Everything You Need To Know About Group Health Insurance

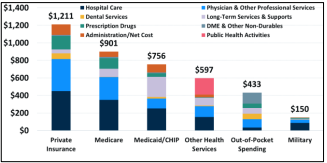

In 2021, the impact of health insurance markets was significant, covering an estimated 179 million individuals, or 54.7% of the U.S. population, while another segment covered 45 million individuals, constituting 13.7%. Highlighting the financial magnitude of the private health insurance industry, expenditures reached a remarkable $1,211 billion, making up 29.9% of the total healthcare expenditures (HCE) for the year. This data underscores the vital role of private health insurance in safeguarding the well-being of millions and contributing to the nation’s healthcare economy.

Image Courtesy: Federation Of American Scientists

Navigating the intricacies of group health insurance can be daunting, whether you’ve just embarked on a new career and are exploring your health insurance coverage options, have existing group insurance but seek a deeper understanding, or are facing uncertainties about coverage due to a recent job loss or change.

This guide is crafted to demystify the complexities of group health insurance, offering clear insights and guidance tailored to your situation. With this comprehensive resource, you’ll be well-equipped to make informed decisions about your health insurance needs.

What is Group Health Insurance?

Group Health Insurance is a policy offered by employers, associations, or other organizations to cover the healthcare needs of its members. Unlike individual policies, group health insurance encompasses a collective, offering standardized coverage and potentially more affordable premiums.

Group health insurance refers to health coverage provided by an employer or member organization through health reimbursement arrangements. The policy usually offers coverage to members at a reduced rate since the insurer’s risk is spread across a number of participants.

How does Group Health Insurance work?

An employer or other entity buys Group Health Insurance, extending the benefits to eligible members. This typically includes employees and their dependents, providing them with a network of doctors, specialists, hospitals, and other healthcare providers at negotiated rates.

In accordance with the Affordable Care Act (ACA), companies that have 50 or more full-time staff members are mandated to offer health insurance to those working full-time and their dependents who are under 26 years old, or they will be subjected to a penalty. Insurance companies are also obligated to extend group coverage to entities with a minimum of two workers. Some regions even make provisions for self-employed persons eligible for group coverage schemes.

The responsibility of selecting and procuring group health insurance plans falls on companies or member organizations, who make these group health plans available to their workforce. A majority of states mandate that a group insurance plan must achieve a 70% participation level, although this rate can vary, being either higher or lower depending on specific state regulations.

Benefits of Group Health Insurance

The provision of Group Health Insurance is more than just a workplace perk; it’s a powerful tool that offers mutual advantages for both employers and employees. From financial incentives to bolstering employee satisfaction, the benefits of group coverage are multifaceted. Below, we explore some key advantages that make group health insurance an essential consideration for businesses and organizations.

Group Coverage Is Less Costly

Group health insurance often comes at a reduced rate compared to individual plans. By negotiating as a group, the employer or organization can often secure a more favorable pricing structure with the insurance company, leading to savings typically shared with employees.

Group Coverage Spreads Out the Risk

In group health insurance, the risk is distributed across multiple participants. This broader risk spreading helps stabilize health insurance premiums and can result in lower costs. The insurer’s risk is mitigated, leading to potentially better terms for the group.

Group Coverage Offers Tax Benefits for the Business

Businesses providing group health insurance can take advantage of significant tax incentives. Contributions towards employee premiums are generally tax-deductible, which can reduce the overall tax liability for the company. This makes offering group health insurance a financially attractive option for many businesses.

Group Coverage Brings Employee Satisfaction

Employees often view health insurance as one of the most valuable benefits provided by their employer. Offering group health coverage can increase overall job satisfaction, help retain existing staff, and attract new talent. It sends a positive message that the employer values the well-being of their workforce.

Group Coverage Offers Open Enrollment

Open enrollment periods are specific times during which employees can join the group health plan, make changes to their existing coverage, or add dependents. This offers flexibility and allows employees to adjust their coverage to fit their evolving needs. Having a regular open enrollment period simplifies the process and helps ensure that all eligible employees can participate in the group plan.

How Many People Do You Need for a Group Health Plan?

The minimum number of individuals required for a group health plan varies by state and insurer. Generally, a small group is considered to be between 2 and 50 employees, although these numbers can vary.

Why Are Group Health Insurance Plans More Affordable?

Group Health Insurance plans can be more affordable due to the collective bargaining power of the group. Insurers often offer reduced rates for larger groups, and administrative costs are spread across more individuals, further reducing the cost.

How to Enroll in a Group Health Insurance Coverage Plan?

Enrollment in a group health insurance plan is typically done during the employer’s open enrollment period. Special enrollment periods may be available for qualifying life events. Contact your Human Resources department or association for specific enrollment instructions.

How Can NPA Benefits Help with Group Health Insurance?

NPA Benefits offers a multifaceted approach to Group Health Insurance, emphasizing personalization, expertise, efficiency, and innovation. Their comprehensive suite of services addresses the complexity of health insurance from every angle, providing your organization with a valuable partner in managing one of the most critical aspects of employee benefits. Whether you are just beginning the journey of selecting a group health plan or looking to enhance an existing one, NPA Benefits is equipped to provide the solutions and support that lead to successful, satisfying outcomes for your organization and its employees.

Frequently Asked Questions

Group health insurance is a type of insurance coverage that provides health benefits to a specific group of people, such as employees within a company. The employer usually selects the plan and offers it to employees as a benefits package. It often comes at a lower cost to individuals, as the risk is spread across multiple participants.

An example of a group health insurance plan might be a Preferred Provider Organization (PPO) offered by a medium-sized tech company to its employees. In this plan, employees would access a network of healthcare providers and facilities at negotiated rates, with incentives for using in-network providers.

Group-term life insurance is a type of life insurance coverage offered to a group, often employees of the same company. It provides a death benefit to the insured person’s beneficiaries for a specific period or “term.” Unlike individual life insurance policies, group term life insurance often does not require medical underwriting, and the premiums may be more affordable.

One advantage of individual insurance over group insurance is customization. While group insurance plans are designed to meet the needs of a diverse group, individual insurance allows for more personalized coverage tailored to an individual’s specific health needs, lifestyle, and preferences. This can lead to a plan that more closely aligns with the individual’s unique situation, although it might come at a higher cost.

Final Words

Health plans sponsored by the government serve as an alternative for individuals who do not have access to group health insurance through their employer. With the introduction of the Affordable Care Act (ACA) in 2010, a health insurance marketplace was established, extending coverage to an estimated 16.3 million people during the open enrollment period of 2022-2023.

Group Health Insurance is a vital aspect of employee benefits, providing healthcare coverage to large numbers of people at affordable rates. It’s a complex topic with various options, advantages, and considerations. Don’t hesitate to contact NPA Benefits or your designated representative for tailored solutions and assistance.