Your Complete Guide to Group Dental Insurance

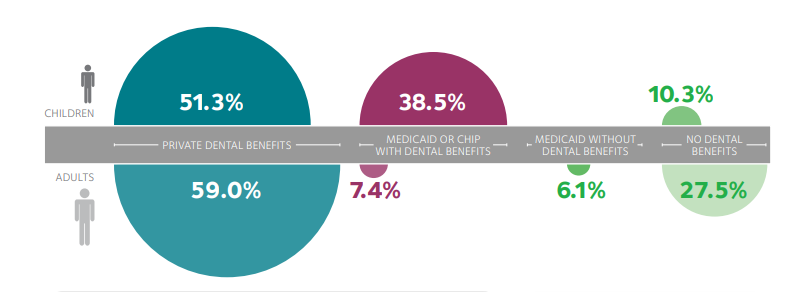

Dental care is a vital part of overall well-being in today’s health-conscious world. For many, dental benefits are essential in maintaining oral health, and the statistics reflect this importance. Among adults aged 19 to 64, 59.0 percent have access to private dental benefits, while another 7.4 percent receive dental benefits through Medicaid. Yet, a concerning 33.6 percent remain without dental benefits. This wide disparity in coverage reveals the complexities and challenges in accessing dental care and emphasizes the need to understand various dental insurance options.

Image Courtesy: American Dental Association

Whether through private insurance, government programs, or lack of coverage, the landscape of dental care is diverse and multifaceted, making it an important subject for exploration and understanding. In the following sections, we will delve into the different types of dental coverage and what they mean for individuals and families seeking the best care for their unique needs and budgets.

What is Group Dental Insurance?

Group Dental Insurance offers a safety net for employees’ dental care needs. By offering group dental insurance plans, employers provide a cost-effective solution for their teams, ensuring quality dental disease care at reduced costs. It encompasses routine check-ups, surgical procedures, and other oral care needs that the employees and their dependents may require.

What Makes a Good Group Dental Insurance?

When it comes to employee benefits, group dental insurance stands as one of the most valuable and appreciated perks a company can offer. It not only promotes good oral health but also conveys that the employer cares about the well-being of its workforce. But what separates a good group dental insurance plan from an average one? Let’s break it down into the key aspects of an excellent plan.

Preventive Care: The Foundation of Oral Health

Preventative care is all about promoting good oral hygiene and early detection of dental issues. A group dental insurance plan that emphasizes preventative care typically includes:

- Regular Check-ups: These allow dentists to catch potential problems before they become serious.

- Cleanings: Regular dental cleanings prevent cavities and gum disease.

- Screenings: This includes screenings for oral cancer and other diseases that might affect overall health.

Preventative care keeps employees’ smiles bright and can catch systemic diseases early, as many are first detectable in the mouth. It’s a critical component that helps reduce long-term health costs and fosters a healthy working environment.

Quality Coverage: Comprehensive and Affordable

Quality coverage is about more than just what’s covered; it’s about how it’s covered. Key elements include:

- Broad Range of Basic Services: From basic fillings to more complex procedures like root canals or orthodontics.

- Affordability: Reasonable premiums, deductibles, and co-payments that don’t strain the employee’s wallet.

- Accessibility: Easy-to-understand policies and claims processes, with clear guidelines about what is and isn’t covered.

Quality coverage ensures employees can access dental care without financial stress, providing peace of mind and boosting overall job satisfaction.

Wide Selection: Choice and Flexibility

A wide selection of dental care providers is essential for any top-notch group dental insurance plan. It includes:

- Diverse Network of Dentists: Ensuring that employees can choose from a variety of dental professionals in different specialties.

- Geographical Reach: Offering choices in various locations, catering to the diverse needs of a distributed workforce.

- In-Network and Out-of-Network Options: Providing flexibility for employees to choose providers outside the network if necessary, though often at a higher cost.

A wide selection offers employees the autonomy to find dental care providers that align with their preferences, needs, and values.

What Types of Costs Will Employees Pay?

When participating in a group dental insurance plan, employees will commonly encounter the following costs:

Deductible

The deductible is the amount an employee must pay out-of-pocket before the insurance plan starts to cover costs. It’s a fixed amount set annually and can vary widely depending on the plan.

Co-pay

A co-pay is the fixed amount an employee pays for a dental service or visit. It’s a standard feature in many insurance plans, making certain preventive services more accessible by spreading the cost between employee and insurer.

Coinsurance

Coinsurance is the percentage of an employee’s cost for a covered service after the deductible has been met. It represents a shared responsibility between the insurer and the insured, with percentages varying based on the plan and specific treatments.

Annual Maximum

The annual maximum is the cap on the amount the insurance plan will pay within a given year. Once this limit is reached, the employee will be responsible for 100% of any additional costs. Understanding this limit is crucial; it helps employees plan their dental care expenses for the year.

Which Dental Plan Type Fits Your Needs?

Understanding the types of dental plans is essential for selecting the right fit:

PPO (Preferred Provider Organization)

A PPO plan offers a network of preferred dentists, allowing flexibility in choosing dental care providers. While you can visit any dentist, staying within the network usually means lower costs. It’s an excellent option for those who want a broader choice of providers.

HMO (Health Maintenance Organization)

An HMO plan requires members to select a primary care dentist within a specific network, typically offering lower costs. Referrals are usually needed for specialist care. If budget-friendly, consistent costs are a priority, and you don’t mind a limited network, this may be a suitable choice.

Fee-for-Service

Fee-for-Service plans allow you to visit any dentist, offering complete flexibility. You pay for services as you receive them, and the insurance reimburses a part or all of the costs, depending on the plan. This option suits those seeking full control over their dental care choices but may include higher out-of-pocket costs.

Discount Plans

Discount dental plans are not insurance but provide access to discounted dental services from participating providers. Members pay a fee for reduced rates on various dental treatments. It can be a good fit for those without traditional dental insurance or who want to supplement their existing coverage.

How Can NPA Benefits Help with Group Dental Insurance?

NPA Benefits specializes in designing tailored group dental insurance plans that suit your company’s unique needs. Our dedicated team will guide you through every step, ensuring seamless integration and maximum benefits for your employees.

Frequently Asked Questions

What is the most common type of dental insurance?

The most common type of dental insurance is typically the Preferred Provider Organization (PPO) plan. It offers a balance between flexibility in choosing dental care providers and cost-effectiveness, making it a popular choice among both individuals and employers.

What does insurance mean in dental?

In dental, insurance refers to a financial arrangement that covers or subsidizes the cost of dental care. Depending on the plan, dental insurance may cover procedures ranging from regular cleanings and check-ups to more complex treatments like root canals or orthodontics, thereby reducing the financial burden on the insured.

What does group dental insurance cover?

Group dental insurance usually covers a broad spectrum of dental services. It often includes preventative care like regular cleanings and exams, basic treatments such as fillings and extractions, and major procedures like crowns or bridges. The exact coverage can vary widely between plans and providers, with some also offering coverage for specialized treatments like orthodontics.

Is my small business eligible for group dental insurance?

Yes, small businesses can often obtain group dental insurance. Eligibility criteria may vary by provider.

Final Words

Investing in group dental insurance is strategic for businesses, ensuring employee satisfaction and overall well-being. Navigating through the available options can be complex, but with expert guidance, you can secure a plan that fits your needs perfectly. Contact our specialists at NPA Benefits to discover how we can create the ideal dental insurance plan for your organization.