you know exactly what your monthly expenses will be, making it easier to budget and plan financially.

Simplified Administration

With fully insured plans, the insurance company takes care of most administrative tasks. This includes processing claims, managing customer service, and ensuring regulatory compliance. For businesses, this means less time spent on paperwork and more time focusing on other priorities.

Fully insured plans often come pre-packaged with ACA-mandated benefits. The insurance carrier handles the compliance-related tasks, ensuring that your company meets federal healthcare regulations. This reduces the risk of penalties and keeps you in line with the law.

Limitations of Fully Insured Plans

Limited Customization

A significant downside to fully insured plans is the lack of customization. Employers have little control over plan design, benefit levels, or cost-sharing arrangements. The insurance carrier offers pre-determined benefit packages, which might not perfectly align with your employees’ needs or your company’s values.

Cost Control Challenges

While fully insured plans offer predictable costs, they can also be more expensive. Premiums can increase annually, often without additional benefits. Businesses may find themselves paying for coverage they don’t need, leading to higher expenses over time.

Fully insured plans offer stability and ease but can lack flexibility and control. Understanding these pros and cons is crucial as you decide which health insurance plan best suits your business needs.

What is the Difference Between Level Funded and Fully Insured?

When choosing between level funded and fully insured health plans, it’s important to understand the key distinctions. Let’s break down the differences, focusing on customization, financial risk, and regulatory compliance.

Key Differences in Premiums and Payments

Fully Insured Plans involve paying fixed premiums to an insurance carrier. These premiums are consistent and predictable, covering all employee healthcare costs. This setup provides financial stability since the insurer absorbs the risk of high claims.

Level Funded Plans, on the other hand, combine elements of both fully insured and self-funded plans. Employers pay a fixed monthly amount that covers estimated claims, administrative fees, and stop-loss insurance. This approach offers predictable costs, much like a fully insured plan, but with a twist: if your claims are lower than expected, you might receive a refund. This potential for savings is a key advantage of level funded plans.

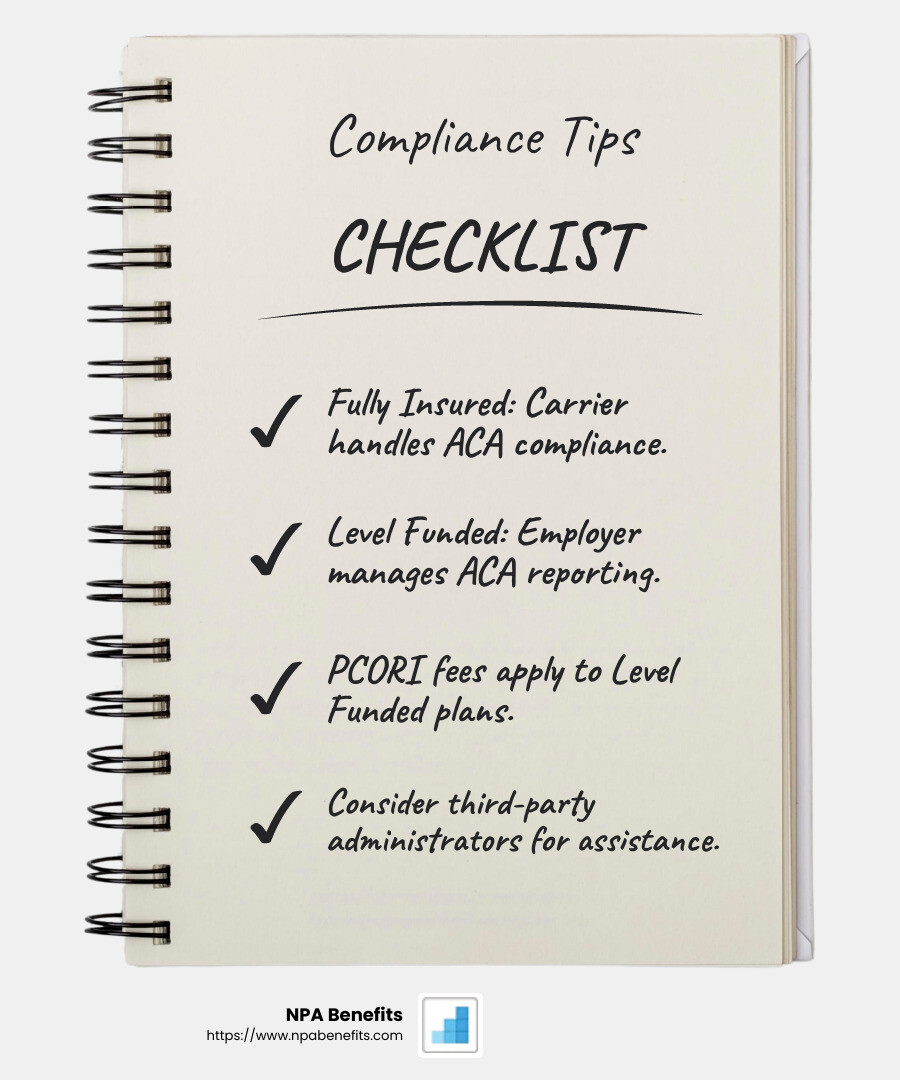

Regulatory Compliance Considerations

Fully Insured Plans come with pre-packaged ACA-mandated benefits. The insurance carrier manages compliance, reducing the administrative burden on your business. This means you don’t have to worry as much about staying in line with federal healthcare regulations.

Level Funded Plans, however, require more attention to compliance. Although they offer customization, employers must ensure they meet both federal and state regulations. This includes handling ACA reporting and paying PCORI fees, which fund health outcomes research. These compliance tasks can be shared with a third-party administrator, but ultimately, the responsibility lies with the employer.

Customization and Financial Risk

Customization is a strong point for level funded plans. Employers can tailor plan designs to better fit their workforce’s needs, offering specialized networks, deductibles, and co-pays. This flexibility allows businesses to align health benefits with their unique culture and values.

Financial Risk is another area where these plans differ significantly. Fully insured plans place the financial risk on the insurer. In contrast, level funded plans involve some employer-assumed risk. If claims exceed the anticipated amount, employers might face higher renewal rates. However, stop-loss insurance is there to cap potential losses, striking a balance between risk and predictability.

In summary, the choice between level funded and fully insured plans hinges on your business’s priorities: predictability and simplicity or customization and potential savings. Understanding these differences will help you decide the best fit for your organization.

Exploring Level Funded Plans

Level funded plans are an intriguing option for businesses seeking a hybrid approach to health insurance. They blend features of both fully insured and self-funded plans, offering a unique mix of cost savings and customization.

Advantages of Level Funded Plans

Cost Savings: One of the standout benefits of level funded plans is potential cost savings. Employers pay a fixed monthly amount, which covers estimated claims, administrative fees, and stop-loss insurance. If the actual claims are lower than expected, employers may receive a refund on the unused portion of their claims fund. This potential for savings is particularly appealing for companies with healthier employee populations.

Plan Flexibility: Level funded plans allow for greater customization compared to fully insured plans. Employers can tailor the plan design to better meet the specific needs of their workforce. This includes adjusting networks, deductibles, and co-pays, which can lead to higher employee satisfaction and align better with the company’s culture and values.

Hybrid Approach: By combining elements of both fully insured and self-funded models, level funded plans offer predictable monthly costs while still providing the financial benefits of self-funding. This balance makes them an attractive option for businesses looking to control costs without sacrificing flexibility.

Risks and Considerations of Level Funded Plans

Financial Risk: While there are cost-saving opportunities, level funded plans also carry a higher level of financial risk compared to fully insured plans. Employers are responsible for claims that exceed their claims fund. Although stop-loss insurance helps limit this risk, it’s crucial for businesses to assess their financial stability and risk tolerance before choosing this option.

Cash Flow Management: Effective cash flow management is essential with level funded plans. Employers need to ensure they have enough cash on hand to cover unexpected high claim costs. This requires careful planning and monitoring to avoid cash flow issues that could arise from claim fluctuations.

Level funded plans can be a strategic choice for businesses that want to balance cost control and flexibility. However, it’s important to weigh the potential risks and ensure that your company is prepared to handle the financial responsibilities involved.

Frequently Asked Questions about Level Funded and Fully Insured Plans

What are the disadvantages of level funded plans?

Level funded plans come with certain financial risks. While they offer cost-saving opportunities through potential refunds on unused claims funds, there’s a catch. If claims exceed projections, employers may face higher renewal rates or unexpected costs. This risk is mitigated by stop-loss insurance, but it’s essential for businesses to evaluate their financial capacity to handle such fluctuations.

Compliance requirements can also be a challenge. Level funded plans must adhere to regulations like ERISA and Section 105(h) nondiscrimination rules. These regulations can increase administrative workload and require careful management to avoid penalties. Compliance can be complex and may necessitate additional resources or external expertise to manage effectively.

Is level funded and fully insured the same?

No, they are not the same. Level funded plans are a hybrid model, combining aspects of both self-funded and fully insured plans. Employers pay a fixed monthly amount that covers estimated claims and fees, but they also have the potential to receive refunds on surplus funds if claims are lower than expected. This means employers share some financial responsibility and risk.

Fully insured plans, on the other hand, involve paying a fixed premium to an insurance carrier, which assumes all financial responsibility for employee claims. This model offers predictability and less financial risk for employers, but lacks the flexibility and refund potential of level funded plans.

What is the difference between level funded and fully insured UHC?

When it comes to plan design and refund conditions, level funded and fully insured plans under UnitedHealthcare (UHC) differ significantly. Level funded plans allow for more customization in plan design, enabling employers to tailor networks, deductibles, and co-pays to suit their workforce’s needs. This flexibility can lead to better alignment with company values and employee satisfaction.

In terms of refund conditions, level funded plans offer the possibility of receiving a refund on unused claims funds if healthcare usage is lower than anticipated. This potential for savings is not available in fully insured plans, where the insurance carrier retains any surplus.

Understanding these differences can help businesses decide which plan structure aligns best with their financial strategy and employee needs.

We’ll examine more about these insurance models and how they can fit into your business strategy.

Conclusion

Choosing the right health insurance plan for your business is crucial. At NPA Benefits, we specialize in helping businesses steer the complexities of health insurance to find the perfect fit. Whether you’re considering a fully insured plan or exploring the flexibility of a level funded plan, we offer solutions that prioritize control and cost savings.

Level funded plans provide a unique hybrid approach. They offer the predictability of fixed monthly payments with the potential for cost savings through refunds on unused claims funds. This means you can have more control over your healthcare expenses while still benefiting from the security of stop-loss insurance. It’s an excellent option for businesses looking to strike a balance between cost control and flexibility.

On the other hand, fully insured plans offer simplicity and straightforward management. With fixed premiums and less administrative burden, they provide peace of mind for businesses that prefer predictability. However, they might lack the customization options that some companies desire.

At NPA Benefits, we understand that each business has unique needs. Our expertise lies in offering flexible health insurance options that cater to those specific requirements. We empower businesses to take control of their healthcare coverage, ensuring it aligns with their financial strategy and employee needs.

Ready to explore how a level funded plan can benefit your business? Learn more about our level funded health insurance plans and take the first step towards a more flexible and cost-effective healthcare solution.

With NPA Benefits, you can create a healthier, more secure workplace for your team. Let us help you find the right balance between cost, flexibility, and control.