Are Hyperice Products FSA Eligible?

Yes, Hyperice products can be FSA eligible! If you’re thinking about using your Flexible Spending Account (FSA) or Health Savings Account (HSA) to buy recovery devices, you’re in luck. Many Hyperice products count as eligible medical expenses under the current rules. Here are some you can consider:

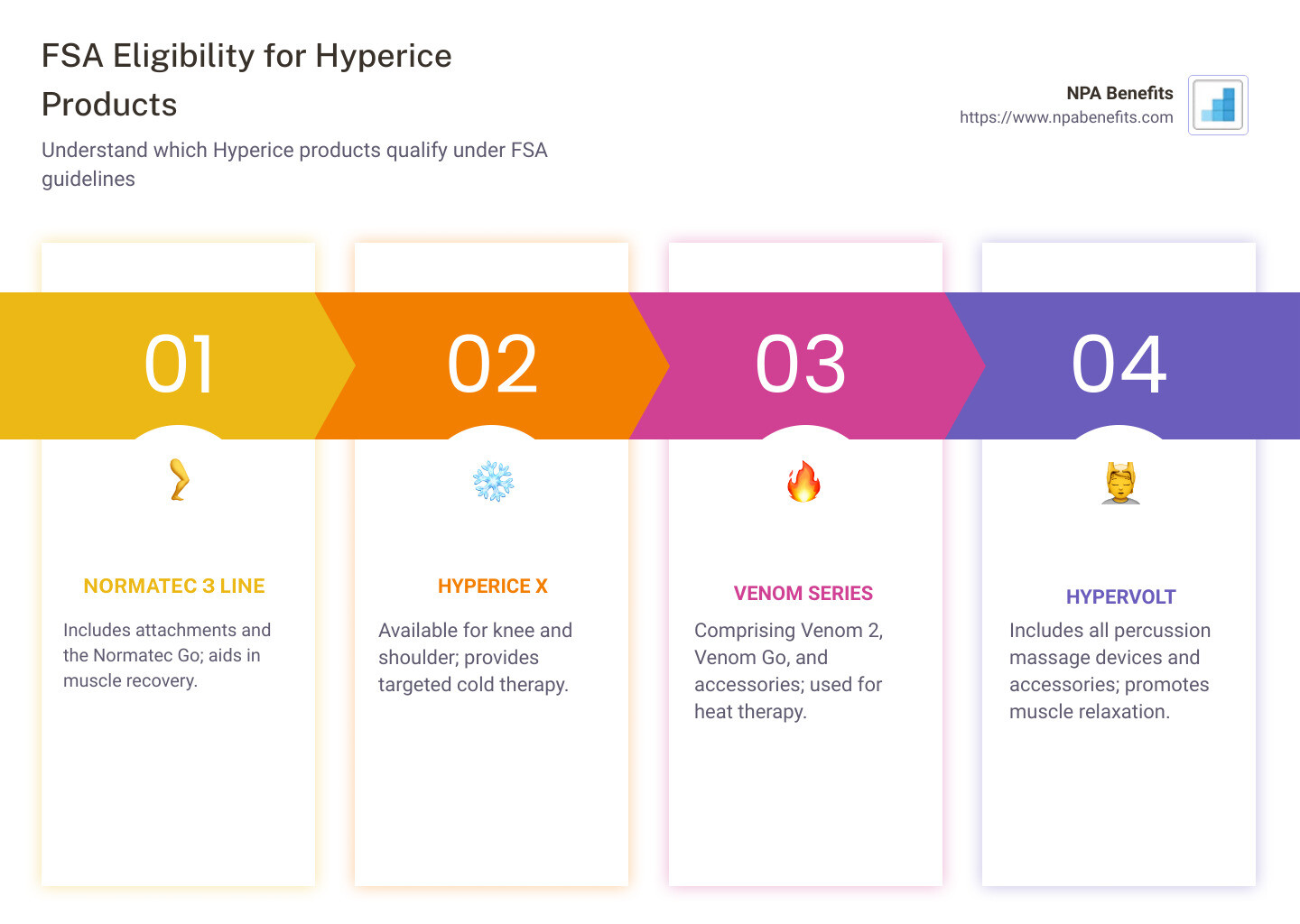

- Normatec 3 Line: This includes all attachments and the Normatec Go.

- Hyperice X: Available models for both knee and shoulder use.

- Venom Series: This covers Venom 2, Venom Go, and all its accessories.

- Hypervolt: All types of percussion massage devices and their related accessories.

These products are designed to help with recovery and can be a great use of your FSA or HSA funds.

Navigating the health savings landscape can be tricky. Health accounts like FSAs and HSAs offer great ways to save on healthcare expenses while reducing taxable income. Hyperice products, as high-quality recovery tools, align well with eligible expenses, making them an investment in wellness you might not have considered before.

As Les Perlson, a seasoned expert in insurance benefits, I have written extensively about the intricacies of health savings accounts, including topics like are hyperice products fsa eligible. My expertise includes helping businesses and individuals steer these waters for optimal financial health. Let’s dive deeper into how you can leverage these benefits for your well-being.

Are Hyperice Products FSA Eligible?

The straightforward answer is yes! When you’re planning to use your Flexible Spending Account (FSA) or Health Savings Account (HSA) for purchasing recovery devices, several Hyperice products qualify as eligible medical expenses under current guidelines:

- Normatec 3 Line: Including attachments and the Normatec Go

- Hyperice X: Available for knee and shoulder

- Venom Series: Including Venom 2, Venom Go, and its accessories

- Hypervolt: All percussion massage devices and related accessories

Navigating the health savings landscape can be tricky. Health accounts like FSAs and HSAs offer great ways to save on healthcare expenses while reducing taxable income. Hyperice products, as high-quality recovery tools, align well with eligible expenses, making them an investment in wellness you might not have considered before.

As Les Perlson, a seasoned expert in insurance benefits, I have written extensively about the intricacies of health savings accounts, including topics like are hyperice products fsa eligible. My expertise includes helping businesses and individuals steer these waters for optimal financial health. Let’s dive deeper into how you can leverage these benefits for your well-being.

Understanding FSA and HSA

When it comes to managing healthcare expenses, understanding Flexible Spending Accounts (FSAs) and Health Savings Accounts (HSAs) is crucial. Both offer tax advantages, but they cater to different needs and come with distinct features.

FSA vs. HSA

Ownership and Portability:

- FSA: The account is owned by your employer. If you change jobs, the funds typically do not transfer with you.

- HSA: You own the account, and it stays with you even if you switch jobs or retire.

Contribution Limits and Rollovers:

- FSA: In 2023, you can contribute up to $3,050. However, it’s a “use-it-or-lose-it” account, with only $610 allowed to carry over to the next year.

- HSA: Higher limits, with $3,850 for individuals and $7,750 for families in 2023. Unused funds roll over indefinitely.

Eligibility Requirements:

- FSA: Available to employees whose employers offer the plan, regardless of their health insurance type.

- HSA: Requires enrollment in a high-deductible health plan (HDHP).

Investment Options:

- FSA: No investment options.

- HSA: Contributions can be invested, potentially increasing your savings over time.

Tax Benefits

Both FSAs and HSAs allow you to use pre-tax dollars for medical expenses, reducing your taxable income. This can lead to substantial savings, especially if you plan your healthcare spending wisely.

For example, if you contribute $2,000 to an FSA, that amount is deducted from your taxable income, providing immediate tax savings. Similarly, HSA contributions can also lower your taxable income, and any investment growth is tax-free as long as it’s used for qualified medical expenses.

Choosing the Right Account

Consider your healthcare needs and financial goals when deciding between an FSA and an HSA. If you have predictable medical expenses and want immediate access to funds, an FSA might suit you. However, if you prefer long-term savings and investment growth, an HSA could be more beneficial.

By understanding the differences between FSAs and HSAs, you can make informed decisions that optimize your healthcare savings. Whether you’re eyeing Hyperice products or other medical expenses, knowing how to leverage these accounts can lead to smarter spending and better financial health.

Eligible Hyperice Products

If you’re wondering, are Hyperice products FSA eligible, you’re in luck. Many Hyperice products qualify for FSA and HSA spending, offering a great way to use your pre-tax dollars on wellness and recovery tools. Let’s explore some of the popular products you can purchase with these accounts.

Hypervolt: Percussion Massage Devices

The Hypervolt series is a favorite among athletes and fitness enthusiasts. These percussion massage devices help relieve muscle tension and improve circulation. All Hypervolt models, including the accessories like the Heated Head Attachment, are FSA/HSA eligible. This means you can enjoy a professional-grade massage at home while using your FSA funds.

Normatec: Compression Therapy

The Normatec line, known for its advanced compression technology, is also FSA/HSA eligible. This includes the Normatec 3 Legs Compression System, hip and arm attachments, and the portable Normatec Go. These products are designed to improve recovery and reduce muscle soreness, making them a smart choice for anyone looking to maximize their workout recovery.

Venom: Heat and Massage Therapy

For those who prefer heat therapy, the Venom series offers a range of heat and massage wraps. The Venom 2, Venom Go, and shoulder wraps are all eligible for purchase with FSA/HSA funds. These wraps combine soothing heat with vibration to target specific areas like the back, shoulders, and neck, providing relief from aches and pains.

Hyperice X: Contrast Therapy

The Hyperice X line is another innovative option. It provides contrast therapy with alternating hot and cold treatments, specifically designed for the knee and shoulder. This product is particularly beneficial for reducing inflammation and accelerating recovery, and it’s fully eligible for FSA/HSA spending.

By choosing these eligible Hyperice products, you can take advantage of your FSA or HSA to improve your health and wellness routine. Whether you’re recovering from a workout or managing chronic pain, these tools offer effective solutions to support your physical well-being.

How to Purchase Hyperice Products with FSA

Navigating the purchase of Hyperice products using your FSA funds is straightforward once you understand the process. Here’s a simple guide to help you use your FSA card, manage reimbursements, and keep track of receipts.

Using Your FSA Card

Many FSAs provide a debit card linked directly to your account. This card simplifies the purchase process, allowing you to buy eligible Hyperice products without upfront personal spending.

- Shop for Eligible Products: Visit authorized sellers or online platforms that offer Hyperice products, ensuring they’re FSA-eligible. These include items like the Hypervolt, Normatec, Venom, and Hyperice X.

- Use Your FSA Card: At checkout, use your FSA debit card just like a regular debit card. This direct payment method reduces hassle and minimizes the need for reimbursement paperwork.

Reimbursement Process

If you don’t have an FSA debit card or prefer to pay upfront, you can still get reimbursed for eligible expenses.

- Purchase Products: Buy your desired Hyperice products using personal funds.

- Submit a Claim: Log into your FSA provider’s portal to submit a reimbursement claim. Follow the instructions provided to ensure your claim is processed smoothly.

- Receive Reimbursement: Once your claim is approved, the funds will be reimbursed to your bank account or sent via check.

Keeping Itemized Receipts

Regardless of how you pay, it’s crucial to keep detailed receipts. These serve as proof of your purchase and are necessary for reimbursement claims or any potential audits.

- Save All Receipts: After purchasing, store your itemized receipts in a safe place. Digital copies can be especially handy for easy access and submission.

- Document Details: Ensure receipts include the product name, purchase date, and amount spent. This information is essential for verifying the eligibility of your expenses.

By understanding these steps, you can efficiently use your FSA funds to invest in Hyperice products, enhancing your health and recovery efforts. This practical approach allows you to maximize your pre-tax health savings while enjoying the benefits of advanced wellness tools.

Frequently Asked Questions about Hyperice and FSA

Does Hyperice accept FSA?

Yes, Hyperice products are FSA eligible! This means you can use your Flexible Spending Account (FSA) to purchase a range of Hyperice products. These include popular items like the Hypervolt percussion devices, Normatec compression systems, and Venom heat/massage wraps. When buying these products, you can use your FSA debit card at checkout, or submit a reimbursement claim if you pay out-of-pocket initially. Remember to keep your receipts for any FSA transactions!

Is Normatec covered by HSA?

Absolutely, the Normatec compression systems, part of the Hyperice lineup, are eligible for purchase with Health Savings Account (HSA) funds. This includes the Normatec 3 line, which features individual attachments and accessories. Using your HSA for these purchases allows you to benefit from pre-tax savings. Check with your HSA provider to ensure these expenses are covered under your specific plan and keep your receipts for your records.

Can I use FSA to buy other wellness products?

While Hyperice products are FSA eligible, it’s important to note that not all similar wellness products automatically qualify. To use your FSA for other wellness devices, you may need a medical necessity letter from a healthcare provider. This letter should explain why the product is necessary for a specific medical condition or treatment. Always confirm with your FSA provider to see if a medical necessity letter is required for such purchases.

By understanding these FAQs, you can make informed decisions about using your FSA and HSA funds for wellness and recovery products.

Conclusion

In conclusion, navigating FSAs can be a game-changer for managing your healthcare expenses. NPA Benefits is here to make this journey smoother for you. Our expertise in flexible health insurance solutions ensures that you have access to the best, cost-saving options custom to your unique needs.

Our focus is on empowering you with control over your health expenses. By choosing NPA Benefits, you partner with a team dedicated to optimizing your financial wellness. We understand that each individual’s or business’s needs are different, and we pride ourselves on offering personalized solutions that align with those needs.

Maximize Your Benefits

Investing in FSA-eligible products like Hyperice can improve your wellness routine while providing financial relief. By using pre-tax dollars for these purchases, you effectively reduce your taxable income, leading to potential savings. This is just one of the many ways we help you stretch your healthcare dollars further.

Explore more about how you can make the most of your FSA with our custom solutions. Visit our FSA eligible products page for more information and guidance on leveraging your benefits effectively.

By partnering with us, you’re not just selecting a service; you’re choosing a committed ally in your health and financial journey. Together, let’s make the most of your healthcare benefits and achieve your wellness goals.