Understanding Administrative Costs in Employer Health Plans

When it comes to administration costs for employer self funded plan vs insurance, it all boils down to control, financial risk, and potential savings. Here’s a quick comparison:

Self-Funded Plan:

– Flexibility: Customize benefits to match employee needs.

– Potential Savings: Lower taxes and reduced carrier fees.

– Risk: The employer bears the financial risk for claims.

– Administration: Requires managing claims and compliance, often through TPAs (Third-Party Administrators).

Fully-Insured Plan:

– Stability: Fixed monthly premiums provide cost predictability.

– Less Risk: The insurance carrier assumes the financial risk.

– Higher Costs: Often more expensive due to state taxes and carrier fees.

– Reduced Burden: Carrier handles most administrative tasks.

Navigating these costs is crucial for employers seeking affordable yet comprehensive health coverage.

I’m Les Perlson, an experienced partner with a strong background in health insurance, emphasizing the administration costs for employer self funded plan vs insurance. My expertise is rooted in over 40 years in the industry, specializing in simplifying health benefits for employers.

Understanding Fully-Insured Health Plans

Fully-insured health plans are the traditional way of providing health coverage for employees. In this setup, the employer pays a fixed premium to an insurance carrier. The carrier then assumes all financial risk, covering employees’ medical claims as per the policy terms.

Pros of Fully-Insured Plans

Financial Predictability: Employers know exactly what their monthly costs will be. This makes budgeting straightforward and reduces financial uncertainty.

Less Financial Risk: The insurance company takes on the financial risk. If medical claims exceed the premiums, the insurer covers the extra costs, not the employer.

Fewer Administrative Burdens: The insurance carrier handles all administrative tasks, including claims processing and compliance with state regulations. This frees up the employer to focus on their core business operations.

Employee Security: Employees have peace of mind knowing their healthcare needs are covered. This predictability can lead to higher employee satisfaction and retention.

Cons of Fully-Insured Plans

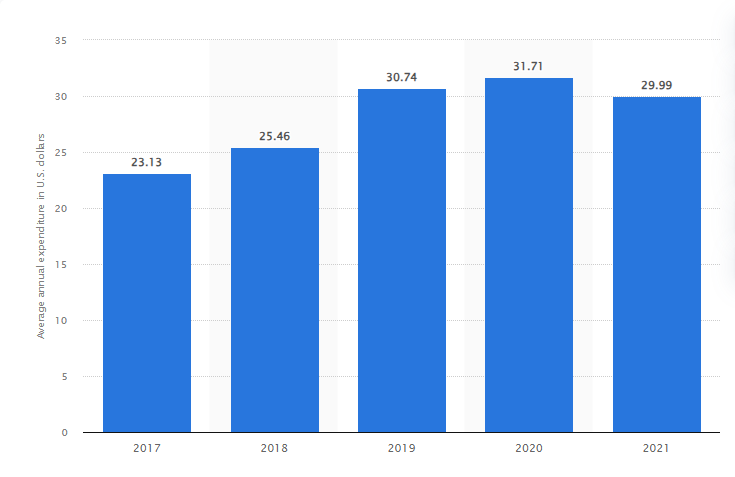

Higher Costs: Fully-insured plans can be more expensive due to fixed premiums, which often increase annually. Over the last five years, premiums have risen by 20%, and they’re expected to surge by another 6.5% in 2024.

Limited Customization: Employers have little flexibility to tailor the plan to their specific needs. They must choose from pre-designed plans offered by the insurer, which may not perfectly fit their workforce.

No Cost Savings: Any surplus premiums (money not spent on claims) are retained by the carrier, not refunded to the employer. This means there are no direct cost savings for the employer.

State Laws and Taxes: Fully-insured plans are subject to state insurance regulations and taxes, adding another layer of cost. Self-insured plans, in contrast, are regulated at the federal level under ERISA, avoiding these state taxes.

Navigating these costs is crucial for employers seeking affordable yet comprehensive health coverage.

Next, we’ll explore the Pros and Cons of Self-Funded Plans to understand how they compare.

Understanding Self-Funded Health Plans

Self-funded health plans offer a different approach compared to fully-insured plans. Here, the employer takes on the financial risk of providing health benefits to employees. This means the employer pays for claims out of pocket as they arise, rather than paying a fixed premium to an insurance carrier.

Pros of Self-Funded Plans

Customization: Employers can tailor health plans to meet the specific needs of their workforce. This flexibility allows for the inclusion of benefits such as mental health counseling or disease management programs, which might not be available in standard fully-insured plans.

Cost Savings: Self-funded plans can lead to significant cost savings. Employers only pay for the actual claims incurred, and if claims are lower than expected, the savings can be substantial. For instance, Roundstone, a self-funded insurance provider, has returned $72 million in unspent premiums to businesses since 2003.

Lower Taxes: Self-funded plans are exempt from state insurance regulations and taxes, thanks to the Employee Retirement Income Security Act (ERISA). This can result in lower overall administrative costs.

Compliance with ERISA: Self-funded plans are regulated at the federal level, which can simplify compliance and reduce the burden of adhering to varying state laws.

Transparency: Employers have access to detailed claims data, allowing for better management and cost control. This transparency can lead to more informed decisions about healthcare spending.

Cons of Self-Funded Plans

Financial Risk: The employer assumes the risk of paying out claims. This can be a significant burden, especially if there are unexpected high-cost claims. Many employers mitigate this risk by purchasing stop-loss insurance, which reimburses expenses that exceed a set amount.

Administrative Burden: Managing a self-funded plan requires substantial administrative effort. Employers must handle claims processing, compliance with federal regulations, and other day-to-day management tasks. This can be time-consuming and may distract from core business operations.

Cash Flow Variability: Since claims are paid as they occur, there can be significant fluctuations in monthly costs. This requires employers to have a stable cash flow to cover these variable expenses.

Despite these challenges, self-funded plans offer a level of flexibility and potential savings that fully-insured plans cannot match. Employers must weigh these pros and cons carefully to determine the best fit for their organization.

Next, we’ll explore the Administration Costs for Employer Self-Funded Plan vs Insurance to understand the financial implications of each option.

Administration Costs for Employer Self-Funded Plan vs Insurance

When it comes to health plans, one of the biggest considerations is administration costs. Let’s break down the components of administration costs for both self-funded and fully-insured plans.

Components of Administration Costs in Self-Funded Plans

Self-funded plans come with several key administrative expenses. Here’s what you need to know:

Administrative Fees

Employers typically hire Third-Party Administrators (TPAs) to handle tasks like claims processing, customer service, and compliance. These TPAs charge administrative fees, which are a fixed cost each month.

Stop-Loss Insurance

To mitigate financial risk from high claims, employers purchase stop-loss insurance. There are two types:

- Specific Stop-Loss: Covers claims that exceed a certain amount per individual.

- Aggregate Stop-Loss: Caps the total claims cost for the entire group.

Stop-loss premiums are another fixed monthly expense, but they provide crucial financial protection.

Claims Payouts

The biggest variable cost in self-funded plans is claims payouts. Employers pay for medical claims as they occur, which means costs can fluctuate greatly from month to month. This requires careful cash flow management.

Components of Administration Costs in Fully-Insured Plans

Fully-insured plans have a different cost structure. Here’s how they break down:

Fixed Premiums

In fully-insured plans, employers pay a fixed premium to the insurance carrier. This premium covers all administrative costs and claims. While this ensures financial predictability, it often comes at a higher cost.

Carrier Administration

The insurance carrier handles all administrative tasks, including claims processing, compliance, and customer service. These costs are bundled into the premium, making it simpler but less transparent.

State Taxes

Fully-insured plans are subject to state taxes on premiums. These taxes can increase the overall cost of the plan. Self-funded plans, on the other hand, are generally exempt from these state taxes, leading to potential savings.

Next, we’ll compare the Financial Risks and Predictability of self-funded and fully-insured plans to help you understand the trade-offs involved.

Comparing Financial Risks and Predictability

Financial Risks in Self-Funded Plans

Self-funded plans come with a different set of financial risks compared to fully-insured plans. When an employer opts for a self-funded plan, they take on the financial risk of paying for employee healthcare claims as they occur. This means costs can vary significantly from month to month.

One of the major risks is catastrophic claims. These are unexpected, high-cost medical claims that can drain the employer’s cash reserves. For example, a single employee requiring extensive cancer treatment could result in claims exceeding $100,000. To mitigate this risk, many employers purchase stop-loss insurance.

Stop-loss insurance comes in two forms:

1. Specific Stop-Loss: This covers individual claims that exceed a predetermined amount.

2. Aggregate Stop-Loss: This covers total claims that exceed a certain limit for the entire group.

Stop-loss insurance adds a layer of financial protection, but it also adds to the overall cost of the plan.

Financial Predictability in Fully-Insured Plans

Fully-insured plans offer more financial predictability. Employers pay a fixed premium to an insurance carrier, which covers all anticipated claims and administrative costs. This fixed premium makes budgeting easier and reduces financial uncertainty.

However, the predictability comes at a price. Insurance carriers assume the financial risk, which means they set the premiums high enough to cover potential claims and still make a profit. This often leads to annual rate hikes. In fact, the average premium for fully-insured plans has increased by 20% over the last five years, with costs expected to surge around 6.5% for 2024, according to surveys by Mercer and Willis Towers Watson.

While fully-insured plans reduce the employer’s financial risk, they can become increasingly expensive over time. The lack of visibility into claims data also means employers can’t implement cost-saving measures based on actual usage.

Next, we’ll explore the Flexibility and Customization options available in self-funded and fully-insured plans, to help you understand how these plans can be custom to meet your company’s unique needs.

Flexibility and Customization

Customization in Self-Funded Plans

One of the standout features of self-funded plans is the ability to customize your health plan to align with your employees’ needs. Unlike fully-insured plans, which often come as pre-designed packages, self-funded plans offer the flexibility to tailor benefits specifically for your workforce.

For example, a tech startup with a predominantly young workforce might prioritize mental health services and preventive care, while a manufacturing company might focus on occupational health services and physical rehabilitation benefits. This customization allows businesses to create a more attractive benefits package, improving employee satisfaction and retention.

Plan architecture in self-funded plans is entirely in the employer’s hands. You can choose multiple carriers for different components of the plan. For instance, you might select one vendor for your prescription drug program and another for medical claims. This approach not only gives you more control but also allows you to negotiate better rates and services.

Moreover, self-funded plans allow for regulatory compliance with ERISA, which preempts state laws. This simplifies administration and can reduce costs.

Rigidity in Fully-Insured Plans

Fully-insured plans, on the other hand, are often rigid and come with limited options. The insurance carrier controls the plan design, meaning you have to choose from pre-designed packages that may not meet your employees’ unique needs. This lack of flexibility can result in paying for unnecessary coverage or missing out on essential benefits.

For instance, a fully-insured plan might include pediatric care in a workforce that is predominantly middle-aged, leading to wasted resources. Conversely, it might lack coverage for specialized drug therapies for rare conditions, which could be crucial for some employees.

Additionally, fully-insured plans are subject to state regulations and taxes, which can add to the overall cost and complexity. The carrier also manages most administrative tasks, from claims handling to regulatory compliance, leaving employers with little room for customization or cost control.

Next, we’ll dig into the Frequently Asked Questions about administration costs for employer self-funded plans vs. insurance, to address common concerns and provide further insights.

Frequently Asked Questions about Administration Costs for Employer Self-Funded Plan vs Insurance

What is the difference between self-funded and employer-funded insurance?

A self-funded plan means the employer takes on the financial risk of providing health benefits to employees. Instead of paying a fixed premium to an insurance company, the employer pays for claims as they occur. This setup allows for more customization and potential cost savings but comes with higher financial risk.

Employer-funded insurance, on the other hand, typically refers to fully-insured plans where the employer pays a fixed premium to an insurance company. The insurer assumes the financial risk and handles all claims and administrative tasks, offering more predictability but usually at a higher cost.

What are the cons of a self-funded health insurance plan?

Financial Risk: Employers assume the financial risk of covering medical claims. While this can lead to savings, it can also result in significant expenses if claims are high.

Administrative Burden: Self-funded plans require more administrative work. Employers may need to hire a third-party administrator (TPA) to manage claims and compliance tasks, adding to the overall costs.

Compliance Requirements: Self-funded plans must comply with federal regulations like ERISA, which can be complex. This requires ongoing attention to legal and regulatory changes.

Cash Flow Variability: Monthly costs can fluctuate based on actual claims, making budgeting more challenging. Employers need a stable cash flow to handle these variations.

Is self-insured cheaper than fully-insured?

Premium Costs: Fully-insured plans come with fixed premiums, providing financial predictability but often at a higher cost. The insurance company keeps any surplus if claims are lower than expected.

Financial Risk: Self-insured plans can be cheaper if claims are low. Employers keep any surplus, leading to potential cost savings. However, high claims can result in unexpected expenses.

Administrative Burden: Self-insured plans require more administrative effort and expertise, often necessitating a TPA. This can add to the costs but offers more control over plan design and management.

In summary, whether a self-insured plan is cheaper depends on the specific circumstances of the employer, including the health of the employee population and the company’s ability to manage administrative tasks and cash flow variability.

Next, we’ll dig deeper into comparing financial risks and predictability between self-funded and fully-insured plans to help you make an informed decision.

Conclusion

Choosing between a self-funded health plan and a fully-insured plan involves careful consideration of cost control, flexibility, administrative costs, and financial risk.

NPA Benefits specializes in helping businesses steer these choices. With our expertise, you can implement a health plan that meets your needs and supports your financial goals.

Cost Control

Self-funded plans offer significant opportunities for cost control. You pay for actual claims rather than fixed premiums, which can lead to savings, especially if your workforce is relatively healthy. Additionally, you can avoid certain taxes and fees associated with fully-insured plans.

Flexibility

When it comes to flexibility, self-funded plans shine. You can tailor your plan to meet the specific needs of your employees, whether that means focusing on mental health services or offering more robust disease management programs. Fully-insured plans often come with a one-size-fits-all approach, limiting your ability to customize.

Administrative Costs

Administrative costs can be higher for self-funded plans due to the need for third-party administrators (TPAs) and stop-loss insurance. However, these costs come with the benefit of greater control over plan management and design. Fully-insured plans typically have lower administrative burdens but come with higher premiums and less transparency in cost management.

Financial Risk

Self-funded plans do carry more financial risk, as the employer is responsible for covering claims. This risk can be mitigated with stop-loss insurance, which protects against catastrophic claims. Fully-insured plans transfer this risk to the insurance carrier, offering more predictable costs but often at a higher price.

In conclusion, the choice between self-funded and fully-insured health plans depends on your company’s specific needs and resources. At NPA Benefits, we are committed to providing you with the guidance and support needed to make the best decision for your business.

For more information on how we can assist you in implementing a self-funded health plan, visit our self-funded health insurance page.

By choosing NPA Benefits, you’re investing in the health and well-being of your employees, which ultimately contributes to the success of your business.