Level funded health insurance explained: It’s a type of health plan blending elements of both traditional fully-insured plans and self-funded plans. Essentially, it provides predictable monthly costs while offering potential savings if claims are lower than expected.

Health insurance costs have been climbing steadily, making it harder for small- and medium-sized businesses to afford quality coverage for their employees. As premiums rise, companies are on the lookout for more budget-friendly and flexible healthcare solutions. This is where level-funded health insurance can play a critical role.

Why Consider Level-Funded Health Insurance?

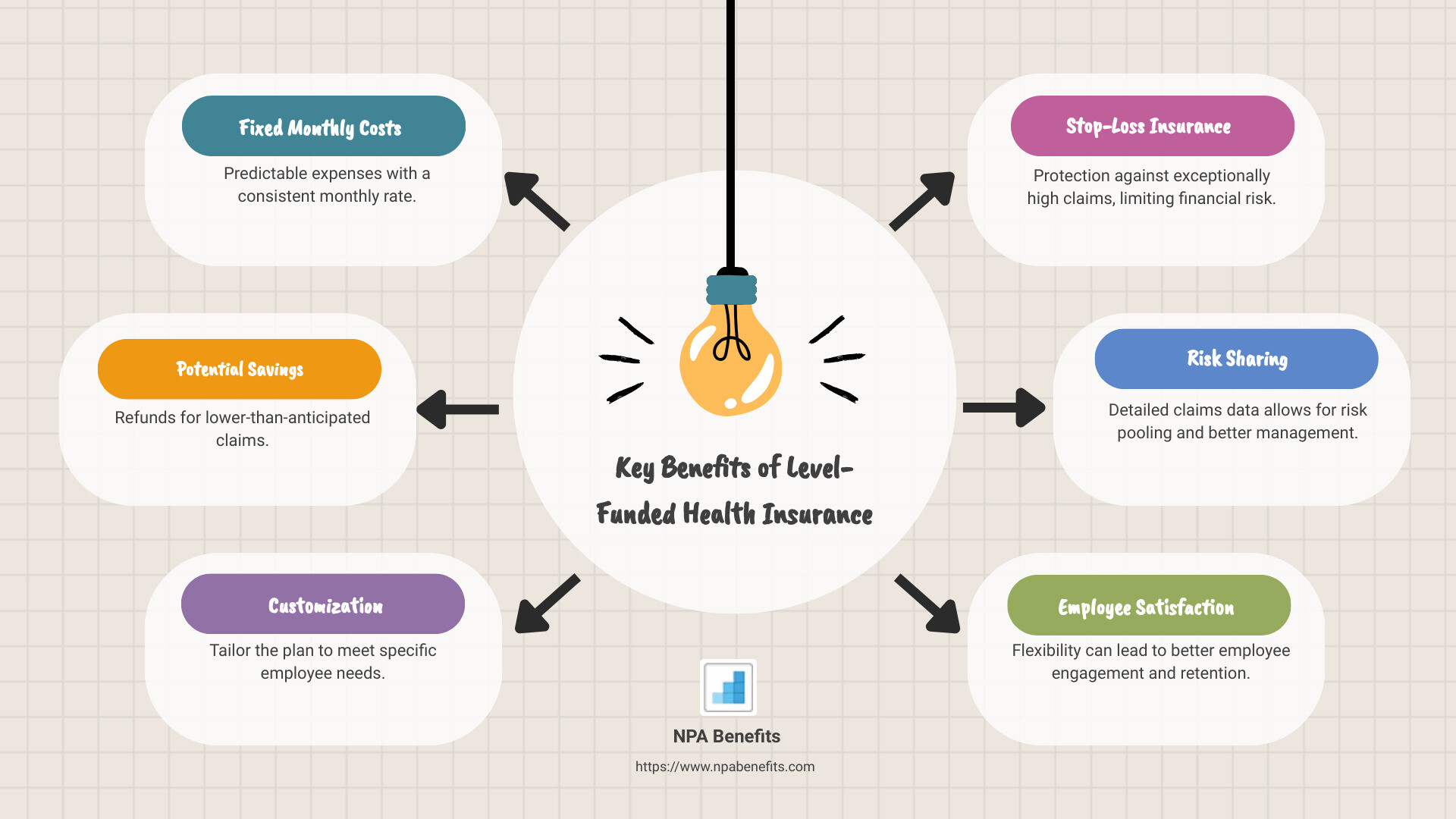

1. Fixed Monthly Costs: Predictable expenses as businesses pay a consistent monthly rate.

2. Potential Savings: If actual claims are lower than anticipated, businesses might get refunds at the end of the plan year.

3. Customization: Greater flexibility to tailor the plan to meet specific employee needs.

4. Stop-Loss Insurance: Protects against exceptionally high claims, limiting financial risk.

Level-funded plans are designed to strike a balance between cost control and flexibility, providing business owners with an affordable and adaptable healthcare option.

My name is Les Perlson, bringing over 40 years of experience in the insurance industry. I aim to simplify complex topics like level funded health insurance explained to help you make well-informed decisions for your business.

Infographic Description: This infographic visually summarizes the benefits of level-funded health insurance. It features a pie chart showing key benefits such as predictable monthly costs (35%), potential savings (30%), customization (20%), and stop-loss insurance (15%). Clear icons and short descriptions accompany each benefit, making it visually engaging and easy to understand.

What is Level-Funded Health Insurance?

How Does Level-Funded Health Insurance Work?

Level-funded health insurance is a unique type of health plan that combines elements of both traditional fully insured plans and self-funded plans. This hybrid approach aims to offer businesses more control over their healthcare costs while still providing comprehensive benefits to employees. Let’s break down how it works.

1. Self-Funded with a Fixed Monthly Cost

In a level-funded plan, the employer pays a fixed monthly amount. This is similar to traditional insurance, where you know exactly how much to budget each month. The monthly payment covers three main components:

- Claims Account: A portion of the monthly payment goes into an account specifically for paying employee health claims.

- Stop-Loss Insurance: This is a safety net for when claims exceed a certain threshold. It ensures that your business isn’t hit with unexpectedly high costs.

- Administration Fees: Part of the payment covers the costs of administering the plan, such as participant onboarding, billing, claims processing, and customer service.

2. Stop-Loss Insurance: Your Safety Net

Stop-loss insurance is a crucial part of level-funded plans. It protects your business from very high claims.

- Specific Stop-Loss: This kicks in when an individual’s claims exceed a certain limit, often between $10,000 and $100,000.

- Aggregate Stop-Loss: This covers the total claims exceeding a predetermined amount for the whole group of employees.

Think of stop-loss insurance as a financial cushion. It limits your risk, ensuring that your business won’t face catastrophic costs due to unexpected high claims.

3. Administration Fees

Administration fees are the costs associated with managing the health plan. These fees cover a range of services provided by a third-party administrator (TPA), including:

- Participant Onboarding: Helping new employees get started with their health benefits.

- Billing and Claims Processing: Managing the financial transactions and paperwork.

- Customer Service: Providing support and answering questions from employees.

4. Risk Sharing

Level-funded plans involve some risk sharing between the employer and the insurer. Here’s how it works:

- Employer Risk: The employer funds the claims up to a certain threshold. This means if claims are high but below the stop-loss limit, the employer pays for them.

- Insurer Risk: The stop-loss insurance covers claims that exceed the threshold, protecting the employer from very high costs.

This balance of risk helps keep monthly costs predictable while still providing a safety net for high claims.

Example: How It Works

To illustrate, consider a small business that chooses a level-funded plan. They pay a consistent monthly premium, which covers employee health claims up to $50,000. Any claims beyond this limit are covered by stop-loss insurance. This setup provides predictability in budgeting and shields the company from potential high costs due to unforeseen medical issues.

Summary

Level-funded health insurance offers a blend of predictability and flexibility. Businesses pay a fixed monthly cost, fund employee claims up to a certain limit, and are protected by stop-loss insurance for high claims. This approach provides more control over healthcare expenses while still offering comprehensive benefits to employees.

Next, we’ll dive into a comparison of Level-Funded vs Fully Insured Plans to see how they stack up against each other.

Level-Funded vs Fully Insured Plans

Key Differences

When comparing level-funded health insurance to fully insured plans, several key differences emerge. These differences can significantly impact an employer’s decision on which type of plan to choose. Let’s break down these differences in simple terms.

1. Fully Insured Plans: Fixed Premium and Risk Pooling

In a fully insured plan, the employer pays a fixed premium to the insurance carrier. This premium is set for the year and does not change, regardless of how many claims are filed. Here’s how it works:

- Fixed Premium: Employers pay a consistent amount each month, which makes budgeting straightforward.

- Risk Pooling: The insurance carrier pools the risk across all their clients. This means that the insurer assumes all the risk, covering the cost of claims, even if they exceed the expected amount.

- Surplus Retention: If the total claims are lower than expected, the insurance company retains the surplus. Employers do not receive any refunds.

2. Level-Funded Plans: Employer Risk and Cost Savings

Level-funded plans blend elements of fully insured and self-funded plans, offering potential cost savings and more flexibility. Here’s what sets them apart:

- Employer Risk: Employers fund employee claims up to a certain threshold. This means they assume some risk, but stop-loss insurance protects them from very high claims.

- Cost Savings: If the total claims are lower than expected, employers may receive a refund on the claims portion of their payments. This can result in significant savings.

- Plan Flexibility: Employers have more control over plan design, including networks, deductibles, and co-pays. This allows them to tailor the plan to better meet the needs of their employees.

3. Surplus Retention

One of the main benefits of level-funded plans is the potential for surplus retention. Unlike fully insured plans where the insurer keeps any unused funds, level-funded plans allow employers to retain surplus claim dollars. This can lead to a refund at the end of the year if the actual claims are lower than expected.

4. Predictability vs Flexibility

- Fully Insured Plans: Offer predictability in costs, as the premium is fixed and the insurer assumes all risk. However, they lack flexibility in plan design and do not provide refunds for low claims.

- Level-Funded Plans: Provide a balance of predictability and flexibility. Employers pay a fixed monthly amount, but also have the potential to save money if claims are low. Additionally, they can customize the plan to better suit their needs.

Real-World Example

Consider a mid-sized business that opts for a level-funded plan. They pay a fixed monthly amount, which covers employee claims up to $50,000. Any claims beyond this limit are covered by stop-loss insurance. At the end of the year, if the total claims are lower than expected, the business receives a refund on the unused claim funds. This setup offers predictable costs and the potential for savings, making it an attractive option for many employers.

Next, we’ll compare Level-Funded vs Self-Funded Plans to see how they differ and which might be the best fit for your business.

Level-Funded vs Self-Funded Plans

Key Differences

When deciding between level-funded and self-funded health insurance plans, it’s important to understand their key differences. Each type has its own approach to funding, risk management, and potential savings.

Self-Funded Plans: Direct Payment and Customization

In a self-funded plan, the employer takes on the direct cost of employee healthcare. Here’s how it works:

- Direct Payment: Your business pays for employee healthcare claims as they occur, rather than paying a fixed monthly premium. This means costs can vary each month.

- Plan Customization: You have the freedom to design the plan according to your specific needs. You can choose the networks, deductibles, co-pays, and other benefits.

- Unlimited Liability: Without stop-loss insurance, your financial risk is unlimited. A single high-cost claim can significantly impact your budget.

Level-Funded Plans: Fixed Liability and Stop-Loss Contracts

Level-funded plans blend elements of self-funding with the predictability of fully insured plans. Here’s what sets them apart:

- Fixed Liability: Unlike self-funded plans, level-funded plans limit your risk. Employers pay a fixed monthly amount that includes estimated claims, stop-loss insurance, and administrative fees.

- Stop-Loss Contracts: These contracts protect you from catastrophic claims. If healthcare claims exceed a certain threshold, the stop-loss insurance covers the excess costs.

- Surplus Funds: If claims are lower than expected, you may receive a refund for the surplus funds. This can result in significant savings.

Comparison Table: Self-Funded vs Level-Funded Plans

| Feature | Self-Funded Plans | Level-Funded Plans |

|---|---|---|

| Payment Model | Pay-as-you-go | Fixed monthly payments |

| Plan Customization | High | Moderate to high |

| Financial Risk | Unlimited without stop-loss | Fixed, limited by stop-loss |

| Surplus Retention | Employer retains all surplus | Employer may receive a refund |

| Predictability | Low | High |

Real-World Example

Consider a small business that switched from a self-funded plan to a level-funded plan. Previously, they faced unpredictable monthly costs and a few high-cost claims that strained their budget. With the level-funded plan, they now pay a fixed monthly amount, which includes stop-loss insurance. At the end of the year, they received a refund because their actual claims were lower than expected. This change provided financial stability and potential savings.

Next, we’ll explore the Pros and Cons of Level-Funded Health Insurance to help you determine if it’s the right fit for your business.

Pros and Cons of Level-Funded Health Insurance

Advantages

Predictable Monthly Costs

One of the biggest perks of level-funded health insurance is the predictability of costs. Employers pay a fixed monthly fee, which covers estimated claims, stop-loss insurance, and administrative fees. This makes budgeting easier and reduces financial uncertainty.

Lower Premiums

Level-funded plans often have lower premiums compared to fully insured plans. If your employees are generally healthy and don’t submit many claims, you could see significant savings.

Plan Customization

Level-funded plans allow for more customization than fully insured plans. You can tailor the health benefits to meet the specific needs of your workforce, including networks, deductibles, and co-pays.

Surplus Retention

If your actual claims are lower than what was estimated, you may receive a refund or credit at the end of the year. This can be a nice financial bonus and encourages maintaining a healthy workforce.

Detailed Claims Data

Employers get access to detailed monthly claims data. This helps you understand how employees are using their benefits and identify areas for cost optimization. For example, you can see the number of claims, the cost of each claim, and overall usage patterns.

Disadvantages

Potential for Higher Renewal Rates

If your claims exceed the stop-loss coverage in a given year, you might face higher renewal rates. This could negate some of the cost benefits you initially enjoyed.

Administrative Resources

Managing a level-funded plan can require more administrative effort compared to fully insured plans. You’ll need resources to handle claims processing, plan management, and compliance.

Compliance Requirements

Level-funded plans are considered self-funded for most compliance purposes, which means they must adhere to regulations like ERISA and certain ACA requirements. This can add complexity and require careful management.

Lack of Integrated Wellness Programs

Unlike some fully insured plans that come with built-in wellness programs, level-funded plans might not automatically include these. You’ll need to implement your own wellness initiatives, which can add to costs and administrative duties.

Claims Exceeding Stop-Loss

In years with high-cost claims, the stop-loss insurance will cover the excess, but this could still lead to higher renewal rates. It’s a safety net, but not a perfect one.

Next, we’ll explore How to Switch to a Level-Funded Plan to guide you through the transition process and ensure a smooth implementation.

How to Switch to a Level-Funded Plan

Switching to a level-funded health plan can offer significant benefits, but it requires careful planning. Here’s a step-by-step guide to make the transition smooth and effective:

Preliminary Analysis

Start with a preliminary analysis of your current health plan. This should be done 3 to 6 months before your renewal date. Consulting with health benefits advisors can help you understand if a level-funded plan is right for your organization.

Tip: NPA Benefits clients can reach out to their group health benefits advisors for assistance in assessing the suitability of a level-funded health insurance plan.

Experienced Partners

Don’t go with the first vendor you come across. Look for experienced partners who offer level-funded health plans. Compare proposals from multiple stop-loss carriers and Third Party Administrators (TPAs). This ensures you get the best deal in terms of cost, service, and plan flexibility.

Fact: According to a survey by WellNet, 98% of brokers and consultants believe a level-funding strategy is the best long-term solution for their clients.

Plan Design

Finalize your plan design and funding levels. Work with your chosen provider to customize the plan to fit your company’s needs. Consider factors like coverage options, deductibles, and co-payments. A well-designed plan not only meets your employees’ needs but also manages costs effectively.

Note: Customization options can include networks, special programs, and value-added benefits.

Employee Education

Educate your employees about the new plan. Provide clear information on what the plan entails and how it differs from the old one. Use resources like network links and FAQs to answer their questions. This will help minimize confusion and ensure a smooth transition.

Statistic: 56% of U.S. adults with employer-sponsored health benefits said that liking their health coverage is a key factor in deciding to stay at their current job.

Wellness Incentives

Incorporate wellness incentives to reduce overall health plan costs. Encourage preventive care, regular health screenings, and the use of wellness programs like fitness memberships and telemedicine services. A healthier workforce can lead to fewer claims and lower costs.

Example: Many level-funded plans include wellness programs and 24/7 virtual care options, which can help employees save on out-of-pocket costs.

By following these steps, you can transition to a level-funded health plan that maximizes benefits for both your company and your employees. This approach helps manage costs while providing flexible, comprehensive health coverage. The key to a successful implementation is thorough preparation and clear communication.

Next, we’ll address Frequently Asked Questions about Level-Funded Health Insurance to help you understand the finer details and make an informed decision.

Frequently Asked Questions about Level-Funded Health Insurance

What are the disadvantages of a level-funded health plan?

Choosing a level-funded health plan can be beneficial, but it’s not without its challenges. Here are some potential drawbacks:

Higher Renewal Rates: After a year with high claims, your renewal rates might increase significantly. This can make budgeting challenging for the following year.

Administrative Burden: Managing a level-funded plan requires more resources than fully-insured plans. You’ll need to handle claims processing, benefit administration, and compliance with regulations like ERISA and ACA.

Compliance Requirements: Level-funded plans must adhere to various regulations. This can add complexity and require additional oversight to ensure compliance.

Fact: The need for more resources to manage plan administration and compliance is a common concern among employers considering level-funded plans.

What is the difference between level-funded and fully funded insurance?

Understanding the differences between level-funded and fully funded insurance can help you make an informed decision:

Cost Savings: Level-funded plans can offer lower monthly premiums if your workforce is young and healthy. In contrast, fully funded plans often have higher premiums due to risk pooling.

Surplus Refund: With a level-funded plan, if your claims are lower than expected, you may receive a surplus refund. Fully funded plans do not offer this benefit; the insurer keeps any surplus.

Risk Sharing: In a fully funded plan, the insurer assumes all the risk. With a level-funded plan, the employer takes on some risk, but stop-loss insurance limits this exposure.

Statistic: According to a recent survey, 42% of small firms now offer level-funded plans, indicating a growing preference for this type of insurance.

What are the components of level-funded health insurance?

Level-funded health insurance is a hybrid model that combines elements of self-funded and fully insured plans. Here are its main components:

Fixed Monthly Cost: Employers pay a fixed monthly fee that covers maximum claims liability, administrative fees, and stop-loss insurance.

Stop-Loss Insurance: This protects against unexpectedly high claims. If claims exceed a certain threshold, the stop-loss insurance covers the excess, limiting the employer’s financial risk.

Administration Fees: These fees cover the cost of managing the plan, including claims processing, customer service, and compliance with regulations.

Example: A level-funded plan from UnitedHealthcare includes wellness programs and 24/7 virtual care options, which can help employees manage their health more effectively.

By understanding these components, you can better assess whether a level-funded health plan meets your organization’s needs.

Next, we’ll explore more about the pros and cons of level-funded health insurance to give you a comprehensive view of this option.

Conclusion

At NPA Benefits, we understand that every organization has unique needs when it comes to health insurance. That’s why we offer flexible health insurance options, including level-funded health plans, designed to give you control over your healthcare costs while providing comprehensive coverage for your employees.

Flexible Health Insurance Options

Our level-funded health insurance plans offer a balance between cost control and flexibility. By combining elements of self-funded and fully insured plans, we provide a solution that allows you to manage your budget with predictable monthly costs. This means you can plan your finances more effectively and avoid unexpected expenses.

Cost-Saving Strategies

One of the major benefits of level-funded plans is the potential for cost savings. If your employees’ healthcare claims are lower than expected, you may receive a surplus refund at the end of the plan year. This not only rewards your efforts in maintaining a healthy workforce but also helps in reducing overall healthcare costs.

Control for Businesses and Individuals

With level-funded health insurance, you gain greater insights into your healthcare spending. Monthly data reports from your insurer can help you understand how your employees are using their benefits, allowing you to optimize your plan and make informed decisions. Additionally, you have the flexibility to customize your plan to better meet the needs of your workforce.

By partnering with NPA Benefits, you are choosing a path that prioritizes financial predictability, cost savings, and comprehensive coverage. Our expertise in level-funded health insurance ensures that you get the best value for your investment while providing your employees with the health benefits they need.

Ready to explore level-funded health insurance options for your organization? Visit our Level-Funded Health Insurance Plans page to learn more and get started today.

Together, let’s redefine employee health benefits and build a healthier, more sustainable future for your organization.