Understanding Self-Pay Health Insurance Options

Let’s face it – navigating health insurance without employer support can feel like trying to solve a puzzle with missing pieces. Whether you’re self-employed, between jobs, or working for a company that doesn’t offer benefits, finding the right coverage is essential for both your wellbeing and financial security.

I’m Les Perlson, a partner with over 40 years in the health insurance industry. Throughout my career, I’ve helped countless individuals find their way through the sometimes confusing world of self-pay health insurance options.

The good news? You have more choices than you might think. And contrary to popular belief, these options can be affordable – especially with the right guidance.

When we talk about self-pay health insurance options, we’re referring to health coverage plans you purchase directly, without employer or government sponsorship. These come in several varieties, each designed to meet different needs and budgets.

ACA Marketplace Plans offer comprehensive coverage with essential health benefits, preventive care, and protection for pre-existing conditions. The real advantage here? About 90% of enrollees qualify for financial assistance, according to 2024 data from the Centers for Medicare & Medicaid Services. That can make a significant difference in your monthly premium.

For those who don’t qualify for subsidies but still want robust coverage, Off-Exchange Plans purchased directly from insurers might be the answer. These plans offer similar benefits to ACA plans but sometimes with more flexibility.

If you’re in a transition period – perhaps between jobs or waiting for other coverage to begin – Short-Term Plans can provide temporary protection. They typically feature lower premiums but offer more limited benefits for periods ranging from 30 to 364 days.

Young, healthy individuals under 30 (or those with hardship exemptions) might consider Catastrophic Plans. These feature very low monthly premiums paired with high deductibles, while still covering preventive care.

For those open to alternative models, Health Sharing Plans offer a different approach. While not technically insurance, these plans can provide meaningful coverage at lower costs, with some offering faith-based options.

| Self-Pay Option | Best For | Key Features |

|---|---|---|

| ACA Marketplace Plans | Comprehensive coverage with possible subsidies | Essential health benefits, preventive care, pre-existing conditions covered |

| Off-Exchange Plans | Those who don’t qualify for subsidies but want major medical coverage | Similar to ACA plans but purchased directly from insurers |

| Short-Term Plans | Temporary coverage between jobs or during transitions | Lower premiums, limited benefits, typically 30-364 days |

| Catastrophic Plans | Healthy people under 30 or those with hardship exemptions | Low premiums, very high deductibles, preventive care covered |

| Health Sharing Plans | Those comfortable with alternative coverage models | Not insurance, faith-based options available, lower costs |

In the sections that follow, we’ll dive deeper into each of these self-pay health insurance options, exploring their benefits, limitations, and how to determine which might be right for your unique situation. The best choice often depends on your health needs, budget constraints, and personal preferences.

Want to learn more about specific aspects of self-pay coverage? Check out our dedicated resources on self pay insurance meaning and self pay medical options.

Finding the right health insurance doesn’t have to be overwhelming. With the right information and guidance, you can secure coverage that protects both your health and your wallet – even without employer support.

Comprehensive Major Medical Self-Pay Health Insurance Options

When you’re exploring self-pay health insurance options, comprehensive major medical plans deserve your first look. These robust plans cover everything from your annual check-ups to those unexpected hospital stays that keep you up at night worrying about costs.

The ACA Marketplace (also called the Health Insurance Exchange) is where many people start their search. It’s like a shopping mall for health insurance where you can compare plans side-by-side, all meeting federal standards for quality coverage and consumer protections.

Metal Tiers: Understanding Your Options

The ACA organizes plans into four “metal tiers” that make it easier to understand what you’re getting:

Think of it like this: Bronze plans are like buying a basic car – lower monthly payments but you’ll pay more when you need repairs (insurance covers about 60% of costs). Silver plans strike a middle ground with moderate premiums and out-of-pocket costs (insurance covers about 70%). Gold plans cost more monthly but provide more coverage when you need care (insurance covers about 80%). And Platinum plans have the highest monthly premiums but the lowest costs when you actually use your insurance (covering about 90% of costs).

I recently helped a client who initially wanted the Bronze plan for its low premium. After we calculated her prescription costs, we finded a Silver plan would actually save her money throughout the year. Sometimes the cheapest monthly option isn’t the most affordable in the long run.

Why self pay health insurance options on the ACA Marketplace make sense

For many folks I work with, ACA plans offer real financial benefits that make them stand out among self-pay health insurance options:

First, there are premium tax credits that can dramatically lower your monthly bill. If you earn between 100% and 400% of the Federal Poverty Level, these subsidies can make a huge difference. One self-employed client of mine saw his $475 monthly premium drop to just $175 after tax credits – that’s $3,600 saved per year!

Second, if your income falls between 100% and 250% of the poverty level, you might qualify for cost-sharing reductions that lower your deductibles, copays, and other out-of-pocket costs. The catch? These are only available with Silver plans.

Third, unlike some other insurance options, ACA plans can’t deny you coverage or charge you more because of pre-existing conditions. That peace of mind is priceless for many of my clients with chronic conditions.

The numbers speak for themselves – according to Covered California data, about 90% of enrollees qualify for financial assistance. That’s why ACA plans remain among the most accessible self-pay health insurance options available.

When Can You Enroll?

Timing matters with ACA plans:

Open Enrollment typically runs from November 1 through January 15 in most states. This is your annual window to sign up or switch plans.

If you miss this window, don’t panic! Special Enrollment Periods are available if you experience qualifying life events like losing your job-based coverage, getting married, having a baby, moving to a new area, or changes in your income. These events open a 60-day window to enroll outside the standard period.

Michael, a graphic designer I worked with, shared: “After my wedding last June, I thought I’d have to wait months for insurance. But the Special Enrollment Period let me get coverage right away, and the premium tax credits made it surprisingly affordable.”

Pros & cons of self pay health insurance options in major medical plans

Let’s be honest about the good and the challenging aspects of ACA plans:

On the bright side, you get comprehensive coverage including all essential health benefits mandated by law. Your preventive services like annual check-ups, vaccinations, and screenings are covered at no additional cost – I always remind clients to take advantage of these. There’s also the security of knowing pre-existing conditions are covered, plus those potential financial subsidies we discussed. And don’t overlook the protection of annual out-of-pocket maximums that cap your spending if serious health issues arise.

On the flip side, these plans can be expensive without subsidies. The network limitations might mean changing doctors if yours isn’t in-network. Deductibles can be substantial, especially with Bronze plans – I’ve seen clients face $7,000+ deductibles before coverage kicks in. And the limited enrollment periods mean you can’t just sign up anytime you want.

At NPA Benefits, we’ve guided countless individuals through these complex choices. We recently helped a freelance writer earning about $45,000 annually secure a Silver plan with a $175 monthly premium after subsidies – saving her over $300 every month compared to the standard rate.

Want to learn more about your affordable healthcare options? Check out our detailed guide at More info about Affordable Healthcare Options or see the latest research on plan affordability directly from healthcare.gov.

Off-Exchange & Private Major Medical Plans

Looking beyond the ACA Marketplace reveals another world of self-pay health insurance options that might be perfect for your situation. Off-exchange plans are sold directly by insurance companies or through brokers (like us at NPA Benefits) rather than through the government-run Marketplace website.

Think of off-exchange plans as cousins to Marketplace plans – they still follow ACA rules by covering essential health benefits and protecting folks with pre-existing conditions, but they operate under slightly different rules.

Key Differences from Marketplace Plans

The biggest difference? Money. Off-exchange plans don’t qualify for those helpful premium tax credits or cost-sharing reductions – even if your income would normally make you eligible. This might sound like a deal-breaker, but there are some compelling reasons why these plans still make sense for many people.

For starters, off-exchange plans often feature broader provider networks. I’ve worked with countless clients who chose this route simply because they wanted to keep seeing their trusted doctors who weren’t in any Marketplace plan networks.

Jennifer, a bakery owner I helped last year, told me: “My family has been seeing the same pediatric specialist for years. When I realized he wasn’t in any Marketplace plan networks, going off-exchange was really our only option. The premium is higher, but my peace of mind is worth every penny.”

Off-exchange plans also sometimes offer unique plan designs you won’t find on the Marketplace. Insurance companies have more flexibility to create innovative coverage options when they’re not constrained by the standardization required for Marketplace listings.

While most off-exchange plans still follow the standard Open Enrollment Period, some insurers offer certain plans year-round, giving you more flexibility if you miss the regular enrollment window.

Who Should Consider Off-Exchange Plans?

In my experience helping clients steer their self-pay health insurance options, off-exchange plans tend to be particularly good fits for:

People earning too much to qualify for subsidies – if you’re not getting financial help anyway, why limit yourself to Marketplace options?

Families with strong provider preferences – if keeping your doctors is your top priority, and they’re not in Marketplace plan networks, off-exchange plans offer that continuity of care.

Those seeking specific plan features – maybe you want a particular prescription formulary or coverage for alternative therapies that’s only available through an off-exchange plan.

At NPA Benefits, we take pride in comparing both on-exchange and off-exchange options for every client. This thorough approach ensures you see the full spectrum of self-pay health insurance options before making such an important decision.

I recently worked with a self-employed consultant earning above the subsidy threshold. After reviewing his family’s specific healthcare needs and usage patterns, we finded an off-exchange plan from a regional insurer that offered substantially better coverage for his children’s orthodontic needs at nearly the same price as comparable Marketplace plans.

For more personalized guidance on finding the right coverage for your unique situation, check out our resources on Customized Health Insurance Plans.

Short-Term Medical Insurance

When you need temporary health coverage, short-term medical insurance represents one of the most flexible self-pay health insurance options available. These plans are designed to provide limited coverage during transitions in your life.

What is Short-Term Medical Insurance?

Think of short-term medical insurance as your healthcare safety net during life’s transitions. These plans provide temporary coverage for specific periods, typically ranging from 30 days up to 364 days, depending on where you live. Some states are more generous, allowing renewals that can extend your coverage for up to 36 months, while others have stricter rules or don’t permit these plans at all.

Short-term plans march to their own beat – they’re not ACA-compliant. This means they can review your medical history before approving you, they don’t have to cover all the essential health benefits that ACA plans do, and they can set limits on how much they’ll pay for your care. They can also charge different premiums based on your health status.

Despite these limitations, short-term plans fill an important gap in the health insurance landscape. They typically offer much lower premiums than comprehensive coverage, making them an attractive option when you need something temporary without breaking the bank.

As Jake, one of our clients, told us after losing his job: “The short-term plan was a financial lifesaver. It cost less than half of what COBRA would have, and while I knew the coverage wasn’t as comprehensive, it gave me peace of mind knowing I wouldn’t go bankrupt if something serious happened.”

When Short-Term Plans Make Sense

Life doesn’t always align perfectly with insurance enrollment periods. Short-term plans shine brightest during those awkward in-between times. They’re perfect when you’re between jobs and waiting for new employer coverage to kick in. They’re a smart choice if you missed the Open Enrollment window for ACA plans and don’t qualify for a Special Enrollment Period.

Recent college graduates who’ve aged out of their parents’ plans often turn to short-term coverage as a budget-friendly option. Early retirees who aren’t yet eligible for Medicare find these plans helpful to bridge the gap. And for folks who find ACA plans simply out of financial reach, a short-term plan offers at least some protection against catastrophic medical bills.

Research from the Kaiser Family Foundation shows that a significant number of short-term plan enrollees choose these plans primarily for economic reasons. With premiums often 50-80% lower than unsubsidized ACA plans, it’s not hard to see why.

Shopping tips for short-term self pay health insurance options

Finding the right short-term plan requires a careful eye for detail. Here’s what to watch for:

First, take time to understand what’s covered and what’s not. Many short-term plans skip coverage for things like maternity care, mental health services, prescription drugs, and preventive care. If you need these services, factor in their out-of-pocket costs when comparing plans.

Be especially mindful of benefit maximums. A plan might advertise a $1 million lifetime maximum, which sounds impressive, but then cap individual incidents at much lower amounts – like $50,000 for a hospital stay. That could leave you with substantial bills if you experience a serious medical event.

Pay attention to renewal options in your state. Even when renewals are allowed, developing a new medical condition during your initial coverage period might affect your ability to renew or change your premium.

Most short-term plans won’t cover pre-existing conditions. Check how far back the plan “looks” to determine what counts as pre-existing – it could be anywhere from the past 12 months to five years.

Finally, understand any network restrictions. Some plans offer better coverage if you stay in-network, while others let you see any provider but reimburse at a lower rate.

“I initially chose the cheapest short-term plan I could find,” shares Maria, a freelance designer. “But when I looked closer, I realized it had a $10,000 deductible and only covered 60% after that. Spending a little more for a plan with a $3,500 deductible and 80% coverage gave me much better protection.”

State Variations

Your zip code matters enormously when it comes to short-term plans. State regulations create a patchwork of availability and features across the country.

If you live in California, New York, or Massachusetts, you’ll find short-term plans effectively prohibited. Other states like Colorado and Washington allow them but with stricter rules than federal standards. Some states limit duration to periods shorter than the federal maximum of 364 days, while others require short-term plans to cover benefits not mandated by federal regulations.

At NPA Benefits, we stay current on these ever-changing state rules. We can quickly tell you what’s available in your location and whether a short-term plan makes sense for your situation. We’ve helped countless clients find that perfect temporary solution that balances affordability with adequate protection.

Want to explore if a short-term plan might be right for your situation? Check out our Alternative Health Insurance Options page for more details on how these plans compare to other self-pay health insurance options.

Catastrophic & High-Deductible Plans (HDHPs + HSAs)

If you’re generally healthy and looking for protection against major medical disasters without breaking the bank each month, catastrophic and high-deductible health plans might be the perfect fit among your self-pay health insurance options.

Catastrophic Health Plans

Think of catastrophic health plans as your financial safety net for worst-case scenarios. These special ACA plans come with rock-bottom monthly premiums but very high deductibles – perfect for those who rarely visit the doctor but want protection from potentially bankrupting medical emergencies.

Not everyone can get these plans, though. You’ll need to be under 30 years old or qualify for a hardship exemption that demonstrates standard plans are unaffordable for your situation.

Despite their high deductibles, catastrophic plans still offer valuable benefits before you meet that threshold:

– Three primary care visits covered each year

– All preventive services at zero cost to you

– Certain preventive medications covered

“As a healthy 28-year-old freelancer, a catastrophic plan gives me peace of mind at a price I can afford,” shares Alex, a self-employed photographer. “I rarely need medical care, but I sleep better knowing I’m protected from financial disaster if something serious happens.”

High-Deductible Health Plans (HDHPs) with HSAs

Want to combine lower monthly premiums with amazing tax benefits? High-Deductible Health Plans paired with Health Savings Accounts offer exactly that – they’re quickly becoming one of the most popular self-pay health insurance options for budget-conscious consumers who still want quality coverage.

In 2024, HDHPs have minimum deductibles of $1,600 for individuals and $3,200 for families. Yes, that’s higher than traditional plans, but it comes with a silver lining – substantially lower monthly premiums and maximum out-of-pocket limits ($8,050 for individuals, $16,100 for families in 2024). Plus, preventive care is still covered 100% before you hit your deductible.

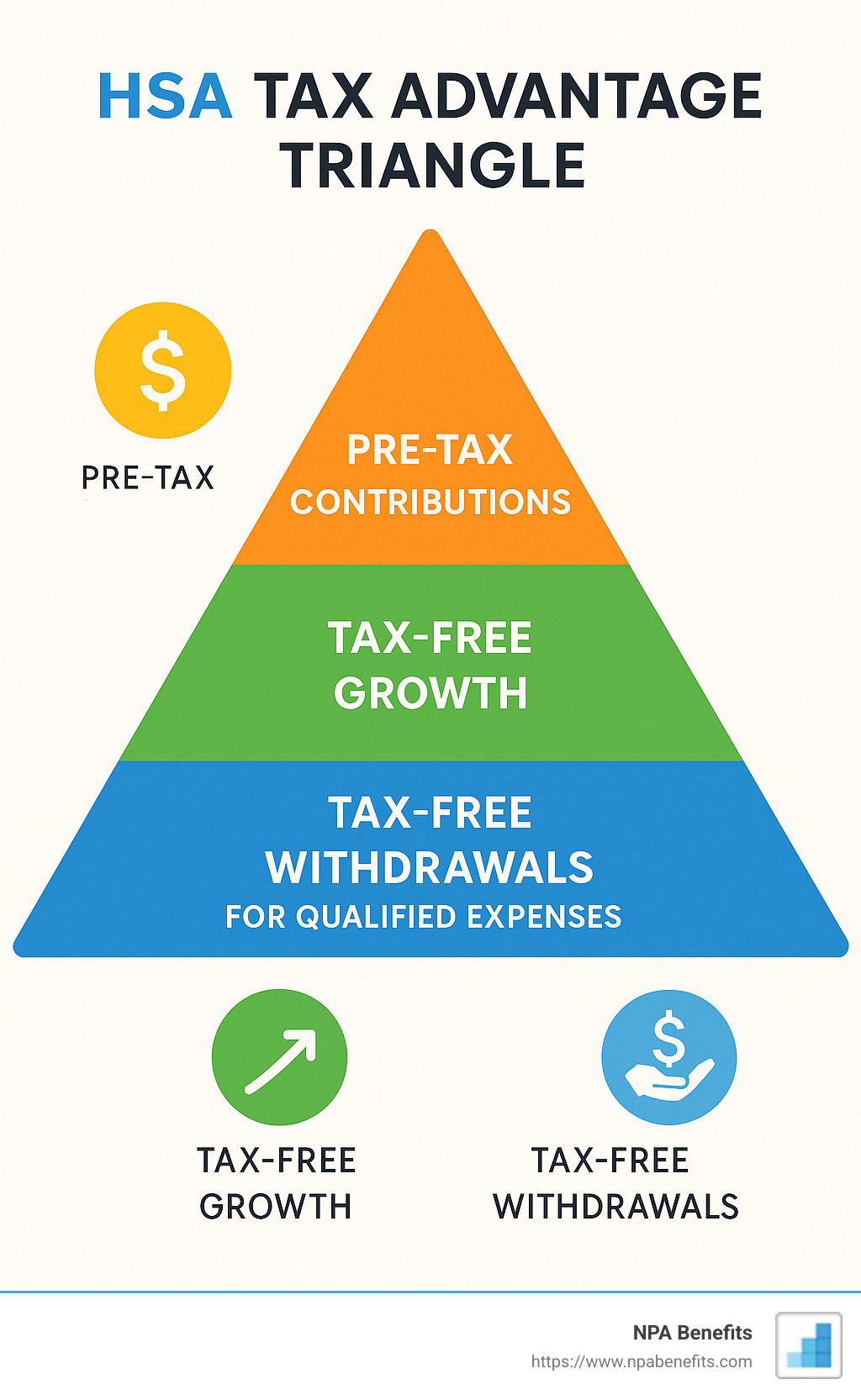

The real magic happens when you pair your HDHP with a Health Savings Account (HSA):

The HSA offers what financial planners call the “triple tax advantage” – something almost unheard of in the tax world. Your contributions are tax-deductible, your money grows tax-free, and withdrawals for qualified medical expenses are tax-free too. It’s essentially the unicorn of tax-advantaged accounts!

For 2024, individuals can stash away up to $4,150 in their HSA, while families can contribute up to $8,300. If you’re 55 or older, you can add another $1,000 as a catch-up contribution. Unlike Flexible Spending Accounts (FSAs), your HSA money rolls over year after year – no “use it or lose it” pressure.

“The HSA has been a game-changer for our family,” explains Rachel, a self-employed consultant. “We’re building a health savings fund while reducing our taxable income. After five years, we’ve accumulated over $15,000 that’s growing tax-free for future medical expenses.”

What many people don’t realize is that an HSA can also function as an additional retirement account. After age 65, you can withdraw funds for non-medical expenses without penalty (though you’ll pay regular income tax, just like a traditional IRA).

Strategic Considerations

Before jumping into a catastrophic plan or HDHP, take a moment to consider your situation:

First, be honest about your health status. These plans work best if you’re generally healthy and don’t anticipate frequent doctor visits or ongoing prescription needs.

Next, check your financial readiness. Could you comfortably cover the full deductible if you had an unexpected hospital stay? If not, a plan with a lower deductible might be safer, even with higher monthly premiums.

Your tax situation matters too. If you’re in a higher tax bracket, the tax deduction from HSA contributions becomes even more valuable – potentially saving you thousands each year.

Finally, consider the long-term perspective. Using an HSA as part of your retirement strategy can be incredibly powerful when you start early and contribute consistently.

At NPA Benefits, we’ve helped countless clients find the perfect balance between immediate coverage needs and long-term financial advantages. One of our self-employed clients saves over $3,200 annually by switching from a traditional plan to an HDHP with maximized HSA contributions – money that’s now working for her future instead of going to an insurance company.

Want to explore if these options might work for your situation? We’re here to help you steer the specifics of catastrophic plans and HDHPs with the personal touch that only comes from decades of experience in self-pay health insurance options.

Alternative Models & Supplements for Self-Payers

Beyond traditional insurance plans, several alternative models and supplemental options can improve or even replace conventional self-pay health insurance options for some individuals.

Health Care Sharing Ministries

When I talk with clients about alternatives to traditional insurance, health care sharing ministries (HCSMs) often come up in conversation. These aren’t insurance in the technical sense, but rather communities where members share medical expenses based on shared religious or ethical beliefs.

Thomas, a small business owner I’ve worked with for years, puts it this way: “As a person of faith, my health sharing ministry aligns with my values while providing the coverage I need at about half the cost of traditional insurance. The community aspect is meaningful to me – knowing my contributions directly help others.”

These programs typically offer lower monthly costs than traditional insurance, though it’s important to understand that they’re not required to cover all essential health benefits. Pre-existing conditions may be limited or excluded, and most have lifestyle requirements consistent with their faith-based foundations.

Direct Primary Care

Have you ever wished you could just pay your doctor directly and skip the insurance hassle altogether? That’s essentially what Direct Primary Care (DPC) offers. This growing model removes insurance from the primary care equation entirely.

For a monthly membership fee (typically $50-$150 depending on your age and location), you gain unlimited access to your primary care doctor. No copays, no surprise bills – just straightforward care when you need it.

Marisa, a freelance writer who came to us frustrated with traditional insurance options, found her solution in this approach. “I pair my DPC membership with a catastrophic plan,” she told me recently. “For $75 a month, I get unlimited visits with my doctor, discounted medications, and same-day appointments. It’s the best healthcare experience I’ve ever had.”

Many of our clients find that combining DPC with a high-deductible or catastrophic plan for major medical needs creates an affordable, patient-centered approach to healthcare.

Supplemental Coverage Options

Think of your health coverage like a puzzle – sometimes the main piece (your major medical plan) needs a few additional pieces to create a complete picture of protection. That’s where supplemental coverage comes in.

Dental and vision insurance fill obvious gaps, as most major medical plans don’t include these essential services. Jennifer, a self-employed accountant I’ve advised for years, found that “adding dental and vision coverage for my family costs just $78 per month total, and saves us hundreds each year on routine care.”

Accident and critical illness insurance provide financial cushioning when life throws its worst at you. These policies typically cost $20-$50 monthly and pay lump-sum benefits when specific events occur – like accidents or diagnoses of serious conditions such as cancer or heart attack. These funds can help cover your deductible or even non-medical expenses during recovery.

Telehealth memberships have exploded in popularity, and for good reason. For about $10-20 monthly, you gain 24/7 access to medical professionals via phone or video. Michael, a self-employed consultant and father of three, shared with me that “my telehealth membership has saved me countless urgent care visits for my kids. At 2 AM with a sick child, being able to consult a doctor immediately from home is invaluable.”

Prescription discount cards are another tool in your cost-saving arsenal. Often free or very low-cost, these programs can sometimes beat your insurance copays. They’re particularly valuable for those medications your insurance might not cover well – or for people without prescription coverage altogether.

At NPA Benefits, we rarely recommend a one-size-fits-all approach. Instead, we work with clients to create strategic combinations of these alternatives and supplements based on individual needs and budgets. One family we work with combines a high-deductible health plan with an HSA, dental insurance, and a telehealth membership – creating comprehensive coverage at a lower overall cost than a traditional low-deductible plan would provide.

The world of self-pay health insurance options extends far beyond traditional plans, and sometimes the most effective and affordable solution involves thinking outside the conventional insurance box. Want to learn more about these alternative approaches? Check out our detailed guide to Self-Pay Medical for more information.

Conclusion

Finding the right self-pay health insurance options can feel like searching for a needle in a haystack. But take a deep breath – you’ve got this! And now that we’ve explored the landscape together, you’re equipped to make a confident decision that protects both your health and your wallet.

Key Takeaways

The beautiful thing about today’s health insurance market is its diversity. Whether you need comprehensive coverage with all the bells and whistles or just basic protection against life’s bigger curveballs, there’s something out there for you.

Your health needs should be your compass in this journey. If you visit doctors frequently or manage chronic conditions, a plan with higher premiums but lower out-of-pocket costs might save you money in the long run. If you’re generally healthy and rarely see doctors, a high-deductible plan could be your ticket to lower monthly payments.

Remember the seesaw relationship between premiums and out-of-pocket costs – when one goes down, the other typically goes up. Finding your sweet spot on this seesaw is key to selecting the right plan.

Don’t limit yourself to traditional insurance models either. Many of our clients have found creative solutions by combining approaches – like pairing a direct primary care membership with a catastrophic plan, or supplementing a high-deductible plan with specific coverage for their particular needs.

And please – don’t assume coverage is out of reach financially without checking for subsidies. I’ve seen countless faces light up when clients find they qualify for assistance that makes quality coverage surprisingly affordable.

Budgeting for Self-Pay Health Insurance

When planning your healthcare budget, think beyond just the monthly premium. Consider what healthcare typically costs you in a normal year, but also have a plan for worst-case scenarios.

Elena, a graphic designer who recently started freelancing, told me: “After years of avoiding doctors because I didn’t have insurance, finding an affordable Marketplace plan changed everything. Now I actually get preventive care, and the peace of mind alone is worth every penny of my subsidized premium.”

Smart healthcare budgeting also means looking for tax advantages where available. HSA-eligible plans offer triple tax benefits that can significantly reduce your overall healthcare costs while building savings for future needs.

The Importance of Network Verification

Here’s a mistake I see too often: people choose a plan based solely on price, only to find their trusted doctors aren’t in-network. Before finalizing any plan, take a few minutes to verify that your preferred providers are covered. Sometimes paying a bit more for a plan that includes your established doctors delivers better value than disrupting your care relationships.

Annual Review is Essential

Your health insurance isn’t something you should set and forget. Your health needs evolve, your financial situation changes, and the insurance marketplace itself transforms from year to year. At NPA Benefits, we recommend reviewing your coverage annually – ideally a few weeks before open enrollment begins – to ensure it still fits your life like a glove.

Expert Help Makes a Difference

With so many moving parts in the health insurance world, having an experienced guide can save you time, money, and headaches. Our team at NPA Benefits specializes in helping people steer self-pay health insurance options every day. We speak insurance jargon fluently so you don’t have to!

Whether you’re self-employed, between jobs, aging off a parent’s plan, or simply looking for better options than what your employer offers, we’re here to translate the complex into the understandable.

The best health plan isn’t necessarily the cheapest or the one with the most benefits – it’s the one that gives you the right coverage at a price that works for your budget, providing peace of mind and access to care when you need it most.

For more information about self-insured health plans and how they might benefit you, visit our self-insured health plans page or reach out directly for personalized guidance. We’d love to help you find your perfect health insurance match.