Flexcard for seniors has become a buzzword among Medicare Advantage enrollees seeking extra benefits. These cards offer various advantages, but it’s crucial to cut through the clamor to better understand what they truly entail. So, what exactly are flex cards, and why might they be a good fit for some seniors? Let’s quickly break it down:

- Available only through specific Medicare Advantage plans—not traditional Medicare.

- Designed to cover certain health-related expenses, like over-the-counter items or services not fully covered by insurance.

- Not all plans offer this benefit, and the availability of these cards can vary by region and insurer.

Understanding these aspects helps in determining whether a flexcard is a right fit for you or your loved ones.

I’m Les Perlson, an expert in insurance solutions with special insights into flexcard for seniors. With decades of experience in the insurance industry, I aim to make navigating these options as comprehensible as possible.

Learn more about flexcard for seniors:

– flex card benefits

– flex card for medicaid

– medicare flex card benefits

Understanding Flexcards for Seniors

Flexcards are a unique perk available through certain Medicare Advantage plans. They act as preloaded debit cards, helping seniors manage out-of-pocket health-related expenses. Let’s dig into how these cards work and who can access them.

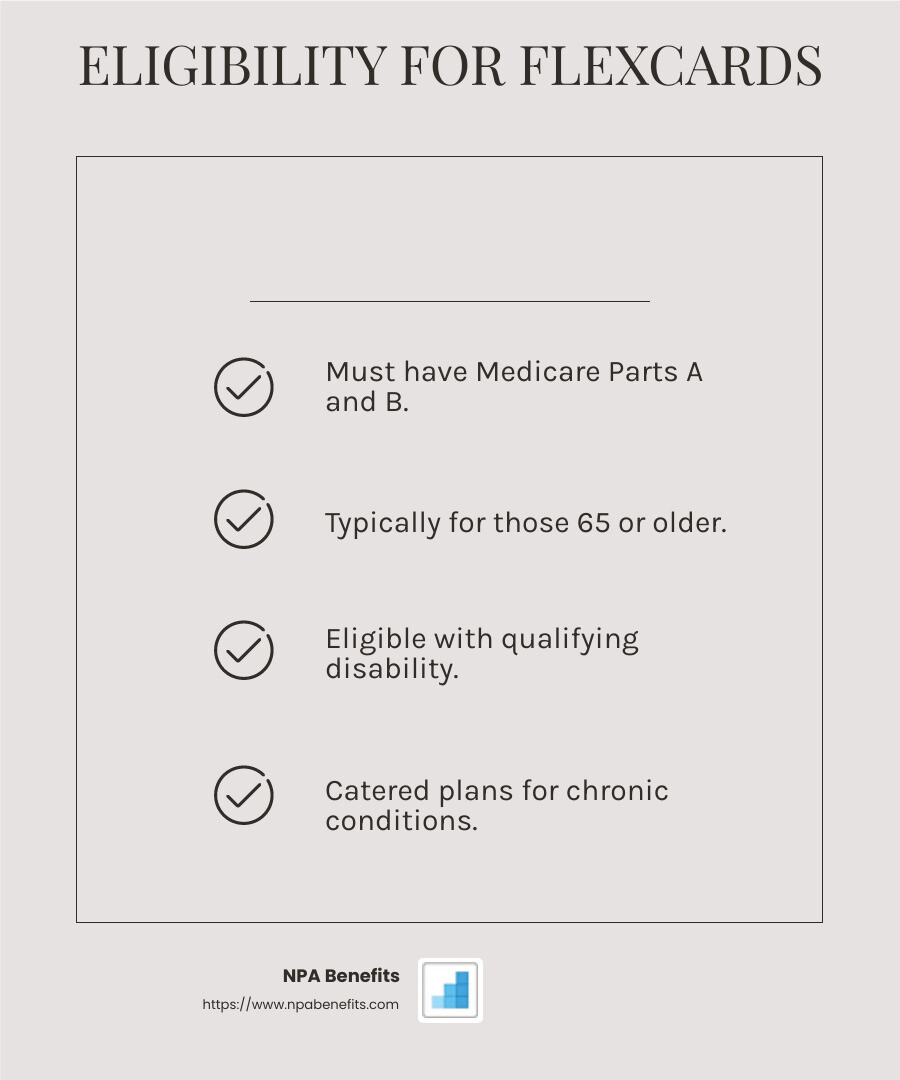

Eligibility Criteria

To qualify for a flexcard, you must first be eligible for a Medicare Advantage plan. This means you need to have Medicare Parts A and B. Typically, you should be 65 or older, but if you have a qualifying disability, you might be eligible earlier. Some plans also cater to specific needs, such as chronic conditions or dual eligibility for Medicare and Medicaid.

How Flexcards Work

Once you’re enrolled in a Medicare Advantage plan that offers a flexcard, you’ll receive a card preloaded with funds. These funds can be used for various health-related expenses not typically covered by Original Medicare. Think over-the-counter medications, vision care, or even assistive devices like hearing aids.

Spending Rules

Each plan has different spending rules. Some might allocate funds annually, while others might distribute them monthly or quarterly. It’s essential to understand your plan’s specific rules to maximize your card’s benefits.

Participating Vendors

Another critical aspect is where you can use your flexcard. Plans usually have a network of participating vendors and pharmacies. Before making a purchase, check if the vendor is approved under your plan. This ensures your transaction will be covered.

By understanding these key elements, you can better decide if a flexcard aligns with your healthcare needs. Now, let’s explore the specific benefits these cards can provide.

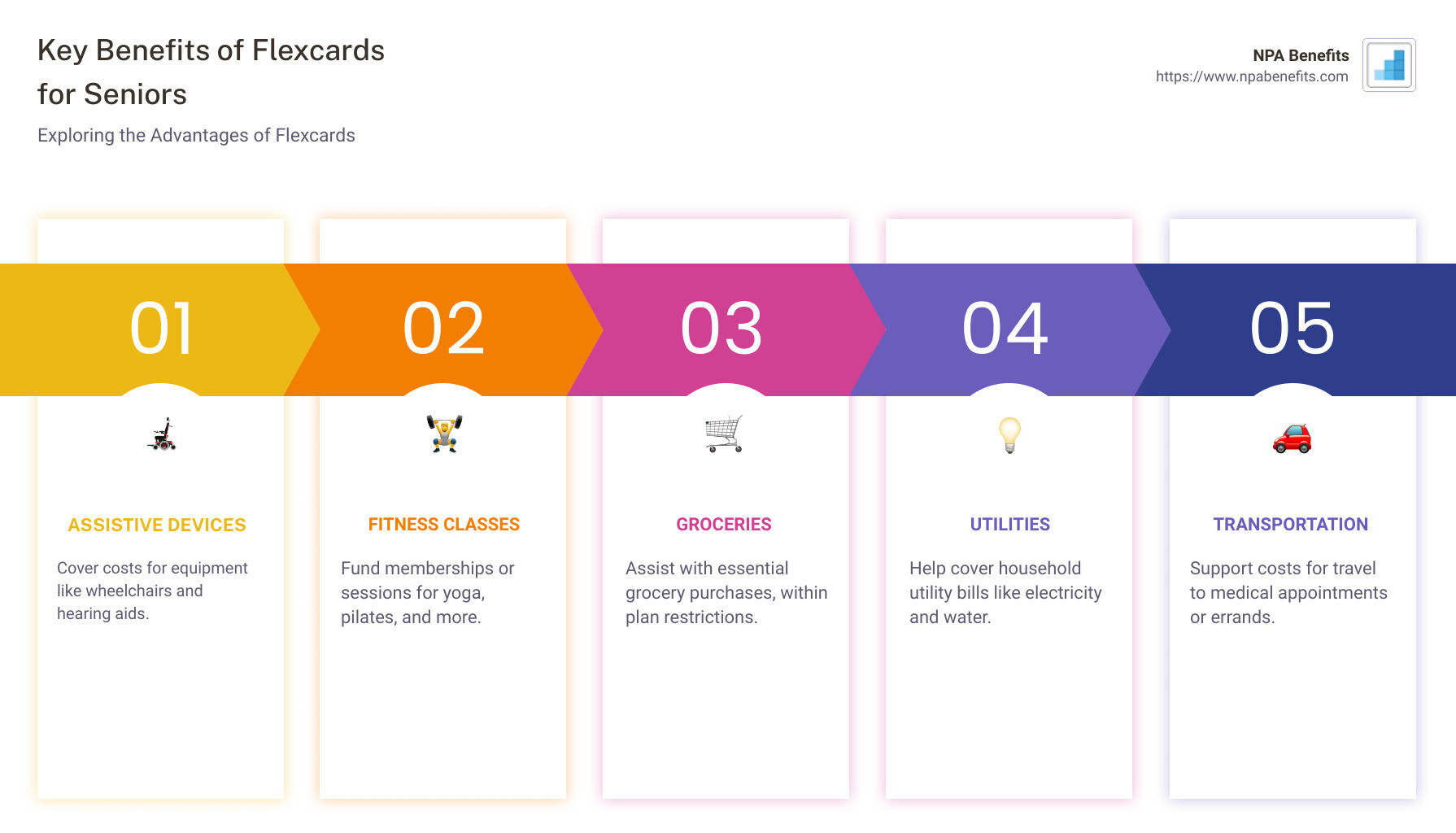

Benefits of Flexcards for Seniors

Flexcards offer several valuable benefits for seniors enrolled in certain Medicare Advantage plans. These cards can help cover a wide range of expenses that go beyond basic healthcare needs.

Coverage Details

Dental, Vision, and Hearing Services

Flexcards can be a lifeline for seniors needing additional care for their teeth, eyes, and ears. Many plans allow cardholders to use their preloaded funds for dental check-ups, new eyeglasses, or hearing aids. This coverage can significantly reduce out-of-pocket costs for these essential services.

Over-the-Counter Medicines

With a flexcard, seniors can purchase over-the-counter items like pain relievers, vitamins, and other everyday health products. This can help manage minor health issues without a trip to the doctor, saving both time and money.

Additional Perks

Assistive Devices and Fitness Classes

Flexcards often cover assistive devices like walkers or blood pressure monitors, making it easier for seniors to maintain independence. Additionally, some plans offer coverage for fitness classes, encouraging seniors to stay active and healthy.

Groceries and Utilities

In certain plans, flexcards can also help with the cost of healthy groceries. This is especially beneficial for seniors on a tight budget who want to maintain a nutritious diet. Some plans even allow cardholders to pay for utilities, easing the financial burden of monthly bills.

Transportation

For seniors who need help getting to medical appointments, some flexcards offer coverage for non-medical transportation. This means seniors can use their cards for public transit or rideshare services, ensuring they can access the care they need.

Meal Delivery and Gym Memberships

Beyond groceries, some flexcards include benefits for meal delivery services, ensuring that seniors have access to healthy meals without the hassle of cooking. Additionally, gym memberships or exercise equipment purchases might be covered, promoting a more active lifestyle.

By understanding these benefits, seniors can make the most of their flexcards, ensuring they receive comprehensive support for their health and wellness needs.

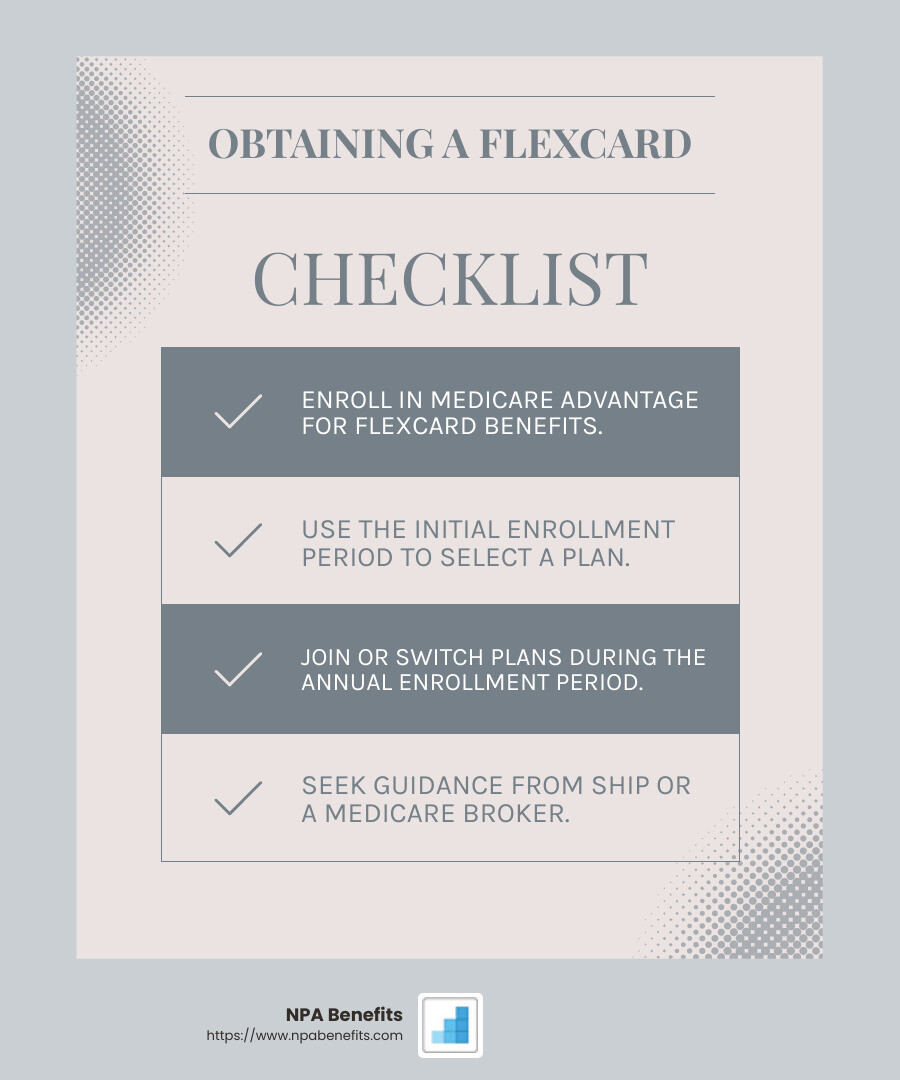

How to Obtain a Flexcard

Enrollment Process

Getting a flexcard for seniors starts with enrolling in a Medicare Advantage plan that offers this benefit. Here’s a simple breakdown of how you can go about it:

1. Medicare Advantage Enrollment

Flexcards are not available through Original Medicare, so you’ll need to enroll in a Medicare Advantage plan that includes a flexcard benefit. These plans are offered by private insurers and come with additional perks that Original Medicare doesn’t provide.

2. Initial Enrollment Period (IEP)

The Initial Enrollment Period is the first opportunity you have to sign up for Medicare Advantage. This period starts three months before you turn 65, includes your birth month, and ends three months after your birthday month. During this time, you can choose a plan that offers a flexcard.

3. Annual Enrollment Period (AEP)

If you miss the Initial Enrollment Period, don’t worry. The Annual Enrollment Period allows you to join or switch Medicare Advantage plans. It runs from October 15 to December 7 each year. This is a good time to review your options and select a plan that includes the flexcard benefit.

4. State Health Insurance Assistance Program (SHIP)

For personalized help, consider reaching out to your State Health Insurance Assistance Program. SHIP offers free, unbiased counseling to help you understand your Medicare options, including which plans offer flexcards. They can guide you through the enrollment process and help you make informed decisions.

5. Medicare Broker Guidance

A Medicare broker can also be a valuable resource. Brokers are knowledgeable about the different plans available and can assist you in finding a plan that meets your needs, including one with a flexcard. They can help you compare plans and understand the benefits and costs associated with each.

By taking advantage of these resources and understanding the enrollment periods, you can find a Medicare Advantage plan that offers a flexcard, helping you manage your health expenses more effectively.

Once you have a plan in mind, it’s important to ensure the network covers your preferred doctors and services. This way, you can make the most of your plan and the flexcard benefits it offers.

Frequently Asked Questions about Flexcards

Who Qualifies for a Flexcard?

To qualify for a flexcard for seniors, you must be enrolled in a Medicare Advantage plan that offers this benefit. These plans are provided by private insurance companies and are not part of Original Medicare. Eligibility generally includes those who have Medicare Parts A and B. Additionally, individuals with certain chronic conditions or disabilities may find more options available to them, as some plans cater specifically to these needs.

Can You Buy Groceries with a Flexcard?

The ability to buy groceries with a flexcard depends on the specific Medicare Advantage plan you choose. While some plans offer a grocery allowance, this is not a standard feature across all plans. It’s crucial to understand your plan’s restrictions. Typically, grocery purchases are limited to health-related items or are available only under certain conditions, such as a physician’s recommendation for specific dietary needs. Always check with your plan administrator to know exactly what your flexcard can cover.

Does Everyone on Medicare Get the Flexcard?

Not everyone on Medicare receives a flexcard. These cards are exclusive to certain Medicare Advantage plans, meaning they are not universally available to all Medicare beneficiaries. If you’re interested in this benefit, you’ll need to specifically look for a Medicare Advantage plan that includes a flexcard as part of its offerings. That the availability of these plans can vary by location and provider, so research and compare plans in your area to find one that fits your needs.

Conclusion

Navigating healthcare benefits can be challenging, but with the right tools and information, you can make informed decisions that best suit your needs. At NPA Benefits, we specialize in providing flexible health insurance options that empower individuals and businesses to take control of their healthcare spending.

Our focus is on offering self-funded health insurance plans that prioritize flexibility and cost savings. We understand that every individual’s healthcare needs are unique, which is why we provide options that allow you to tailor your benefits. Whether it’s through a flexcard for seniors or other innovative solutions, our goal is to improve your coverage while maximizing your savings.

By choosing NPA Benefits, you gain more than just insurance coverage—you gain a partner dedicated to helping you steer the complexities of health insurance. We believe that control should be in your hands, allowing you to decide how to use your benefits to best meet your needs.

If you’re ready to explore how our flexible health insurance plans can benefit you or your business, visit our flex card page to learn more about how we can help you take control of your healthcare journey.