Unlocking the Mystery of Group Accidental Death & Dismemberment Insurance

In the world of insurance, Group Accidental Death & Dismemberment (AD&D) insurance often remains shrouded in mystery. With its unique coverage parameters and specific conditions, it can be challenging to comprehend fully, let alone determine its necessity in a comprehensive insurance strategy. This guide aims to unlock the enigma of AD&D insurance, helping you navigate its complexities and understand how it can play an integral role in your financial protection plan.

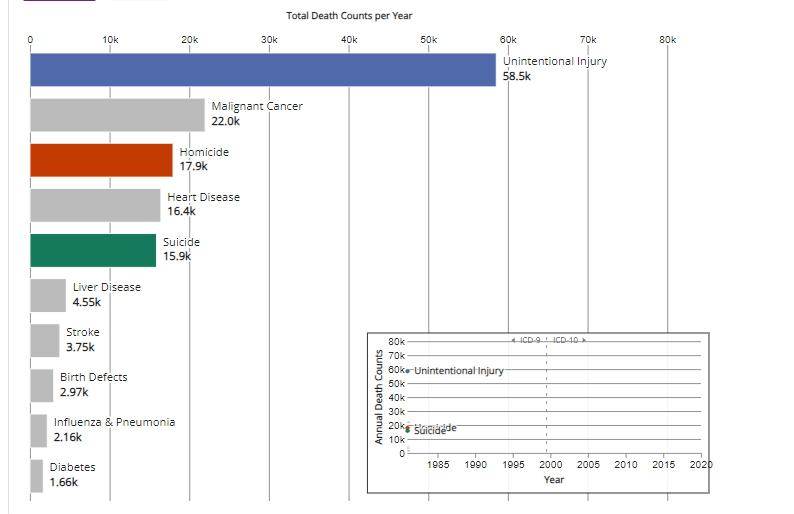

Image Courtesy: Centers for Disease Control and Prevention

As we delve into the intricacies of AD&D insurance, we’ll explore its essential components, including how it works, its common exclusions, advantages, disadvantages, and frequently asked questions. In shedding light on these aspects, we hope to equip you with the necessary knowledge to make informed decisions about incorporating this insurance into your or your organization’s protection plan. By comprehending its benefits and potential limitations, you can be better prepared to face life’s unexpected turns.

What Is Accidental Death and Dismemberment (AD&D) Insurance?

AD&D insurance is a unique policy that covers accidental death or severe injury leading to dismemberment. It is a supplement life insurance that offers financial protection to the policyholder’s beneficiaries if death occurs directly from an accident or if the policyholder suffers a severe injury leading to loss of limb, speech, hearing, or sight.

Moreover, it’s crucial to remember that AD&D insurance is considered a supplementary form of life insurance coverage. It’s designed to provide additional protection, particularly in severe accidents leading to death or dismemberment.

However, it is not designed to replace a comprehensive life insurance policy. AD&D coverage, while beneficial, does not cover a variety of situations that a standard life insurance policy would, such as death from illness or natural causes. Therefore, it’s essential to consider it as an added layer of protection, not as a standalone solution for regular life insurance needs.

How Accidental Death and Dismemberment (AD&D) Insurance Works

Understanding how AD&D insurance works is crucial in determining if it fits your personal or organizational needs.

Accidental death benefit policy

This portion of the policy benefits your beneficiaries financially if you die from an accident. This could range from a car accident to an accidental fall – the policy is designed to cover unforeseen and sudden events.

Dismemberment benefits

Dismemberment coverage kicks in if the policyholder suffers a severe injury leading to the loss of a limb, speech, hearing, or sight. The payout typically depends on the severity and type of loss sustained.

Voluntary AD&D

Voluntary Accidental Death and Dismemberment insurance is an optional coverage that employees can choose to add to their basic life insurance options. It provides an extra layer of protection to help manage the financial impact of a serious accident.

Common Exclusions

All insurance companies have a list of specific exceptions included in their life insurance policies. This often comprises self-inflicted harm, deaths due to illness or naturally occurring causes, and injuries sustained during warfare.

Additional usual exceptions often encompass death due to the misuse of harmful substances, fatalities while under the influence of non-prescription drugs, self-destruction, certain high-risk hobbies, and injuries or deaths of professional athletes during their sporting events.

If the insured’s loss is due to an illegal activity they participated in, benefits typically are not disbursed. Individuals employed in occupations with elevated risk levels (like public safety roles and military service) might not be eligible for AD&D coverage.

Advantages of AD&D Insurance

While no insurance policy can provide complete protection from all life’s uncertainties, AD&D offers unique benefits worth considering.

Financial support

AD&D insurance provides essential financial assistance during tough times. It can cover medical bills or funeral costs following an accident. This financial support can alleviate the financial burden your loved ones face in your absence.

Lost income coverage

An accidental death or severe injury could result in a significant loss of income. The payout from an AD&D insurance policy can help supplement this lost income, offering financial stability to beneficiaries during challenging times.

Low premiums

Compared to traditional life insurance, AD&D insurance often has lower premiums. This makes it a more affordable option for many individuals and groups, allowing for wider coverage without straining finances.

No medical exam

One of the key advantages of AD&D insurance is that it typically does not require a medical examination for approval. This makes it a more accessible and convenient option for individuals who may not be eligible for other types of life insurance due to medical conditions.

Disadvantages of AD&D Insurance

As with all insurance policies, you should be aware of potential drawbacks to AD&D coverage.

Covers specific incidents only

AD&D insurance provides coverage only for certain types of accidents leading to death or severe injury. Illness-related death, for instance, is not a covered accident as per the policy, which limits the scope of protection offered by this policy.

Low likelihood of payout

Due to its specific coverage conditions, AD&D insurance generally has a lower payout probability than more traditional forms of life insurance. This means you may pay premiums for years without ever seeing a benefit.

Connected to the present jobs

Group AD&D insurance is often linked to your current employment. If you change or lose your job, you may also lose this coverage, which could expose you during a transitional period.

False sense of security

While AD&D insurance offers important coverage, it’s not a comprehensive solution. Relying solely on AD&D insurance can lead to a false sense of security, as it doesn’t provide the breadth of coverage that a comprehensive life insurance policy would.

How Can NPA Benefits Help?

NPA Benefits is committed to helping you navigate the intricacies of group AD&D insurance. Our dedicated team can provide personalized advice, ensuring you get a policy tailored to your needs and circumstances.

Frequently Asked Questions (FAQs)

Group Life & AD&D is a combined insurance policy often offered by employers. It provides beneficiaries with a payout in the event of the policyholder’s accidental death or severe injury resulting in dismemberment, in addition to standard life insurance benefits.

Group accidental life insurance is a policy offered by employers that pays out a benefit if the policyholder dies as a result of an accident. It’s part of the broader benefits package companies provide employees to enhance their overall compensation.

An AD&D insurance policy is a type of coverage that pays benefits in case of the policyholder’s accidental death or dismemberment. This means that a benefit is paid out if the policyholder dies or suffers a serious injury, such as the loss of a limb, sight, hearing, or speech due to an accident.

Dismemberment coverage is a component of an AD&D insurance policy that provides a payout if the policyholder experiences a severe injury that results in the loss of a limb, sight, hearing, or speech due to an accident. The amount paid out often depends on the severity and type of loss.

Final Words

While AD&D insurance can play a vital role in your broader insurance strategy, it’s important to thoroughly understand its benefits and limitations. Consult a professional to ensure you make the most informed decision for you or your organization.