FSA eligible meaning refers to expenses that can be covered using a Flexible Spending Account (FSA), a powerful tool for managing healthcare costs. FSAs allow you to set aside pre-tax earnings to pay for qualified medical expenses, which helps reduce your taxable income and make healthcare more affordable. Eligible expenses include costs related to diagnosis, treatment, and prevention of diseases, such as prescription medications, doctor’s visits, dental and vision care.

An FSA is an arrangement that can save money on taxes for both employers and employees. Funds contributed to an FSA are deducted from your salary before income taxes, giving you immediate tax savings. However, it’s crucial to note that FSAs follow a “use-it-or-lose-it” rule, requiring careful planning and budgeting of your medical expenses to avoid forfeiting any remaining balance at the end of the year.

As Les Perlson, with years of experience in employee benefits design and health insurance, I have helped businesses steer the complexities of FSAs, ensuring they leverage this tool effectively. My background in integrating insurance solutions and reducing healthcare costs makes me well-equipped to guide you through understanding the fsa eligible meaning and other related concepts.

Related content about fsa eligible meaning:

– fsa eligible products

– what is a flexible spending account

– fsa feds

Understanding FSA Eligible Meaning

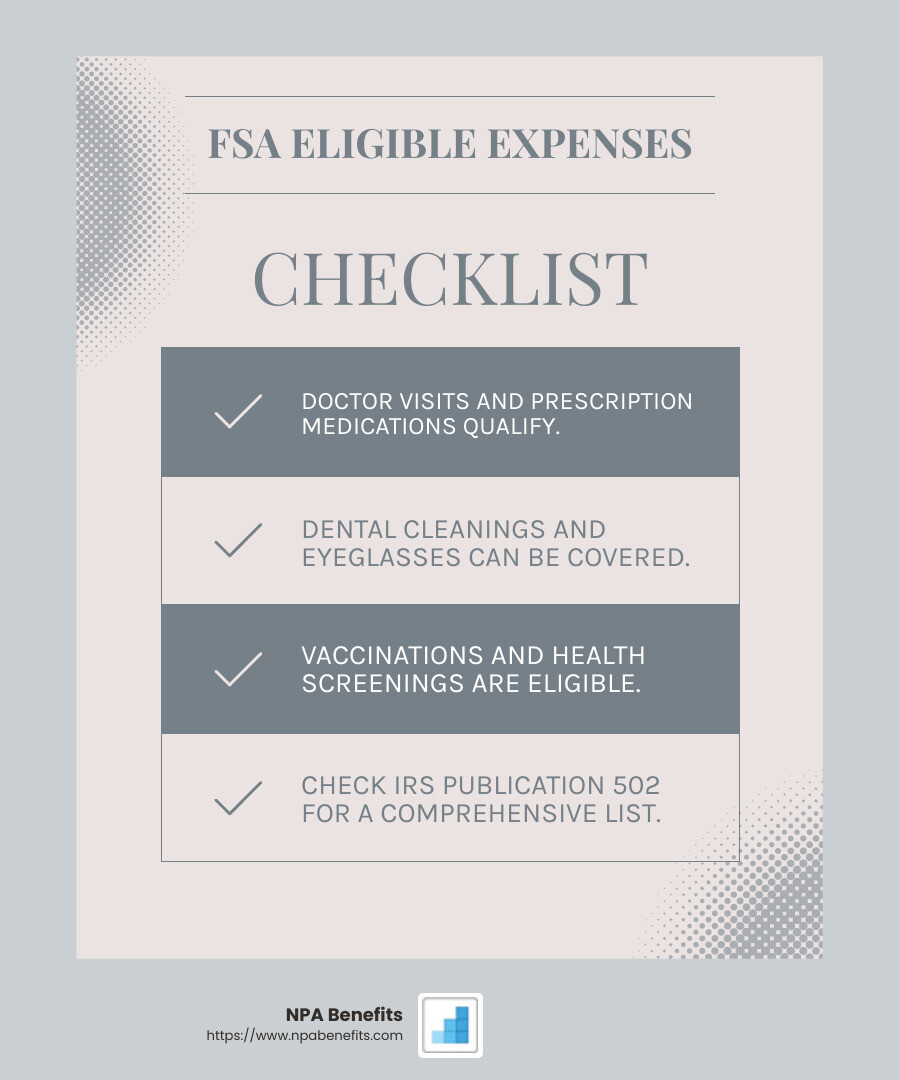

When we talk about FSA eligible, we’re diving into what you can pay for using your Flexible Spending Account. The IRS has clear guidelines on this. Basically, these are medical expenses that help diagnose, treat, or prevent diseases.

What Falls Under FSA Eligible?

-

Medical Expenses: Think about costs like doctor visits, hospital services, and prescription medications. These are the bread and butter of FSA eligibility. Even over-the-counter medications can qualify if you have a doctor’s prescription.

-

Dental and Vision Care: Expenses such as dental cleanings, braces, eyeglasses, and eye exams are typically covered. These are crucial for maintaining overall health and are considered essential.

-

Preventative Services: Vaccinations and health screenings are also eligible. These services help catch potential health issues early, saving money and stress down the line.

The IRS Guidelines

The IRS outlines what counts as an eligible expense. They focus on whether an expense is necessary for medical care. This means it must be primarily for the prevention or treatment of a disease or condition.

For a clear list of eligible items, check out the IRS publication 502, which is updated yearly. Staying informed about these guidelines can help you make the most of your FSA and avoid any surprises.

Planning and Budgeting

FSAs operate under the “use-it-or-lose-it” rule, so careful planning is important. Estimate your yearly medical expenses to avoid losing money. Some employers offer a grace period or allow a small carryover to the next year.

In short, understanding the fsa eligible meaning can save you money and make healthcare costs more manageable. Keep these guidelines in mind, and you’ll be well on your way to maximizing your FSA benefits.

Next, we’ll explore the different types of FSAs and what each covers.

Types of FSAs

When it comes to Flexible Spending Accounts (FSAs), not all are the same. Each type is designed to meet specific needs and cover different expenses. Let’s break down the main types of FSAs:

Health FSA

A Health FSA is the most common type. It’s all about covering medical expenses that your insurance doesn’t fully take care of. Think of it as a financial cushion for things like:

- Deductibles and co-pays: These are the costs that come out of your pocket before your insurance kicks in.

- Dental care: From cleanings to fillings and even braces, these expenses are typically eligible.

- Vision care: Eye exams, glasses, and contact lenses fall under this category.

For 2024, you can contribute up to $3,200 to a Health FSA. This helps you save on taxes while managing healthcare expenses more effectively.

Dependent Care FSA

A Dependent Care FSA is a bit different. It’s designed to help you pay for childcare expenses or care for a dependent adult, so you can work or look for work. This includes:

- Daycare: For children under 13 or dependent adults.

- After-school programs and summer camps: But remember, overnight camps don’t count.

The contribution limit for a Dependent Care FSA is $5,000 per household (or $2,500 if married and filing separately) for 2024. This type of FSA can significantly reduce the financial burden of dependent care, allowing you to focus on your career with peace of mind.

Limited Purpose FSA

The Limited Purpose FSA is a special type. It’s meant to work alongside a Health Savings Account (HSA) and is limited to:

- Dental expenses: Such as check-ups and orthodontics.

- Vision expenses: Like glasses and contact lenses.

For 2024, you can contribute up to $3,200 to a Limited Purpose FSA. This type allows you to save your HSA funds for other medical expenses or future healthcare needs.

Why Does This Matter?

Understanding the types of FSAs available helps you plan your healthcare spending better. You can decide where to allocate your pre-tax dollars based on your needs. Whether you’re managing medical bills, ensuring quality care for your child, or maximizing savings with an HSA, there’s an FSA designed for you.

Next, we’ll dive into common expenses that are FSA-eligible, helping you make the most of your account.

Common FSA Eligible Expenses

When it comes to using your Flexible Spending Account (FSA), knowing what expenses are FSA eligible is key to maximizing your savings. Here’s a quick guide to some of the most common eligible expenses:

Medical Copays

Medical copays are a frequent out-of-pocket expense. These are the fixed amounts you pay for healthcare services, such as doctor visits or hospital stays, before your insurance covers the rest. Using your FSA to cover these costs can significantly reduce your financial burden and help manage your annual healthcare budget.

Prescription Drugs

Prescription drugs are another major category of FSA eligible expenses. Whether it’s medication for chronic conditions or a short-term prescription for an illness, you can use your FSA funds to cover these costs. This includes both brand-name and generic medications, making it easier to afford necessary treatments.

Dental Expenses

Dental care can be expensive, but your FSA can help. You can use these funds for a wide range of dental expenses, including:

- Routine cleanings: Keep your smile bright without the financial stress.

- Fillings and root canals: Necessary procedures are covered.

- Braces and orthodontics: Even orthodontic treatments can be funded through your FSA.

Vision Care

Vision care is another area where FSAs offer significant benefits. You can use your FSA to cover:

- Eye exams: Regular check-ups to maintain your eye health.

- Glasses and contact lenses: Both prescription glasses and contacts are eligible.

- Prescription sunglasses: Protect your eyes with style.

Why It Matters

Knowing which expenses are FSA eligible empowers you to make smarter healthcare spending decisions. You can plan your budget around these common costs, ensuring that you use your pre-tax dollars effectively. This not only saves you money but also provides peace of mind when unexpected medical expenses arise.

Next up, we’ll explore expenses that require a letter of medical necessity, helping you steer more specific FSA reimbursements.

Expenses Requiring a Letter of Medical Necessity

Sometimes, you need more than just a receipt to get your FSA reimbursement. That’s where a Letter of Medical Necessity (LOMN) comes in. This letter, usually from your doctor, explains why a specific item is essential for your health. Here are some expenses that often require this extra step:

Air Purifiers

If you suffer from allergies or asthma, an air purifier can be a lifesaver. But to get FSA coverage, you’ll need a LOMN. Your doctor must state that the air purifier is necessary to treat or alleviate your condition. Without this letter, your claim might be denied.

Specialized Infant Formula

For parents of infants with specific dietary needs, specialized infant formula is crucial. To use your FSA for these expenses, a LOMN is required. The letter should explain the medical condition that necessitates this special formula, such as a severe allergy or digestive issue. Regular infant formula, however, does not qualify.

Home Improvements

Some home improvements can be FSA eligible if they help manage a medical condition. For instance, installing a wheelchair ramp or modifying a bathroom for accessibility might qualify. A LOMN is essential here too, detailing how these changes are necessary for your health or the health of a dependent.

Why It Matters

Understanding when a Letter of Medical Necessity is needed can save you time and trouble. It ensures that your FSA funds are used wisely and that you’re prepared for any additional paperwork. Next, we’ll look at expenses that are not eligible for FSA reimbursement, helping you avoid common pitfalls.

Non-Eligible FSA Expenses

While FSAs are great for covering many medical expenses, not everything qualifies. Let’s explore what isn’t covered to help you avoid surprises.

Cosmetic Surgeries

Cosmetic surgeries are typically not FSA-eligible unless they correct a deformity caused by a disease, accident, or birth defect. So, procedures like facelifts, liposuction, or purely aesthetic improvements won’t qualify. However, if a surgery is needed to treat a medical condition, it might be eligible with proper documentation.

Exercise Equipment

Thinking of buying a treadmill or weights to stay fit? Unfortunately, exercise equipment is not FSA-eligible. These items are considered for general health rather than treating a specific medical condition. Even if a doctor recommends exercise, the equipment itself won’t qualify for FSA funds.

Insurance Premiums

Paying for your health insurance premiums with FSA money is a no-go. FSAs are designed to cover out-of-pocket medical expenses, not the cost of insurance itself. This includes premiums for health, dental, and vision insurance plans.

Why It Matters

Knowing what’s not covered helps you plan better and avoid wasting your FSA dollars. Always check your plan’s guidelines or consult with your HR department if you’re unsure about a specific expense.

Next, we’ll tackle some frequently asked questions about FSA eligibility to clear up any lingering doubts.

Frequently Asked Questions about FSA Eligibility

What is the meaning of FSA eligible?

FSA eligible means that an expense can be paid for using your Flexible Spending Account funds. These expenses must align with IRS guidelines and are typically for medical, dental, and vision costs that aren’t covered by your insurance. Think of things like prescription drugs, medical copays, or even contact lenses. Always double-check with your FSA administrator or the IRS guidelines to confirm if an item is eligible.

Is everyone eligible for an FSA?

Not everyone can contribute to an FSA. To be eligible, you need to be a full-time or part-time employee at a company that offers an FSA as part of its benefits package. This means self-employed individuals are usually out of luck when it comes to FSAs. Instead, they might consider a Health Savings Account (HSA) if they have a high-deductible health plan. Always check with your employer to see if you can participate in an FSA.

How is money distributed from an FSA?

Accessing your FSA funds is pretty straightforward. Most plans offer an FSA debit card that you can use to pay for eligible expenses directly. If you don’t have a debit card, you can pay out-of-pocket first and then submit a claim for reimbursement. This involves providing receipts or proof of purchase to your FSA provider. Once approved, you’ll get reimbursed, usually through a direct deposit or check. Keep track of your spending and submit claims promptly to make the most of your FSA benefits.

Next, we’ll explore the different types of FSAs and how they can fit your needs.

Conclusion

At NPA Benefits, we believe in empowering you with flexible health insurance options that are not only cost-effective but also put you in control. Our unique approach to self-funded health insurance plans provides you with the tools to manage your healthcare expenses effectively.

Flexible Spending Accounts (FSAs) are a key part of our offerings. They allow you to use pre-tax dollars to pay for eligible medical expenses, reducing your taxable income and increasing your savings. This means more money stays in your pocket to cover those out-of-pocket costs that can add up quickly.

Our commitment to providing cost-saving solutions means that we prioritize flexibility and control for both individuals and businesses. Whether you’re looking to manage your own healthcare costs or improve your employee benefits package, our team is here to support you every step of the way.

If you’re ready to explore how FSAs can benefit you or your company, visit our service page for more information. Let us help you steer the complexities of FSAs and ensure you make the most of your contributions. Together, we can optimize your health coverage and financial wellness.