When it comes to managing healthcare costs, a Flexible Spending Account (FSA) can be a game-changer for both employers and employees. An FSA allows you to allocate tax-free dollars towards a wide range of out-of-pocket medical expenses, making healthcare more affordable and accessible. These expenses can include everything from insurance copayments and deductibles to prescription drugs, insulin, and even medical devices.

Utilizing FSAs can significantly lower your taxable income, translating to tangible savings. It’s a financial tool that supports not just the individual employee but also offers small to medium-sized business owners a competitive edge in benefits offerings.

Eligible spending with your FSA covers:

– Insurance copayments and deductibles

– Prescription medications

– Insulin

– Medical devices

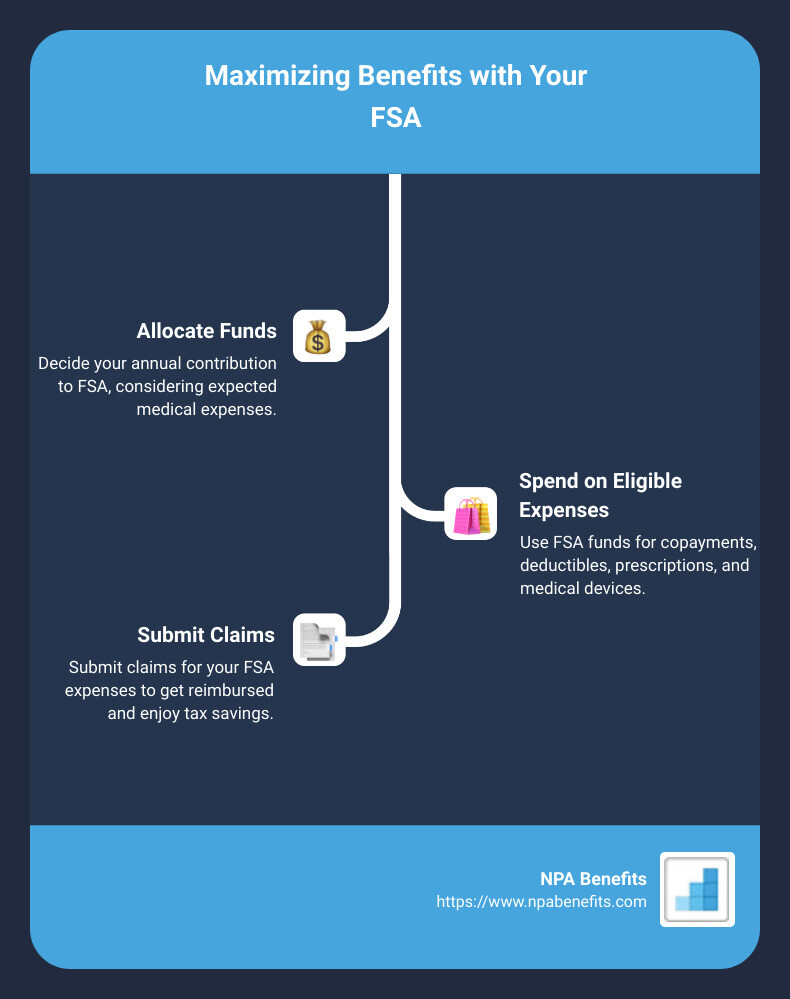

Each year, you decide how much to contribute to your FSA—up to a limit set by your employer—and use these funds for qualified medical expenses. It’s a proactive approach to managing your healthcare costs, ensuring you and your employees can focus on wellness without the added stress of financial constraints.

What Qualifies for Flexible Spending Account?

When we talk about Flexible Spending Accounts (FSA), we’re diving into a world where managing out-of-pocket healthcare costs gets a bit easier. Let’s break down what expenses qualify, ensuring you’re making the most of your FSA.

Insurance Copayments and Deductibles: These are often the first costs that come to mind when we think about medical expenses. Whether it’s a visit to the doctor or a prescription refill, your FSA is designed to cover these costs. It’s like having a financial safety net for those predictable expenses that pop up throughout the year.

Prescription Drugs: From antibiotics to medication for chronic conditions, prescription drugs can put a dent in your budget. FSAs step in to lighten the load, allowing you to use pre-tax dollars to cover these costs. It’s a relief to know that the medicine you need is within reach, financially speaking.

Insulin: For those managing diabetes, insulin is a non-negotiable part of daily life. FSAs recognize this necessity, covering insulin expenses. This inclusion underscores the FSA’s role in supporting essential healthcare needs.

Medical Devices: The term “medical devices” covers a broad range of items. Think beyond just crutches or wheelchairs. FSAs cover a variety of devices, including but not limited to, blood sugar monitors, diagnostic devices (like blood pressure cuffs), and even some fertility monitors. If a device is there to support your health, there’s a good chance your FSA will cover it.

Understanding what qualifies for FSA reimbursement empowers you to plan your healthcare spending more effectively. It’s about making your health a priority without the added worry of whether you can afford the care you need. The goal is to use these funds to maintain or improve your health and well-being.

As we transition into the next section, keep in mind that while FSAs offer flexibility, they’re guided by rules on what qualifies as an eligible expense. Knowing these rules will help you maximize your contributions and ensure you’re not leaving money on the table as the year ends.

In the next segment, we’ll delve deeper into how to determine the eligibility of less straightforward expenses and how to make every dollar in your FSA count.

IRS List of FSA-Eligible Items

Navigating Flexible Spending Accounts (FSAs) doesn’t have to be complicated. Especially when it comes to understanding what expenses are eligible. Let’s break it down into simpler terms, focusing on a few key items that the IRS says you can use your FSA dollars on:

-

Prescriptions: Whether it’s antibiotics or medication for chronic conditions, as long as it’s prescribed by your doctor, it’s covered.

-

Doctor Fees: This includes visits to your primary care physician, specialists, and even some alternative practitioners if they’re considered necessary for your health care.

-

Crutches: Had a mishap and need crutches? FSAs have got you covered. This extends to other medical equipment you might need temporarily or permanently to aid mobility.

-

Flu Shot: Protecting yourself from the flu is important, and fortunately, getting a flu shot is an expense that FSAs will happily cover.

-

Hearing Aids: If you or your dependents need hearing aids, rest assured that this significant expense can be paid for with FSA funds.

-

Motorized Wheelchair: For those with mobility issues, a motorized wheelchair can be a game-changer, and yes, it’s an eligible expense.

-

X-Rays: Necessary imaging like X-Rays to diagnose or treat a condition? You can use your FSA dollars for that too.

Why does this matter? Because using pre-tax dollars to pay for these expenses can lead to substantial savings. Imagine you’re in a 22% tax bracket; every $100 spent on these eligible expenses saves you $22 in taxes. Over a year, that can add up, especially if you have ongoing medical needs.

Real-World Application

Let’s say Jane has chronic arthritis and requires regular medication, occasional X-rays, and even a specialized brace. By using her FSA, she can manage her condition without the added stress of hefty out-of-pocket costs. Or consider Mike, who decided to get his annual flu shot and realized he could use his FSA for it, effectively reducing his taxable income and saving money in the process.

Quick Tips

- Always keep your receipts: For prescriptions, doctor’s visits, or any FSA-eligible expense. They’re your ticket to reimbursement.

- Check with your plan: Some FSAs might have specific rules about what they consider an eligible expense.

- Plan ahead: If you know you’ll have these expenses, consider setting aside FSA funds accordingly.

By understanding and utilizing your FSA for these IRS-listed eligible items, you’re not just ensuring your health and well-being; you’re also making financially savvy decisions that can benefit you and your family in the long run. So, as you plan your healthcare spending, remember these key points to make the most out of your FSA contributions.

What is Not Covered by a Flexible Spending Account?

When it comes to Flexible Spending Accounts (FSAs), not everything is fair game for reimbursement. It’s crucial to know which items don’t make the cut, so you don’t end up with unexpected out-of-pocket costs. Here’s a straightforward look at some common expenses that are typically not covered by FSAs:

- Antacids: Even though they’re a go-to solution for heartburn and indigestion, antacids generally need a doctor’s prescription to be FSA eligible.

- Allergy Medicine: Over-the-counter (OTC) allergy meds are a must-have for seasonal sniffles, but without a prescription, they aren’t covered.

- Pain Relievers: OTC pain relievers like ibuprofen or acetaminophen are staples in many medicine cabinets. However, stocking up on these will require a prescription for FSA reimbursement.

- Cold Medicine: Battling a cold? OTC cold remedies are only FSA-eligible with a doctor’s prescription.

- Feminine Products: Items like tampons, pads, and menstrual cups are essential for many, but FSAs don’t cover these products.

Why aren’t these items covered?

The main reason is that FSAs are designed for specific health-related expenses. While the items listed above are undoubtedly important for your health and comfort, the IRS sets strict guidelines on what qualifies as a medical expense. For an item to be reimbursed through an FSA without a prescription, it must be deemed a “medical necessity,” which these items, without a prescription, are not typically classified as.

Exceptions to the Rule:

It’s worth noting that there are exceptions. For instance, if you have a prescription for an OTC medication like antacids or allergy pills, they become FSA-eligible. This emphasizes the importance of consulting with your healthcare provider about your needs and ensuring you get the necessary documentation.

Navigating FSA Rules:

Understanding what isn’t covered by your FSA can save you time and prevent frustration. Before making purchases, check with your FSA administrator or refer to the IRS guidelines to confirm the eligibility of items. Rules can change, so staying informed is key.

In the next section, we’ll dive into how to determine FSA eligibility for various expenses, offering tips on how to navigate these rules effectively. This knowledge will empower you to maximize your FSA benefits and make informed decisions about your healthcare spending.

How to Determine FSA Eligibility

Determining what is covered by your Flexible Spending Account (FSA) might seem like decoding a secret language at first. But, don’t worry. It’s simpler than it looks. Here are some straightforward ways to figure out what’s eligible and what’s not.

Talk to Your Benefits Administrator

First things first, your benefits administrator is your go-to source for all things FSA. They have the most up-to-date information on what your specific plan covers. If you’re ever in doubt, give them a call or shoot them an email. It’s their job to help you navigate your benefits, so don’t hesitate to reach out.

Antibiotics and Prescription Medications

Generally, prescription medications, including antibiotics, are eligible for FSA reimbursement. This is a relief for many, as these expenses can add up, especially during cold and flu season or if you have a condition that requires ongoing medication.

Anti-Itch Cream and Over-the-Counter Items

Thanks to recent changes in legislation, over-the-counter (OTC) items like anti-itch creams now qualify for FSA spending without a doctor’s prescription. This change significantly expands what you can use your FSA dollars on. From pain relievers to allergy medications, the list of eligible OTC items has grown, making your FSA more versatile than ever.

Remember:

- Check the List: The IRS provides a comprehensive list of FSA-eligible expenses, which is a great resource. However, keep in mind that your employer might have specific rules that apply to your plan.

- Prescriptions Might Be Required: For some OTC items, you might still need a prescription to get reimbursed. When in doubt, ask your benefits administrator.

- Keep Your Receipts: No matter what, keep your receipts for all medical expenses. You’ll need them for reimbursement and to verify your purchases if ever questioned.

Navigating FSA eligibility doesn’t have to be complicated. By keeping in touch with your benefits administrator, staying informed about eligible expenses, and keeping good records, you can make the most out of your FSA. Next, we’ll look at how to maximize your contributions to get the most benefit from your FSA account.

Maximizing Your FSA Contributions

Making the most out of your Flexible Spending Account (FSA) involves a bit of planning and strategy. Here’s how you can ensure you’re not leaving money on the table:

Setting Aside Money

Start with a Plan: Look back at your medical expenses from the previous year. This includes everything from copays and deductibles to over-the-counter (OTC) medicines and dental work. If last year felt “normal,” it’s a good starting point. If you’re expecting any changes (think braces for your kid or a planned surgery), adjust accordingly.

Be Conservative, But Not Too Much: If you’re unsure, it’s better to err on the side of caution. If you don’t use it, you might lose it. However, with options to carry over up to $640 or a 2.5-month grace period to use your funds (depending on your employer’s plan), you have some wiggle room.

Planned Medical Expenses

Schedule Appointments Early: If you have annual exams, dental cleanings, or eye checks, schedule them early in the year. This way, if follow-up treatments are needed, you have time to plan and use your FSA funds.

Consider Upcoming Needs: Expecting a baby? Planning to start therapy? Include these expenses in your FSA contributions. Even things like acupuncture and chiropractic care can qualify.

Dental Work

Don’t Forget Your Smile: Many people overlook dental expenses, which can quickly add up. From cleanings and fillings to more significant procedures like crowns or orthodontics, your FSA can cover these costs. If you’ve been putting off dental work, your FSA is a perfect way to address it without dipping into your savings.

OTC Medications

Stock Up Wisely: Recent changes now allow for over-the-counter medications to be reimbursed through FSAs without a prescription. This includes items like pain relievers, allergy meds, and even menstrual care products. Consider your yearly usage of these items and include them in your FSA budget.

Apps and Tools: Use apps or online tools to scan your previous purchases for eligible items. You might be surprised at what’s covered, from sunscreen to band-aids.

Remember: The key to maximizing your FSA is planning. Take a proactive approach by estimating your medical expenses for the year, keeping abreast of what’s eligible, and using your FSA funds for planned and unplanned medical expenses alike. By doing so, you can save a significant amount on taxes while ensuring you and your family’s health needs are met.

We’ll explore how to utilize your FSA before the year ends, ensuring you make the most out of every dollar contributed.

Utilizing Your FSA Before Year-End

As the year draws to a close, it’s crucial to review your Flexible Spending Account (FSA) balance. Not using these funds means losing them. Here’s how to make sure every dollar works for you, especially for those unexpected or often overlooked expenses.

Baby Monitor

Yes, in some cases, a baby monitor can be considered an eligible expense if it’s for a special medical need. This is less common, but if your child has a medical condition that necessitates constant monitoring, this could qualify. Always check with your FSA administrator for approval.

Glasses and Eye Exams

Eye care is a significant area where FSAs shine. Glasses, whether prescription or reading, and eye exams are straightforward expenses you can cover with FSA funds. Considering the cost of eyewear and eye care, using your FSA here can lead to substantial savings.

Ovulation Strips and Pregnancy Tests

Planning for a family? Ovulation strips and pregnancy tests are FSA-eligible. It’s an excellent way to use your funds for family planning purposes. These items can add up in cost over time, making your FSA a smart way to cover these expenses.

Cold Medicine

With the cold season coming up, stocking up on cold medicine with your FSA funds is a wise choice. Over-the-counter (OTC) medications, including cold and flu remedies, are eligible expenses. It’s always better to have these items on hand before you actually need them.

Key Takeaways:

- Review your FSA balance regularly, especially as the year ends.

- Consider unexpected eligible expenses like special baby monitors.

- Don’t forget about essential eye care – both glasses and exams are covered.

- Family planning items like ovulation strips and pregnancy tests are eligible.

- Stock up on OTC medications for the upcoming cold season.

By focusing on these areas, you can ensure that you’re making the most of your FSA funds before the year is out. The goal is to use all your contributions effectively, ensuring that you’re not leaving money on the table.

In the next section, we’ll wrap up with a conclusion, highlighting the benefits of partnering with NPA Benefits for self-funded health insurance plans and exploring flexible health insurance options.

Conclusion

As we wrap up our ultimate guide on identifying eligible flexible spending expenses, it’s crucial to remember the overarching goal: maximizing your healthcare benefits while minimizing out-of-pocket costs. Flexible Spending Accounts (FSAs) offer a powerful way to manage your healthcare expenses tax-efficiently. However, the real game-changer comes when you partner with a knowledgeable and experienced benefits provider like NPA Benefits.

NPA Benefits: Your Partner in Health

At NPA Benefits, we understand that navigating healthcare benefits can be complex and, at times, overwhelming. That’s why we’re committed to simplifying this process for you. Our expertise lies in offering tailor-made self-funded health insurance plans that provide both flexibility and cost savings. By choosing NPA Benefits, you’re not just selecting a service; you’re partnering with a team dedicated to your well-being and financial health.

The Advantage of Self-Funded Health Insurance Plans

Self-funded health insurance plans are a cornerstone of what we offer at NPA Benefits. These plans put you in control, allowing for greater customization and potential savings. Unlike traditional insurance, where you pay a fixed premium to an insurance company, self-funded plans mean that your employer assumes the financial risk of providing healthcare benefits. This arrangement often results in lower costs and increased flexibility in plan design. It’s a smart choice for employers seeking to provide high-quality health benefits while keeping an eye on the bottom line.

Exploring Flexible Health Insurance Options

Flexibility is key in today’s ever-changing health landscape. At NPA Benefits, we pride ourselves on offering a range of flexible health insurance options that cater to diverse needs. Whether it’s adjusting coverage levels, incorporating FSAs, or exploring other innovative health benefit solutions, our goal is to ensure that you have access to the best possible care without unnecessary financial strain.

In conclusion, understanding and utilizing eligible flexible spending expenses is just the beginning. With NPA Benefits, you gain access to a world of self-funded health insurance plans and flexible health insurance options designed to support your health, your way. Let us help you navigate the complexities of healthcare benefits, so you can focus on what matters most: your health and well-being.

The right partner makes all the difference. Explore how NPA Benefits can transform your approach to healthcare benefits today.