Group Vision Insurance: A Clear Vision for Your Team’s Future

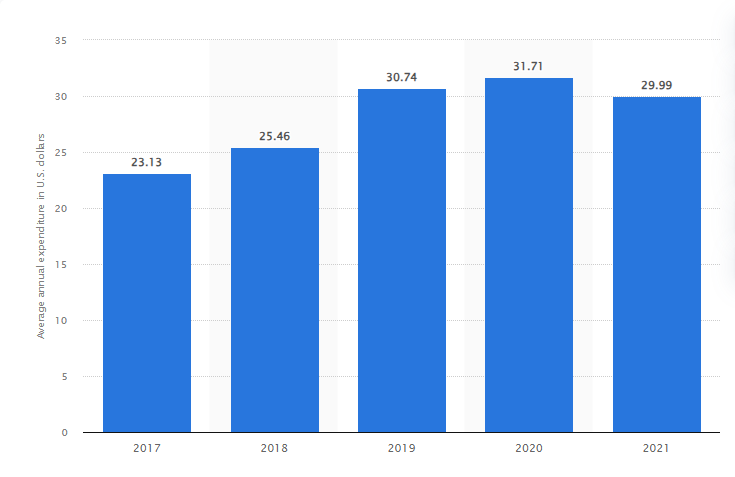

Maintaining good vision is not just about seeing clearly in today’s world. It’s about living a quality life. Yet, it is a pressing issue that many overlook. In 2021, an American spent $29.99 on average on vision care insurance. While this may seem like a nominal amount, it’s a vital investment in maintaining and improving eye health – particularly considering the steady rise in Americans dealing with vision conditions over the last decade.

Image Courtesy: Statista.com

As our nation grapples with an increase in visual impairments and eye diseases, now more than ever, we need to bring the importance of vision care to the forefront. Welcome to NPA Benefits. We believe in providing employee vision benefits and a vision for a healthier and more prosperous future. We’re here to help you understand and utilize the vision part of Group Health Insurance effectively for your team’s success.

What Is Group Vision Insurance?

Group Vision Insurance is a policy offered by employers, providing coverage for vision health care services for their employees. Depending on the plan specifics, it may cover routine eye exams, eyewear, and surgical procedures. Offering vision insurance can be a powerful addition to your employee benefits package.

How Does Group Vision Insurance Work?

Group Vision Insurance operates on a pooling principle. By enrolling a group of people, such as company employees, the risk is distributed, making the plans more affordable per person. This shared risk allows for robust benefits while keeping costs down.

Typically, vision insurance will bear the expenses for regular eye check-ups and subsidize a part of the amount for prescription eyewear or contact lenses. Several vision insurance providers operate with a specific group of service providers. As such, employees might have to seek services from a provider within that network. Alternatively, if they decide to avail of services from a provider outside the network, they may have to shoulder a higher out-of-pocket expense.

What Can You Get with Group Vision Insurance?

Group Vision Insurance offers a variety of benefits designed to improve eye health while reducing costs. This vision coverage can provide substantial savings and options for your employees. Here’s what you can expect:

Saving on Eye Exams

Routine eye exams are crucial for maintaining eye health. Group vision insurance often covers or significantly reduces the cost of these exams, ensuring your team can regularly check their eye health.

Dollar Allowance

A distinct feature of vision insurance is the dollar allowance. This monetary benefit can be applied towards the purchase of prescription eyewear or contact lenses, making these necessities more affordable.

Doctor Network

Group vision insurance usually comes with a comprehensive network of accredited eye care professionals. This guarantees your team has access to quality care and a wide selection of providers to choose from.

Fixed Out-of-Pocket Costs

With group vision insurance, out-of-pocket costs for services and eyewear are predetermined, eliminating unexpected expenses and allowing for easy budgeting.

Streamlined Processes

The administrative processes involved in group vision insurance are typically straightforward and efficient, making it simple for both employers and employees to manage their vision coverage.

Providing Employees More Choice

Vision insurance plans offer a range of choices when it comes to eyewear, allowing your team to choose the glasses or contacts that best fit their lifestyle and preferences.

What Do Group Vision Plans Cover?

Vision insurance plans designed for small businesses can help decrease the out-of-pocket expenses associated with eye care. These plans usually include coverage for routine eye examinations. Additionally, they often extend to cover a broad spectrum of eye care services and products, such as:

- An annual allowance can be applied towards purchasing eyeglasses or contact lenses.

- Coverage or partial coverage for treating significant eye-related medical conditions.

- Reduced rates for laser vision correction surgery procedures, making these operations more affordable.

- Discounts on prescription sunglasses, thus offering protection and clear vision even in bright sunlight.

However, the extent of the benefits provided can vary significantly from one insurance carrier to another and is also dependent on the level of coverage chosen. As such, when selecting a vision insurance plan, it’s crucial to carefully assess the unique needs of your employees to ensure that the plan aligns with their eye care requirements.

Benefits of Group Vision Insurance

Investing in Group Vision Insurance isn’t just about eye care; it’s about shaping a supportive work environment and fostering a contented workforce. Here are some of the compelling benefits of group vision insurance:

Boost Employee Morale

Providing vision insurance signifies your commitment to your employees’ well-being, which can significantly enhance morale. Employees who feel cared for are likely to be more engaged and productive.

Retain Talent

In an increasingly competitive job market, a comprehensive benefits package, including vision insurance, can be a decisive factor in retaining your top talent. It can make employees feel valued and encourage their long-term commitment to your company.

Savings

Group Vision Insurance offers a cost-effective solution for eye care. By pooling the risk among a group, these plans can provide considerable savings on routine eye exams, glasses, contacts, and sometimes even surgeries.

Improved Health Outcomes

Regular eye exams can detect a range of health issues, from vision problems to chronic conditions like diabetes. By offering vision insurance, you encourage employees to get these important check-ups, leading to early detection and better health outcomes.

Enhanced Productivity

Good vision is essential for most tasks. With access to regular eye care and corrective eyewear, employees can work more efficiently and effectively, boosting overall productivity.

How Can NPA Benefits Help?

At NPA Benefits, we help businesses craft the ideal benefits packages for their teams. With our vast network of insurance providers and our commitment to personalized service, we can help you easily navigate the world of group vision insurance.

Frequently Asked Questions

Group vision insurance plans typically provide coverage for routine eye exams and an allowance for eyewear. They may also provide partial coverage for refractive surgery.

A vision insurance allowance is a specified amount provided by your group vision insurance plan that can be used to purchase eyewear.

VSP stands for Vision Service Plan. It’s a trusted name in vision insurance, providing coverage to millions of people across the country.

VSP Choice is a type of vision insurance plan offered by Vision Service Plan. It allows members to choose their preferred eye care provider from a wide network.

Final Words

A clear vision for the future begins with eye health today. Let NPA Benefits guide you in crafting your team’s vision insurance package. We’re committed to helping you achieve your goals and to helping your team see a brighter future.