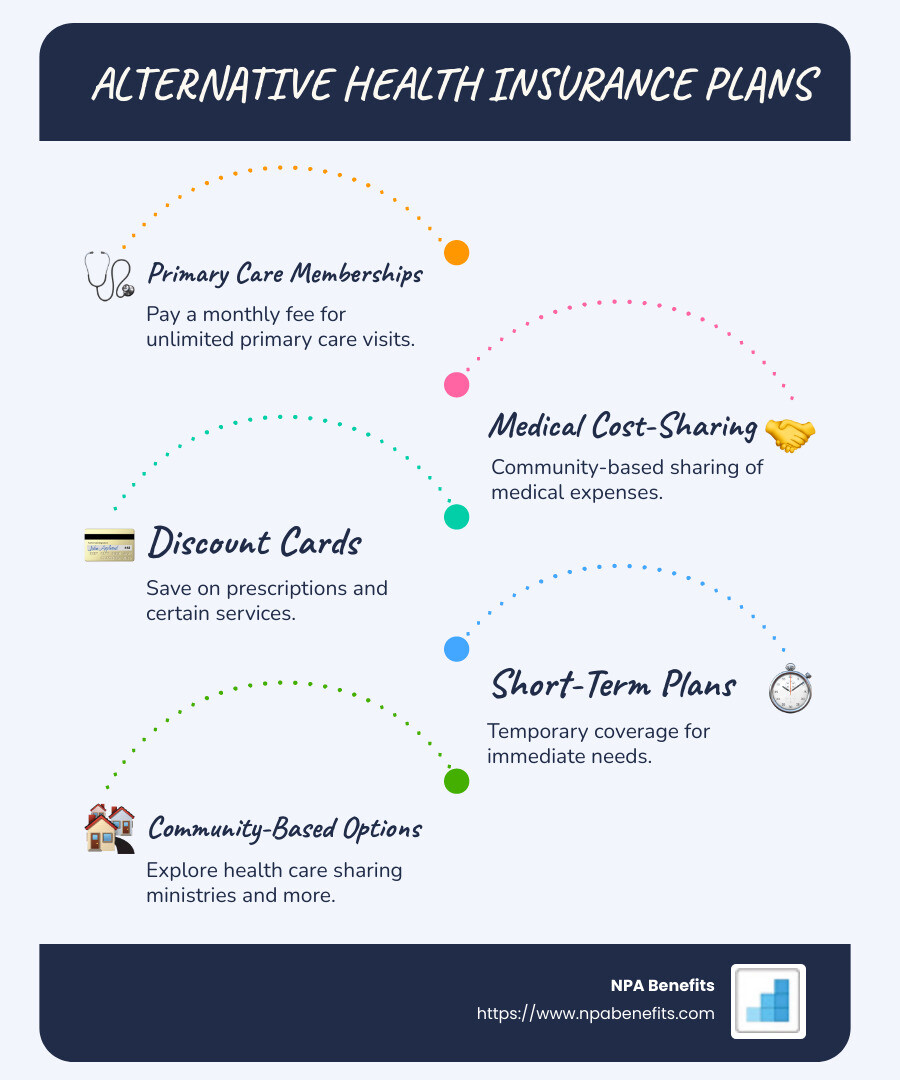

Alternative health insurance plans are emerging as a solution for many overwhelmed by skyrocketing healthcare costs and the daunting complexity of insurance options. If you’re searching for ways to cut expenses without compromising on essential coverage, here are some popular alternatives to consider:

- Primary Care Memberships: Pay a monthly fee for unlimited primary care visits.

- Medical Cost-Sharing Programs: Community-based sharing of medical expenses.

- Discount Cards: Significant savings on prescriptions and certain services.

- Short-Term Plans: Temporary coverage for immediate needs.

Each of these options presents unique benefits and challenges, helping you steer the affordability crisis while effectively securing your healthcare needs.

I’m Les Perlson, with over 40 years of experience in the insurance industry, specializing in crafting practical strategies for alternative health insurance plans. This expertise allows me to guide businesses in finding effective and flexible insurance solutions that balance cost and coverage seamlessly.

Basic alternative health insurance plans terms:

– group health insurance

– what is a group health insurance plan

– what is cobra insurance

Understanding Alternative Health Insurance Plans

Alternative health insurance plans, or AHPs, are gaining traction as viable options for those seeking relief from traditional insurance complexities and high costs. These plans offer a fresh approach to healthcare coverage by focusing on simplicity and cost savings.

What Makes AHPs Different?

AHPs are designed to be straightforward. Unlike traditional plans, which often come with a maze of terms and conditions, AHPs aim to simplify your insurance experience. They strip away unnecessary complexities, making it easier for you to understand what you’re paying for and what you’re getting.

But simplicity isn’t the only advantage. AHPs also emphasize cost savings. By encouraging members to choose high-value, efficient providers, these plans help reduce overall healthcare costs. This approach aligns with Dr. Eric Bricker’s insight that “higher quality doctors can lower healthcare costs by lowering the number of units of healthcare required by patients.”

Plan Design and Flexibility

AHPs offer a variety of plan designs to suit different needs. Whether you’re looking for a plan with low premiums or one that covers specific types of care, there’s likely an AHP that fits. This flexibility means you can tailor your coverage to match your healthcare needs and financial situation.

Moreover, AHPs often partner with major insurance companies to improve their offerings. This partnership can bring added benefits, like access to a wider network of providers or additional resources for clinical navigation.

Cost Savings in Action

Consider the case of high-deductible health plans (HDHPs) from the early 2000s. When startups like Definity and Lumenos introduced HDHPs, they promised lower premiums in exchange for higher deductibles. Once these companies were acquired by larger insurers, HDHP participation soared. While HDHPs had their drawbacks, they demonstrated the potential for alternative plans to capture market share by offering cost-effective solutions.

Today, AHPs are following a similar path, but with an added focus on optimizing provider networks and streamlining plan designs to ensure better value for money.

Key Takeaways

- Simplicity: AHPs cut through the clutter, making it easier to understand your coverage.

- Cost Savings: By promoting efficient healthcare choices, AHPs help reduce expenses.

- Flexibility: With various plan designs, AHPs cater to different needs and budgets.

In the next section, we’ll explore the different types of alternative health insurance plans available, helping you find the right fit for your unique situation.

Types of Alternative Health Insurance Plans

Navigating healthcare can feel like solving a complex puzzle. But alternative health insurance plans (AHPs) offer a range of options that can simplify your choices and potentially save you money. Let’s explore the different types of AHPs available today.

Short-term Plans

Short-term health plans are designed to fill temporary gaps in coverage. They typically last up to 12 months but can sometimes be renewed for up to three years. These plans often come with lower premiums, but they offer fewer benefits than traditional plans. Be aware: if you get sick, renewing or getting a new plan can be tricky. You might need to wait for the open enrollment period on the ACA marketplace to secure a more comprehensive plan.

Limited Benefit Plans

These plans focus on providing coverage for specific health needs. For instance:

- Accident plans cover only certain injuries.

- Disease plans offer payouts for specific illnesses like cancer.

- Fixed-indemnity plans provide a set amount for services, such as a daily hospital rate.

While limited benefit plans can be affordable, they often don’t cover comprehensive medical needs.

Subscription Plans

Subscription plans, also known as concierge or direct care plans, work like a gym membership for healthcare. You pay a monthly or annual fee to access specific services from a provider. This might include unlimited doctor visits or discounted lab tests. However, if you need care outside the plan’s scope, you’re on your own for those costs.

Discount Plans

Discount plans aren’t insurance but offer reduced rates on certain healthcare services. By paying a monthly fee, members can access discounts on services like vision or pharmacy benefits. But remember, these plans won’t cover primary care or emergencies.

Health Care Sharing Ministries

These ministries operate on a faith-based sharing model. Members contribute monthly to cover each other’s medical expenses. While they can offer community support and lower costs, they’re not regulated like traditional insurance. This means there’s no guarantee your medical expenses will be covered, especially for preexisting conditions.

Association Plans

Association health plans are group plans often offered by member-based organizations or employers. They might not be subject to the same state and federal regulations as traditional plans, which can mean fewer covered services. If you’re considering joining an association for its health plan, scrutinize the membership dues, plan coverage, and reviews.

Understanding these alternative health insurance plans allows you to tailor your healthcare coverage to your specific needs. Whether you’re looking for temporary coverage, specific benefits, or a community-based approach, there’s likely an AHP that fits. Next, we’ll explore the benefits and drawbacks of these plans to help you decide which option might be right for you.

Benefits and Drawbacks of Alternative Health Insurance Plans

Alternative health insurance plans can offer a unique approach to healthcare coverage, but it’s crucial to understand both their advantages and potential pitfalls. Here’s a breakdown of what to consider:

Coverage Limitations

Most alternative plans don’t cover everything. They might not include preexisting conditions or chronic illnesses. For instance, short-term plans offer limited benefits and may leave you without coverage for essential services. Similarly, limited benefit plans only cover specific situations, like accidents or certain diseases, leaving gaps for other medical needs.

Financial Support

Alternative plans typically don’t qualify for federal assistance, such as tax credits or subsidies available through ACA plans. This means you could miss out on financial help to lower premiums and out-of-pocket costs. However, some association health plans provide financing options to spread out payments, which can help manage expenses.

Network Optimization

Some plans, like association health plans, focus on optimizing provider networks. They aim to connect you with high-quality, cost-effective healthcare providers. This can mean access to a broad range of services and facilities. But be cautious: not all plans guarantee the same level of care, and you might have fewer choices compared to traditional insurance.

Plan Design

Alternative plans often come with simplified structures. For example, subscription plans provide a straightforward model where you pay a fixed fee for certain services. These can be great if you want a predictable expense, but they might not cover unexpected medical needs. On the other hand, indemnity insurance offers flexibility by reimbursing set amounts for specific services, but you’ll still cover most costs out-of-pocket.

Clinical Navigation

Some plans introduce innovative clinical navigation tools. These help you find and connect with top-quality providers, which can reduce the cost of complex care. For instance, some association health plans offer concierge services or app-based navigation to guide your healthcare decisions. This can improve your experience but may not be available in all plans.

Choosing the right alternative health insurance plan requires weighing these benefits and drawbacks against your personal needs. Up next, we’ll dig into how to select the best plan for your situation, considering eligibility, coverage needs, and cost considerations.

How to Choose the Right Alternative Health Insurance Plan

Picking the right alternative health insurance plan can feel like solving a puzzle. But don’t worry, it’s easier than it seems. Here’s a simple guide to help you find the best fit.

Eligibility

First, check if you qualify for different plans. Some, like health care sharing ministries, require you to share a certain faith or lifestyle. Others, such as association plans, might need you to join a specific group or association. Make sure you meet any requirements before diving in.

Coverage Needs

Think about what you really need. Do you visit the doctor often? Do you have ongoing prescriptions? If you just need basic care, a subscription plan might work. But if you need more comprehensive coverage, consider a plan that offers a wider range of services. Some plans, like short-term plans, might not cover preexisting conditions or chronic illnesses.

Cost Considerations

Money matters. Look at the monthly fees, deductibles, and out-of-pocket costs. Some plans, like discount plans, offer lower rates for specific services like vision or pharmacy needs. But they don’t cover everything. Compare costs with what you get in return. That alternative plans typically don’t qualify for federal subsidies, so factor that into your budget.

Enrollment Periods

Timing is key. Unlike ACA plans, many alternative options don’t have strict enrollment periods. However, some, like short-term plans, might only be available at certain times or for limited durations. If you’re switching from a traditional plan, ensure there’s no gap in your coverage.

By considering these points, you can find an alternative health insurance plan that fits your life and budget. Up next, we’ll tackle some frequently asked questions to clear up any lingering doubts.

Frequently Asked Questions about Alternative Health Insurance Plans

What are alternative health plans?

Alternative health insurance plans (AHPs) are different from traditional health insurance. They offer unique ways to cover medical costs. Unlike ACA plans, AHPs often focus on cost savings and simplicity. They might not cover everything, like preexisting conditions or certain treatments.

AHPs include options like short-term plans, which can be a quick fix if you’re between jobs. Or subscription plans, where you pay a monthly fee for basic doctor visits. But remember, these plans often skip some essential coverages.

Is $200 a month good for health insurance?

Paying $200 a month for health insurance might sound like a good deal. But it depends on what you’re getting. The average premium for an ACA plan is around $477. This means a $200 plan might not cover as much.

Check what the plan includes. Does it cover doctor visits, prescriptions, or emergencies? Sometimes, lower premiums mean higher out-of-pocket costs when you need care. Make sure the plan fits your health needs and budget.

Can you get health insurance as a substitute?

Yes, substitute teachers and others can get health insurance. If you don’t have employer coverage, the ACA marketplace is a good place to start. Here, you might find plans with subsidies that help lower costs.

Subsidies can make health insurance more affordable, especially if your income qualifies. Check the ACA marketplace to see what options are available for you.

Conclusion

In today’s complex healthcare landscape, finding the right insurance can be challenging. At NPA Benefits, we believe in providing flexible options that empower individuals and businesses to take control of their health coverage. Our focus is on offering cost-saving solutions that align with your unique needs.

With our alternative health insurance plans, you gain the ability to tailor your coverage. This means you decide how much to contribute, which expenses to prioritize, and when to use your funds. This level of personalization ensures your benefits work for you, offering peace of mind and financial efficiency.

Control is at the heart of what we do. We know that each person’s health needs and financial situations are different. That’s why we offer plans that are not only affordable but also adaptable, ensuring you get the most out of your healthcare investment.

Explore the possibilities with NPA Benefits and find how our innovative plans can serve you better. Whether you’re looking for individual or group health insurance, we have the expertise and options to help you make the best choice.

For more information on our health insurance benefits, visit our service page. Accept the flexibility and savings with NPA Benefits today.