When it comes down to selecting health insurance for your business, the choice often boils down to ASO vs fully insured options. To put it simply, Administrative Services Only (ASO) plans are where the employer bears the cost of claims, with operational help from a third party. In contrast, fully insured plans involve the employer paying a premium to an insurance company, which then takes on the claims risk.

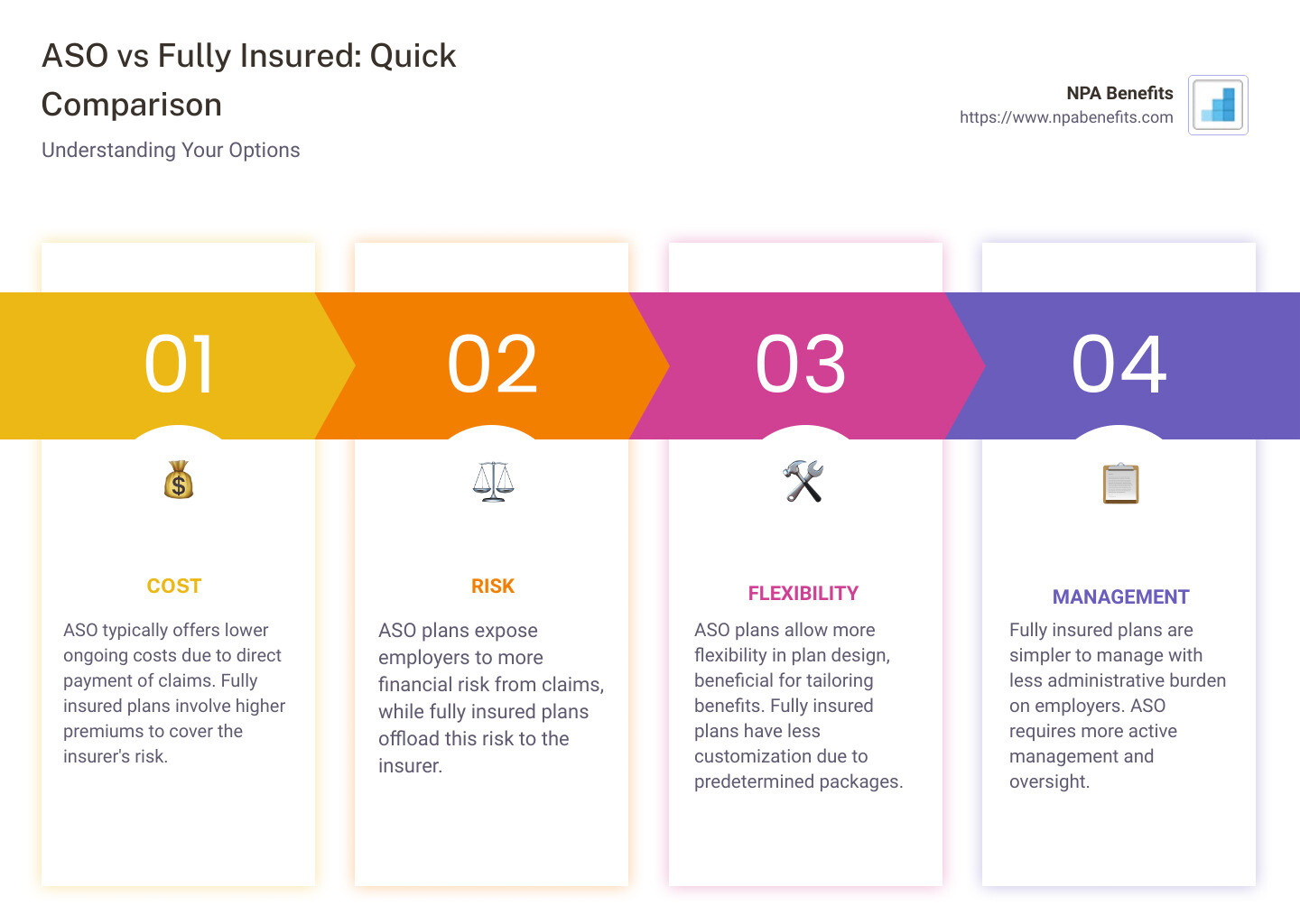

Here’s a quick snapshot:

– ASO: Lower costs, more risk, greater flexibility.

– Fully Insured: Higher premiums, less risk, less operational hassle.

This article is tailored for small to medium-sized business owners who are trying to navigate the complex world of health insurance. We understand it’s not just about finding affordable options; it’s also about offering competitive benefits to attract and retain the best talent, ensuring employee well-being, and safeguarding your business against unexpected medical expenses.

We’ll walk through the basics of ASO and fully insured plans, dive into the key differences, and explore the pros and cons of each to help you make an informed decision.

What is ASO?

Let’s break it down simply. Imagine you have a piggy bank where you save money specifically for health expenses of your employees. When someone needs it, you use that money to help them out. This is somewhat how Administrative Services Only (ASO) works.

ASO stands for Administrative Services Only. It’s a type of plan where a company, like yours, decides to handle its employees’ health or disability benefits directly. Instead of paying a big insurance company to take on the risk, you do it yourself. You’re in charge of the funds and when claims come in, you pay them out from your own pocket.

Self-funding is the key idea here. You’re using your company’s own money to pay for health claims. This might sound a bit scary at first, but it gives you a lot of control over your costs and benefits.

Here’s the role of the employer: You’re not left to figure things out on your own. While you take on the financial responsibility for claims, you can hire an outside company to do the nitty-gritty work – like processing claims and managing paperwork. Your job is to keep the piggy bank funded and make decisions about what kinds of health benefits you want to offer.

To put it simply, with ASO:

- You’re the boss of your health benefit plan.

- You pay for claims directly from company funds.

- You get help from experts for the administrative work.

It’s a way to have more say in how your health benefits work and potentially save money. But, with great power comes great responsibility – you’re taking on the risk of covering those health claims.

In our next sections, we’ll explore how this compares to buying traditional insurance (fully insured plans) and what might be the best fit for your business.

What is Fully Insured?

When we talk about fully insured health plans, we’re stepping into the traditional world of health insurance. This is the route most people are familiar with, and it’s pretty straightforward.

Definition

A fully insured health plan means that your company pays a monthly premium to an insurance carrier. That carrier then takes on the responsibility of paying for your employees’ medical claims. It’s like renting a house – you pay the rent, and the landlord takes care of the repairs.

Traditional Insurance

This is the classic model of health insurance. Companies pay premiums, and in return, the insurance company covers the healthcare costs of employees as outlined in the policy. It’s simple, easy to understand, and offers a hands-off approach to managing health benefits.

Premiums

In a fully insured plan, premiums are fixed for a year, based on the number of employees enrolled each month. These premiums can go up at renewal time, depending on the claims made by your employees during the year. It’s predictable in the short term but can lead to higher costs over time.

Insurer’s Role

The insurance company’s job is to handle everything. They process claims, manage healthcare provider networks, and take on the financial risk of covering your employees’ medical expenses. In exchange for this service, your company pays those fixed premiums.

It’s a trade-off: predictability and ease for a higher cost. Your company doesn’t have to worry about the day-to-day management of a health plan or the unpredictability of healthcare costs. But, you might end up paying more in the long run, especially if your employees are generally healthy and don’t use a lot of healthcare services.

In our discussion about aso vs fully insured plans, it’s clear that the choice between the two depends on what your company values more: control and potential savings, or simplicity and predictability. We’ll dive deeper into comparing these options and how NPA Benefits can guide you through making the best choice for your business and your employees.

Key Differences Between ASO and Fully Insured Plans

When looking at aso vs fully insured coverage options, there are several key areas to consider: cost considerations, financial risk, benefit design flexibility, regulation, and speed of implementation. Let’s break these down in simple terms.

Cost Considerations

- ASO (Administrative Services Only): You pay for the actual healthcare claims plus administrative fees. This could mean significant savings if your employees are healthy and make fewer claims.

- Fully Insured: You pay a fixed premium each month, regardless of how many claims are made. This can be more expensive, but it’s predictable.

Financial Risk

- ASO: The employer takes on the risk. If there’s a month with high claims, the company has to cover these costs. However, stop-loss insurance can protect against very high individual claims.

- Fully Insured: The insurance company takes the risk. High claims don’t affect your costs directly, at least not until renewal time.

Benefit Design Flexibility

- ASO: Offers more flexibility. You can tailor the plan to suit your company’s and employees’ needs, choosing what to cover and what not to.

- Fully Insured: Less flexible. You choose from pre-designed plans and have limited options for customization.

Regulation

- ASO: Generally less regulated, especially under federal laws like ERISA. However, state-specific regulations can still apply.

- Fully Insured: More heavily regulated, with state mandates on coverage and benefits that must be included.

Speed of Implementation

- ASO: Can take longer to set up. You’ll need to find providers for various services (like claims processing) and potentially navigate more complex regulatory requirements.

- Fully Insured: Quicker to implement. The insurance company handles the details, and you can often start using standard plans more rapidly.

In summary, ASO plans offer potential savings and flexibility but come with more complexity and risk. Fully insured plans provide simplicity and predictability, at the cost of potentially higher premiums and less customization.

As we move into discussing the pros and cons of each option, keep these differences in mind. NPA Benefits can help navigate these complexities, ensuring your business finds the best fit for your specific needs and values.

Pros and Cons of ASO

When considering ASO vs Fully Insured coverage options, it’s crucial to understand the advantages and disadvantages of each. Let’s dive into Administrative Services Only (ASO) plans and break down what they mean for your business.

Lower Cost

Pros: One of the most attractive aspects of an ASO plan is the potential for lower costs. Unlike traditional insurance where premiums are fixed, ASO plans allow employers to pay for actual claims. This means if your employees have fewer medical expenses, your company saves money. Over time, these savings can be significant.

Cons: However, it’s not all sunshine and roses. If claims exceed anticipated amounts, costs can quickly spiral. Without careful management, an ASO plan can end up being more expensive than a fully insured option.

Greater Flexibility

Pros: ASO plans offer greater flexibility in designing benefits. You’re not boxed into pre-set packages and can tailor the benefits to meet your employees’ specific needs. This customization can be a powerful tool in attracting and retaining top talent.

Cons: With great power comes great responsibility. Designing a plan from scratch can be complex and time-consuming. It requires a deep understanding of your employees’ needs and the healthcare landscape.

Plan Transparency

Pros: ASO provides greater transparency in how funds are spent. You’ll have detailed insights into the types of claims filed, which can help in making informed decisions about future plan adjustments.

Cons: This level of detail requires diligent oversight and analysis. Not all businesses have the resources or expertise to effectively manage this aspect of an ASO plan.

Risk Management

Pros: Effective risk management strategies, such as purchasing stop-loss insurance, can protect your business from catastrophic claims. This insurance kicks in when claims exceed a certain level, providing a safety net for unexpected expenses.

Cons: The cost of stop-loss insurance can be high, and it’s an additional expense to consider. Plus, navigating the options and finding the right coverage level can be complex.

Stop-Loss Insurance

Pros: Stop-loss insurance is a critical component of managing financial risk in an ASO plan. It ensures that a single high-cost claim won’t derail your company’s finances.

Cons: However, relying on stop-loss insurance means you’re still dealing with an insurance product, which can have its own set of challenges and costs.

In conclusion, while ASO plans offer the allure of lower costs, greater flexibility, and plan transparency, they also come with responsibilities in terms of risk management and the need for stop-loss insurance. It’s a balancing act between potential savings and the resources required to manage these plans effectively.

As we transition into discussing fully insured plans, NPA Benefits is here to help you weigh these pros and cons, guiding you towards the best choice for your company’s unique situation.

Pros and Cons of Fully Insured Plans

When it comes to understanding aso vs fully insured coverage options, it’s crucial to look at both sides of the coin. Fully insured plans, the traditional route for providing employee health benefits, come with their own set of advantages and drawbacks. Let’s dive into these to help you make an informed decision.

Financial Predictability

One of the biggest draws of fully insured plans is their financial predictability. Employers pay a fixed premium to the insurance carrier, and that’s it. No matter how many claims your employees file, your cost remains the same throughout the policy year. This predictability makes budgeting easier and eliminates the worry of unexpected medical expenses.

Ease of Management

With fully insured plans, the insurance company handles the heavy lifting. This includes managing claims, ensuring compliance with state and federal regulations, and dealing with the administrative tasks associated with health benefits. For many businesses, especially small ones without a dedicated HR department, this ease of management is a significant plus.

Higher Costs

However, this convenience and predictability come at a cost—literally. Fully insured plans often have higher premiums compared to ASO plans. This is because the insurance carrier assumes all the risk and also aims to make a profit. Additionally, these plans typically include taxes and fees that self-insured plans may not be subject to.

Less Flexibility

Another downside to fully insured plans is less flexibility in plan design. Employers are limited to the options provided by the insurance carrier, which may not always align perfectly with the needs of their employees. Customization is minimal, if available at all, which can lead to paying for benefits your employees don’t use or missing out on ones they need.

In conclusion, fully insured plans offer a hands-off approach to providing health benefits, with predictable costs and minimal administrative burden. However, they can be more expensive and offer less flexibility compared to ASO plans. It’s a trade-off between convenience and control.

Remember that NPA Benefits can assist in evaluating your specific needs, helping you find the right balance between the predictability of fully insured plans and the customization and potential savings of ASO plans.

Comparing Costs: ASO vs Fully Insured

When it comes to choosing the right health coverage for your company, understanding the cost differences between ASO (Administrative Services Only) and fully insured plans is crucial. Let’s break it down into four main parts: premiums, administrative fees, claims expenses, and potential savings.

Premiums

Fully Insured Plans: Employers pay a fixed premium to the insurance carrier, which remains constant unless the number of enrolled employees changes. This provides financial predictability but may result in higher costs.

ASO Plans: No fixed premiums. Instead, employers pay for actual claims plus administrative fees. This can lead to variable costs month to month but offers the chance for savings if claims are lower than expected.

Administrative Fees

Fully Insured Plans: The premium includes administrative costs, so there’s no separate fee. However, this also means you might be paying more for administration than necessary.

ASO Plans: Employers pay a negotiated administrative fee to the third-party administrator. While this is an extra cost, it’s often lower than the administrative costs wrapped into fully insured premiums.

Claims Expenses

Fully Insured Plans: The insurance company handles all claims expenses. The premium is designed to cover these costs, plus a margin for the insurer.

ASO Plans: Employers directly pay for claims. This can be risky if there are unexpected high expenses, but stop-loss insurance can mitigate catastrophic claims.

Potential Savings

Fully Insured Plans: Any surplus (when claims are lower than expected) remains with the insurance company. There’s less financial risk but also no opportunity for savings.

ASO Plans: If claims are lower than expected, the surplus stays with the employer. This can translate into significant savings and the flexibility to reinvest in additional benefits or other areas of the business.

Fully insured plans offer predictability and ease but at a potentially higher cost. ASO plans, on the other hand, offer the possibility for savings and greater flexibility but come with a higher administrative burden and financial risk.

Navigating these options can be complex, but NPA Benefits is here to help. We understand the nuances of aso vs fully insured plans and can guide you through assessing your company’s specific needs to find the best fit. The right choice can lead to not only cost savings but also a health benefits plan that is more tailored to your employees’ needs.

Regulatory Considerations

When considering aso vs fully insured plans, it’s crucial to understand the regulatory landscape. Each option comes with its own set of rules and requirements, influenced heavily by state-specific regulations, mandated benefits, and compliance necessities. Let’s break these down:

State-specific Regulations

ASO plans, being self-funded, generally fall under federal law (ERISA). This means they’re not subject to state insurance laws, including those about reserves and mandated benefits. This can offer more flexibility but also requires a keen understanding of federal regulations to ensure compliance.

On the other hand, fully insured plans are regulated at the state level. This means they must comply with state-specific insurance laws, which can vary significantly from one state to another. These laws often include requirements for coverage of specific benefits and can impact the cost and design of the plan.

Mandated Benefits

State mandates play a big role in the aso vs fully insured debate. For fully insured plans, states can require coverage of certain benefits, such as specific types of preventive care or treatments for certain conditions. These mandates can increase the cost of premiums but also ensure a broad level of coverage for employees.

ASO plans, while not subject to these state mandates, can choose to include or exclude specific benefits. This offers a level of customization and potential cost savings but requires careful consideration to ensure the plan meets the needs of employees and complies with federal regulations.

Compliance Requirements

Compliance is a key factor in the aso vs fully insured decision. Fully insured plans must adhere to state regulations, which can include filing and reporting requirements, solvency standards, and consumer protection laws. Insurers handle most of these compliance issues, reducing the administrative burden on employers.

ASO plans, while exempt from state insurance laws, must comply with federal regulations under ERISA. This includes requirements for reporting, disclosure, and fiduciary responsibilities. Employers must be prepared to manage these compliance tasks or partner with a knowledgeable administrator who can help.

NPA Benefits understands the complexities of navigating these regulatory waters. Whether you’re leaning towards an ASO or fully insured plan, we’re here to guide you through the compliance maze. Our expertise ensures that your chosen path not only meets regulatory requirements but also aligns with your company’s needs and goals.

Remember that the right health benefits plan can significantly impact your company’s financial health and employee satisfaction. Let’s explore how to implement an ASO or Fully Insured Plan effectively in the next section.

Implementing an ASO or Fully Insured Plan

Choosing the right health benefits plan is a crucial decision for any business. It influences your financial stability and plays a vital role in attracting and retaining top talent. Let’s break down how to make this decision, focusing on ASO vs fully insured options, assessing your company’s needs, understanding employee benefits, and how NPA Benefits can guide you through this process.

Choosing a Plan

1. Evaluate Your Financial Capacity: The first step is understanding your financial ability to take on risk. ASO plans often require a larger upfront investment and a stomach for variable costs, while fully insured plans offer predictable, fixed premiums.

2. Consider Your Employee Demographics: Younger, healthier workforces might benefit more from ASO plans due to lower claims risk, whereas companies with a diverse or older demographic might find safety in fully insured plans.

3. Understand Your Administrative Capabilities: Managing an ASO requires more administrative effort. If you have a robust HR team, this might be feasible. Otherwise, a fully insured plan might be less burdensome.

Assessing Company Needs

Identify Your Goals: Are you looking to save costs in the long term, or is budget predictability more important? Do you value flexibility in plan design, or is simplicity key?

Employee Feedback: Gather insights from your employees. What benefits do they value the most? This can guide whether a more customizable ASO plan or a standard fully insured plan would be preferable.

Understanding Employee Benefits

Transparency and Control: With an ASO plan, you have more control over the benefits offered and can design a plan that closely matches your employees’ needs.

Predictability and Simplicity: Fully insured plans offer a straightforward approach. Employees are familiar with the structure, and it can be easier to manage expectations.

NPA Benefits

At NPA Benefits, we understand that navigating the complexities of health insurance can be daunting. That’s why we’re here to help you:

-

Analyze Your Needs: We’ll help you assess your financial capacity, administrative capabilities, and employee needs to determine the best path forward.

-

Customized Solutions: Whether it’s an ASO or fully insured plan, we tailor our recommendations to fit your unique situation.

-

Ongoing Support: Implementing the plan is just the beginning. We provide continuous support to ensure your health benefits strategy evolves with your business and remains compliant with regulatory changes.

Choosing between an ASO and a fully insured plan is not just about costs; it’s about aligning your health benefits strategy with your business objectives and employee needs. With NPA Benefits, you have a partner committed to navigating this journey with you, ensuring you make informed decisions that benefit your company and your employees.

As you weigh your options, the landscape of health benefits is ever-changing. Staying informed and flexible will allow you to adapt and thrive, no matter which path you choose.

Conclusion

Choosing between an ASO vs fully insured plan is a significant decision that impacts not just your bottom line, but the well-being of your employees and the overall health of your company. At NPA Benefits, we understand the complexities involved in this decision-making process. Our goal is to simplify these complexities, offering clear, straightforward advice and solutions that align with your business’s unique needs and objectives.

The future of health insurance is dynamic, with new regulations, technologies, and market trends constantly emerging. In this changing landscape, having a knowledgeable and adaptable partner like NPA Benefits can make all the difference. We are committed to keeping you ahead of the curve, ensuring your health benefits strategy not only meets today’s needs but is poised to adapt to tomorrow’s challenges and opportunities.

The choice between an ASO and a fully insured plan is not just about the immediate financial implications. It’s about considering the long-term health and success of your organization. It’s about flexibility, control over your benefits, and the ability to provide meaningful support to your employees. With NPA Benefits by your side, you can navigate these decisions with confidence, knowing you have access to the latest insights, expertise, and innovative solutions in health benefits.

As we look to the future, we are excited about the possibilities that lie ahead for transforming health benefits into a strategic advantage for your business. Together, we can create a healthier, more sustainable future for your company and your employees. Let’s embark on this journey together, and explore the innovative world of health insurance with a partner you can trust.