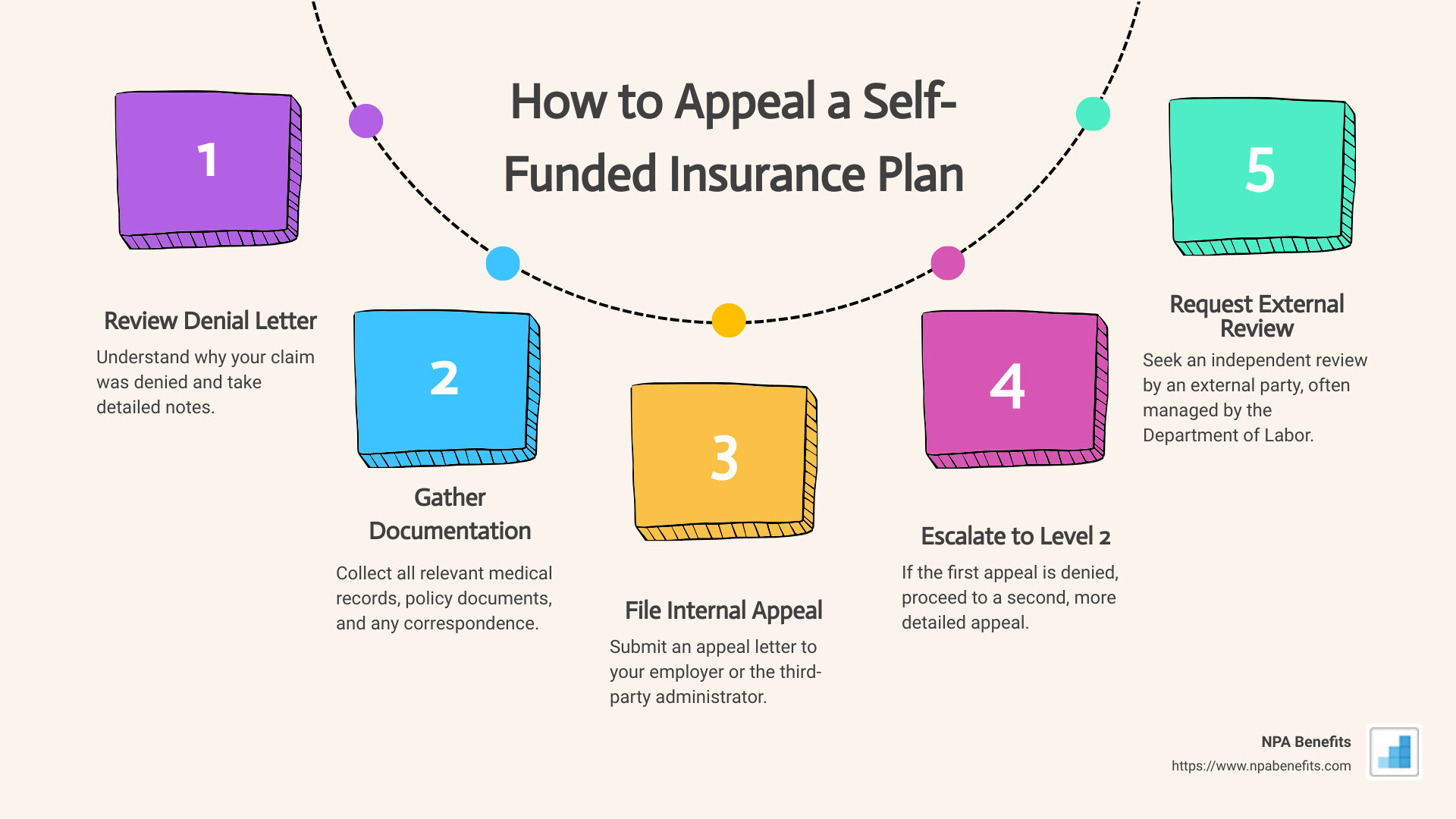

How to Appeal a Self-Funded Insurance Plan

Navigating self-funded insurance plans can be daunting. If you’ve received a claim denial, it’s crucial to know how to appeal a self-funded insurance plan effectively. Here are the basic steps:

- Review Your Denial Letter – Understand why your claim was denied and take detailed notes.

- Gather Necessary Documentation – Collect all relevant medical records, policy documents, and any correspondence.

- File an Internal Appeal – Submit an appeal letter to your employer or the third-party administrator.

- Escalate to a Level 2 Appeal – If the first appeal is denied, proceed to a second, more detailed appeal.

- Request an External Review – Seek an independent review by an external party, often managed by the Department of Labor.

Self-funded plans, where your employer funds your health insurance, can be challenging when it comes time to seek approval for treatments. Unlike traditional insurance, the decision-making power lies with your employer and their third-party administrator.

As an informational content expert with years of experience in insurance appeals, I understand the common pitfalls and effective strategies to overcome them. My name is Les Perlson, and I’m here to help you understand how to appeal a self-funded insurance plan and ensure your case is compelling and well-documented.

Stay tuned, as we’ll dive deeper into each step to ensure your appeal has the best chance for success.

Understanding Self-Funded Insurance Plans

Self-funded insurance plans are becoming more popular among employers, but they can be confusing. Let’s break down what these plans are and how they work.

What is a Self-Funded Insurance Plan?

In a self-funded plan, your employer takes on the financial risk of providing health benefits to employees. Instead of paying fixed premiums to an insurance company, the employer pays for medical claims directly from their own funds.

Employer Responsibility

Employers who choose self-funded plans are responsible for covering the cost of employees’ medical treatments. This can be a big financial risk, especially if multiple employees need expensive treatments at the same time. To manage this, employers often hire a Third-Party Administrator (TPA).

The Role of the Third-Party Administrator (TPA)

A TPA is a company that handles administrative tasks for the self-funded plan. This includes processing claims, managing plan benefits, and providing customer service. While it may look like the TPA is the insurer, they are not. They simply handle the logistics.

ERISA and Federal Oversight

Self-funded plans are governed by the Employee Retirement Income Security Act (ERISA). This federal law sets the standards for most voluntarily established pension and health plans in private industry to provide protection for individuals in these plans.

Because these plans are under federal jurisdiction, state insurance laws do not apply. This means you can’t use state laws to challenge a denial of coverage. Instead, your recourse is with the Department of Labor.

Department of Labor

If your internal appeals are exhausted, your next step is to appeal to the Department of Labor. They oversee ERISA compliance and can investigate your claim. However, this process can be slow and complicated.

Knowing how a self-funded plan works is crucial. It helps you understand who makes the decisions and what laws apply. This knowledge is your first step in effectively appealing a denial.

Next, we’ll dive into the specific steps you need to take to appeal a self-funded insurance plan.

How to Appeal a Self-Funded Insurance Plan

Step 1: Review Your Denial Letter

The first step in how to appeal a self-funded insurance plan is to carefully read your denial letter. This letter will explain why your claim was denied. Look for:

- Reasons for Denial: Understand why your claim was denied. It could be due to lack of medical necessity, incorrect coding, or out-of-network services.

- Policy Details: Compare the denial reasons with your policy details to see if there is a misunderstanding or error.

- Contact Information: Note the contact details for the person or department handling your appeal.

Step 2: Gather Necessary Documentation

Before you file an appeal, gather all the necessary documents. This will support your case and make your appeal stronger.

- Medical Records: Collect all relevant medical records that justify the treatment or service.

- Denial Letter: Keep the denial letter as it contains important information about why your claim was rejected.

- Policy Documents: Have a copy of your Summary Plan Description (SPD) or any other policy documents.

- Doctor’s Letter: Ask your doctor to write a letter explaining why the treatment is necessary.

Step 3: File an Internal Appeal

Once you have all your documents, it’s time to file an internal appeal.

- Appeal Letter: Write a clear and concise appeal letter. Mention the denial reasons, include supporting documents, and explain why the decision should be reconsidered.

- Employer Review: In a self-funded plan, your employer has significant decision-making power. Request your employer to review the denial.

- Third-Party Administrator: If a TPA is involved, they will handle the administrative tasks. Make sure to follow their submission methods.

- Submission Methods: You can usually submit your appeal online, via email, fax, or mail. Check your policy for specific instructions.

Step 4: Escalate to a Level 2 Appeal

If your first appeal is denied, you can escalate to a Level 2 appeal.

- Second Appeal: This is a more formal process. You may need additional documentation or a more detailed explanation.

- Deadlines: Pay attention to deadlines. For example, you must file a Level 2 appeal within 60 days of receiving the denial for grandfathered plans.

- Additional Documentation: Collect any new evidence or expert opinions to strengthen your second appeal.

Step 5: Request an External Review

If your internal appeals are unsuccessful, you can request an external review.

- Independent Review: An independent third party will review your case. This is called an external review.

- External Reviewer: The reviewer will make a decision that your health insurance company must accept.

- Department of Labor: If needed, you can escalate your case to the Department of Labor. They oversee ERISA compliance and can investigate your claim.

By following these steps, you can steer the complex process of appealing a self-funded insurance plan effectively. Next, we’ll share some tips for a successful appeal.

Tips for a Successful Appeal

Appealing a self-funded insurance plan can be challenging, but with the right approach, you can increase your chances of success. Here are some essential tips to help you through the process:

Detailed Documentation

Keep Everything: Document every interaction with your insurer and employer. Save emails, letters, and notes from phone calls.

Medical Records: Gather all relevant medical records and ensure they are up-to-date. Include detailed notes from your healthcare providers explaining why the treatment is necessary.

Denial Letter: Keep the denial letter and any related documents. These will be critical in understanding why your claim was denied and how to counter it.

Clear Communication

Be Concise: When writing your appeal letter, be clear and concise. Stick to the facts and avoid emotional language.

Contact Information: Include all necessary contact information in your appeal letter. This makes it easier for the insurer and employer to reach you.

Follow-Up: Regularly follow up on your appeal status. Persistence shows you are serious and keeps your case on their radar.

Persistence

Stay on Top: The appeals process can be long and frustrating. Keep following up until you get a resolution.

Document Everything: Keep a log of every interaction, noting dates, times, and the names of people you spoke with. This can be useful if you need to escalate the issue.

Don’t Give Up: If your first appeal is denied, don’t be discouraged. Many successful appeals are won on the second or even third attempt.

Legal Advice

Know Your Rights: Understanding your rights can make a big difference. The Code of Federal Regulations and ERISA provide protections for you.

Consult an Attorney: If you’re struggling, consider consulting an attorney who specializes in health insurance appeals. They can provide valuable advice and help steer the complex legal landscape.

External Resources: Use external resources like the Department of Labor for additional support and guidance.

By following these tips, you can improve your chances of a successful appeal. The key is to be thorough, clear, and persistent.

Next, we’ll discuss common challenges you might face and how to overcome them.

Common Challenges and How to Overcome Them

Dealing with a self-funded insurance plan can be tough. Here are some common challenges and how to tackle them:

Employer Resistance

Challenge: Your employer might resist approving your claim because they are directly responsible for the costs.

Solution:

– Communicate Clearly: Start by explaining your situation clearly to your HR department. Highlight the medical necessity of your treatment.

– Document Everything: Keep detailed records of all communications. This includes emails, letters, and phone calls.

– Engage Executives: If HR is unhelpful, escalate the issue. Contact high-level executives within your company. Use their personal fax numbers or email addresses to ensure your appeal gets noticed.

Third-Party Administrator Delays

Challenge: Third-party administrators (TPAs) may delay processing your claim or appeal.

Solution:

– Be Persistent: Follow up regularly. Call, email, and send letters to remind them of your pending appeal.

– Escalate When Needed: If delays continue, escalate the issue to higher authorities within the TPA or your employer.

– Use Deadlines: Remind them of legal deadlines and your right to a timely response. This can speed up the process.

Lack of Transparency

Challenge: Self-funded plans often lack transparency, making it hard to understand why a claim was denied.

Solution:

– Request Detailed Information: Ask for a detailed explanation of the denial. This includes the specific reasons and any policy documents that support their decision.

– Use Legal Rights: Refer to your rights under ERISA, which requires a full and fair review of your appeal.

– Consult Experts: Seek help from experts or organizations like the Department of Labor for guidance on understanding complex policy details.

Legal Problems

Challenge: Legal complexities can make the appeal process daunting.

Solution:

– Know Your Rights: Familiarize yourself with your rights under ERISA and other relevant laws.

– Legal Help: Consider hiring an attorney who specializes in health insurance appeals. They can help steer legal problems and improve your chances of success.

– External Review: If your internal appeal fails, request an external review. This involves an independent third party and can provide a fair assessment of your case.

By understanding these challenges and knowing how to address them, you can improve your chances of a successful appeal. Next, we’ll answer some frequently asked questions to further guide you through the process.

Frequently Asked Questions about Appealing a Self-Funded Insurance Plan

What is a self-funded insurance plan?

A self-funded insurance plan is where your employer pays for your healthcare claims directly instead of buying insurance from a company. This means the employer takes on more risk but can also save money if claims are lower than expected.

In these plans, a third-party administrator (TPA) usually handles the day-to-day operations like processing claims and managing paperwork. While these plans offer flexibility, they can make the appeals process more complicated since the employer has the final say.

How long does the appeal process take?

The appeal process can vary, but here’s a general timeline:

-

Internal Appeal: You have 180 days to file an internal appeal after your claim is denied. The insurer must respond within 30 days for medical services already received, within 15 days if you’re seeking prior authorization, or within 72 hours for urgent care.

-

Level 2 Appeal: If your internal appeal is denied, you usually have 60 days (or up to 4 months for non-grandfathered plans) to file a Level 2 appeal. The response time can vary, but it typically takes around 30 days.

-

External Review: If both internal appeals are denied, you have 4 months to request an external review. The external reviewer must make a decision within 30 days for standard appeals or 72 hours for urgent cases.

What if my appeal is denied?

If your appeal is denied at every level, don’t lose hope. Here are your next steps:

-

Request an External Review: This involves an independent third party. They will review your case and make a binding decision. This can be a game-changer, as it removes the final decision from the employer and TPA.

-

Legal Action: Consider hiring an attorney who specializes in health insurance appeals. They can help you steer the legal complexities and improve your chances of overturning the denial.

-

State Assistance: Contact your state’s department of insurance or attorney general’s office. They can help with an external review and offer additional resources.

By understanding these steps and knowing your rights, you can better steer the appeals process and improve your chances of getting the coverage you need.

Conclusion

Navigating the appeals process for a self-funded insurance plan can be challenging, but it is not impossible. With persistence, clear documentation, and a strategic approach, you can significantly improve your chances of success.

At NPA Benefits, we specialize in helping businesses and their employees understand and manage self-funded insurance plans. Our expertise ensures that you have the guidance and support needed throughout the appeal process.

The key to a successful appeal lies in understanding your plan, gathering all necessary documentation, and striking at both the employer and the third-party administrator. Don’t hesitate to escalate your appeal if necessary, and always keep detailed records of your interactions.

Persistence is crucial. If you encounter resistance or delays, stay the course and continue to advocate for your rights.

For more information on how we can assist you with your self-funded health insurance plan, visit our self-funded health insurance page.

By staying informed and proactive, you can steer the complexities of self-funded insurance plans and secure the coverage you deserve.