Ensuring Tomorrow Together: Your Ultimate Guide to Group Life Insurance

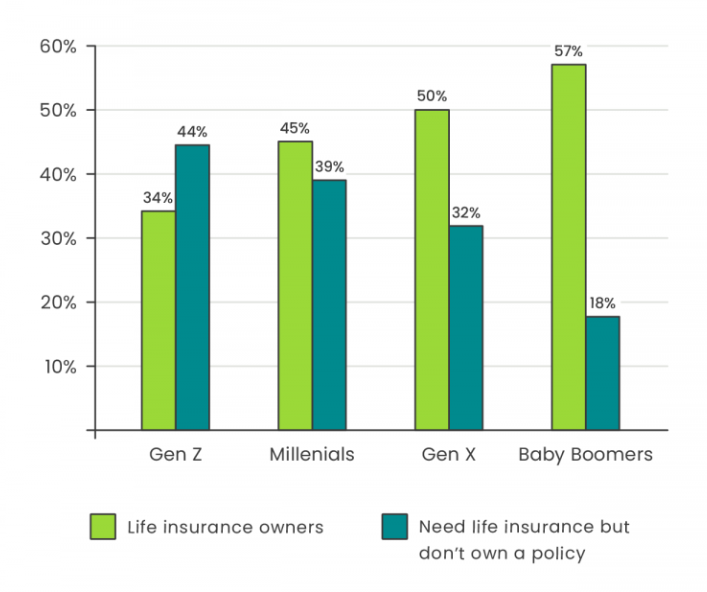

Life insurance is more than just a policy—it’s a cornerstone of financial stability. Yet, intriguingly, its ownership rates have gradually declined over the past decade, with a 2% decrease since 2021 and a total reduction of 13%. In a nation where 53% of men and 46% of women have life insurance, we face a reality where nearly half of our population is missing out on this essential safety net.

The impact?

Image Courtesy: www.annuity.org

A whopping 68% of life insurance owners report feeling financially secure, starkly contrasting to the 47% of non-owners who can say the same. These figures reveal a crucial insight: life insurance ownership isn’t just about preparing for the worst—it’s about investing in peace of mind today.

What Is Group Life Insurance?

Group life insurance is a unique type of coverage that offers lifelong protection for members of a particular group, such as employees of a company. It serves as an essential financial safety net, ensuring the stability of the employees.

Supplemental life insurance is an additional policy that you can purchase to boost your life insurance coverage. This extra layer of protection complements your primary or group life insurance policy, helping you meet greater financial obligations or provide additional security for your family.

Supplemental life insurance can be especially beneficial if you have a high-risk job, significant debts, a large family, or other factors that may necessitate a higher group coverage than your primary policy offers. From paying off a mortgage to funding your child’s education, the payout from supplemental life insurance can alleviate financial burdens and bring peace of mind to you and your loved ones.

Understanding Group Life Insurance

Group life insurance is a significant aspect of many benefits packages, offering security and financial reassurance for employees. Grasping the ins and outs of this insurance can ensure that you make the most of your coverage.

Group life insurance encompasses a single insurance contract that offers life insurance coverage to a multitude of individuals. When a company acquires group life insurance coverage from an insurer at a wholesale rate for its members, it can secure a much more affordable group life insurance cost per employee than universal life insurance policies.

For the beneficiaries of group life insurance, it’s often the case that they incur no out-of-pocket costs for the benefits of the policy. Individuals who opt for additional coverage may choose to have their portion of the premium deducted directly from their earnings. As with traditional insurance policies, those insured must name one or more beneficiaries before the policy takes effect. Beneficiaries can be amended at any time during the coverage period.

The most common type of policy under group insurance is term life insurance, usually renewed annually during a company’s open-enrollment period. This contrasts with whole life insurance, which assures coverage regardless of the time of death. Whole life insurance policies are enduring, carry higher premiums and death benefits, and are the most sought-after form of life insurance.

In the case of group life insurance, the master contract is retained by the employer or organization that procures the policy for its employees or members. Employees who opt for coverage via the group policy generally receive a certificate of coverage. When presenting to a prospective insurer, this certificate is required if an individual decides to leave the company or organization, thereby terminating their coverage.

What Are the Types of Group Life Insurance?

There are numerous types of group life insurance, each offering varying degrees of coverage. The main ones include:

Fixed multiple-of-earnings benefit plans

These plans offer a benefit equivalent to a fixed multiple of the insured member’s earnings. For instance, the policy could pay a death benefit equal to three times the member’s annual salary, helping to support their family’s financial stability.

Variable multiple-of-earnings benefit plans

Unlike fixed plans, variable multiple-of-earnings benefit plans change based on factors like age or tenure at the company. For example, the coverage might be five times the member’s annual salary up to age 35, then reduce incrementally as the member ages.

Flat-dollar-amount benefit plans

Flat-dollar-amount benefit plans provide a fixed dollar amount regardless of the member’s income. These plans are simple to understand, making them popular for many organizations.

Variable-dollar-amount benefit plans

In contrast, variable-dollar-amount plans offer varying benefits depending on specified factors, such as the member’s role in the company. This could mean higher coverage amounts for executive-level employees compared to entry-level staff.

Group Life Insurance Benefits

There are several compelling reasons why organizations opt for group life policy:

Convenience

Group life insurance policies are typically easy to manage, with premiums often deducted straight from payroll. This simplifies the process for members, saving them time and effort.

Price

Due to the nature of the group policy, insurers can often offer coverage at lower rates than individual policies, making it an affordable choice for many employees.

Acceptance

Most group life insurance plans don’t require medical examinations for acceptance, enabling employees with pre-existing conditions to obtain coverage more easily.

Disadvantages of group life insurance

Despite its many advantages, group life insurance has a few drawbacks:

Coverage is tied to your job

One of the key downsides is that the coverage is typically tied to employment. If you change jobs or retire, you may lose your coverage.

Limited choice

Group life insurance policies usually offer less flexibility than individual policies in terms of coverage options, potentially limiting your ability to customize the plan to fit your specific needs.

Low coverage amounts

While group policies are often more affordable, they might not offer the coverage amounts some members require, potentially necessitating supplementary insurance.

How Can NPA Benefits Help?

At NPA Benefits, we are dedicated to simplifying the world of group life insurance for you. Our extensive experience and personalized approach guide you to a suitable plan that aligns with your specific needs.

Frequently Asked Questions (FAQs)

What is basic group life insurance?

Group life insurance is a type of insurance that provides coverage to a group of individuals, typically employees of a company or members of a society. The policyholder is usually an employer or an entity, and the policy covers the employees or members.

What is the difference between individual life insurance and group life insurance?

The key difference lies in the policyholder. In group life insurance, the policyholder is an organization; in individual life insurance policy, the policyholder is the individual insured. Group insurance typically does not require individual underwriting, meaning acceptance is usually guaranteed.

What are group life and accident insurance?

Group life and accident insurance, also known as accidental death and dismemberment insurance, is a policy that benefits the beneficiary if the cause of death is an accident. It also covers the insured for specific types of bodily injury.

What are the different types of group-term life insurance?

Several types of group-term life insurance include fixed multiple-of-earnings benefit plans, variable multiple-of-earnings benefit plans, flat-dollar-amount benefit plans, and variable-dollar-amount benefit plans.

Final Words

Understanding and choosing the right group life insurance plan can be a complex process, but it’s crucial for securing your team’s financial future. Whether you’re an employer looking to provide for your workforce, or an employee seeking clarity about your benefits, knowledge is power. Trust NPA Benefits to help you navigate this journey.